My 3 Favorite Investor Letters

Lots to learn from the best investor letters

I always look forward to January.

It’s the time of year when many of the investing greats publish their ‘Annual Letter’.

These letters include performance updates, but some of them also include a view on the state of the markets or company analyses.

This last part is what’s really interesting because it gives you a look into how great investors think and analyze companies.

Many of the best investor letters are only shared privately with clients. Michael Burry wrote: “For many years, my Scion Capital investor letters did all my marketing for me”.

Fortunately, a few Gurus make their letters available for anyone to read and learn.

Today I’ll share my three favorite investor letters, and a few takeaways from each that I think every long-term investor can benefit from.

The post is quite long, so if you want the TL;DR here is a short AI-generated podcast of today’s newsletter:

Let’s dive in!

→ Start here if you are new to Guru Gems.

→ If you enjoy this newsletter, please subscribe and help others discover it by clicking 🤍

→ If you find value here, consider buying me a virtual coffee ☕

Last week I covered Dev Kantesaria (the ‘Guru’), one of the great quality investors, who runs a very concentrated portfolio with FICO (the ‘Gem’) as his largest position.

🧧 Don’t forget: you can still win a one-month subscription to Michael Burry’s Substack or a copy of Richer, Wiser, Happier, by referring new subscribers to Guru Gems…2 more weeks to go! 🧧

The Timeless Value of Great Letters

The best letters remain relevant many years later.

The most famous example is probably Warren Buffett’s Berkshire Hathaway letters, which are still worth rereading today. You can find the full collection here, and if you haven’t read one yet, I would highly recommend it.

Here is an extract from the 2000 letter, which feels appropriate, given the multiple ‘AI bubble’ warnings we’re hearing today.

But a pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street — a community in which quality control is not prized — will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

At Berkshire, we make no attempt to pick the few winners that will emerge from an ocean of unproven enterprises. We’re not smart enough to do that, and we know it. Instead, we try to apply Aesop’s 2,600-year-old equation to opportunities in which we have reasonable confidence as to how many birds are in the bush and when they will emerge (a formulation that my grandsons would probably update to “A girl in a convertible is worth five in the phonebook.”). Obviously, we can never precisely predict the timing of cash flows in and out of a business or their exact amount. We try, therefore, to keep our estimates conservative and to focus on industries where business surprises are unlikely to wreak havoc on owners. Even so, we make many mistakes: I’m the fellow, remember, who thought he understood the future economics of trading stamps, textiles, shoes and second-tier department stores.

This letter, written in early 2001, is now 25 years old, but it may as well have been written this year. That’s the power of a great investor letter.

With that, here are my top three investor letters, ranked in reverse order.

🥉 Terry Smith - Fundsmith

Terry Smith was the very first Guru I covered in Guru Gems.

He is known for his simple three-step investment strategy:

Buy good companies

Don’t overpay

Do nothing

A Challenging 2025

2025 was a difficult year for Fundsmith, with the fund up just 0.8% while the MSCI World Index rose 12.8%.

In fact, the last 4 years have been difficult for Fundsmith.

After delivering very strong returns for a decade (2011-2021), Fundsmith has significantly underperformed the index since 2022. Not coincidentally, this is the period when the Magnificent Seven drove the majority of index returns.

In his latest annual letter, Terry Smith addresses what happened, why it happened, but also why it doesn’t invalidate the strategy.

“An explanation is not an excuse. I wonder how those commentators or our investors would view it if we offered no explanation.”

Index concentration and the growth of index funds

Terry cites ‘index concentration’ and ‘the growth of index funds’ as 2 of the 3 main reasons for his underperformance (a weaker dollar being the third).

Smith highlights how a small group of mega-cap tech stocks has driven a disproportionate share of index returns. He warns that previous times when the US market value was this concentrated, it would often lead to a bubble bursting and it would take many years for the S&P to regain its bubble highs.

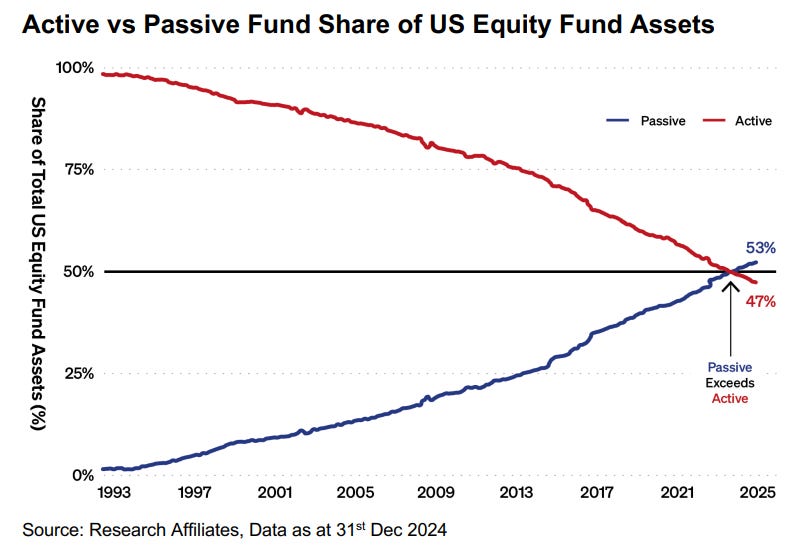

Smith further argues that “the rise of the Magnificent Seven and the AI stocks also had a strong tailwind from the increase in assets held in index funds”

John Bogle, the pioneer of index investing who founded Vanguard, the index fund manager, was asked at the 2017 Berkshire Hathaway annual meeting if there was a level of assets in index funds which would distort markets and he agreed that there was, although he had no method of determining that level. We may already have reached it.

For Terry Smith, index investing behaves like a momentum strategy, mechanically allocating more capital to the biggest winners regardless of valuation or quality.

Bill Nygren has repeatedly made a similar point over the past year. Here is Nygren’s latest Q4 ‘25 update talking about exactly this.

Quality Remains

The fundamental quality of Fundsmith’s portfolio remains very strong:

31% Return on Capital Employed (vs 17% for the S&P 500)

62% Gross Margin (vs 45% for the S&P 500)

16% free cash flow growth in 2025

The quality of our portfolio companies is as high as it has ever been and collectively they continue to grow free cash flow quicker than the historical average of the portfolio. The underlying business performance remains our primary focus. If we get that right then our Fund will emerge with the intrinsic value of its investments maintained or enhanced, as sooner or later, share prices reflect fundamentals, not the other way around.

Based on the portfolio’s fundamental quality, Smith is convinced that continuing to hold good businesses is still the right thing to do.

Whilst we are going to stick to our investment strategy we will of course seek to do it better.

He expects that owning businesses with strong fundamental returns will shine through into superior share price and fund performance over the long term and that “in the interim our fund will prove relatively immune from any shocks which arise if or when the present extraordinary market conditions unwind.”

🥈 David Rolfe - Wedgewood Partners

David Rolfe is Chief Investment Officer and Portfolio Manager at Wedgewood Partners, a focused growth investment firm that I've been following closely.

Their quarterly letters are always packed with detailed company analyses and market insights.

“Each quarter, Wedgewood publishes an in-depth newsletter that reviews recent financial market and investment activity, and also looks ahead to key influences and trends. Our goal is to include candid statements and observations regarding investment strategies, individual securities and economic/market conditioning.” - Wedgewood Partners website

While Wedgewood invests in growth, valuation is still key to generating attractive returns over the long-term: “Unlike most growth investors, Wedgewood is not a momentum investor but rather a contrarian growth investor.”

The Art of Patience

Wedgewood patiently waits for opportunities to purchase what they believe are great businesses at attractive prices.

We tend to buy great companies when they fall out of favor. Perhaps there are controversies surrounding the companies, or temporary issues we firmly believe will dissipate or be quickly corrected. Often, the market just loses interest in a company or industry.

A good example is Zoetis, the global leader in animal healthcare, which they bought in early 2025.

Zoetis is not exactly a hidden gem, but they had done the work to understand the business deeply, and when the market lost interest, they were ready to act.

We have been monitoring Zoetis and other animal healthcare companies for many years. The industry has long boasted healthy and steady growth rates. Critically, Zoetis also boasts high and improving levels of profitability.

We claim to be long-term investors, and our behavior over 30+ years bears this out; therefore, we tend to get excited when we have been monitoring a great business for many years, and the market eventually presents us with an opportunity to buy it at an attractive entry point. […] This has now happened with Zoetis.

Wedgewood’s approach shows the power of maintaining a watchlist of great companies and having the patience to wait for the right price.

This ‘art of patience’ is something I also highlighted in my deep dive on Dev Kantesaria, who studied FICO for 7(!) years before seeing an opportunity to purchase it.

Annus Horribilis

Just like Fundsmith, Wedgewood significantly underperformed the index in 2025.

The year would prove to be our worst relative calendar year since 1993. Horribilis, indeed.

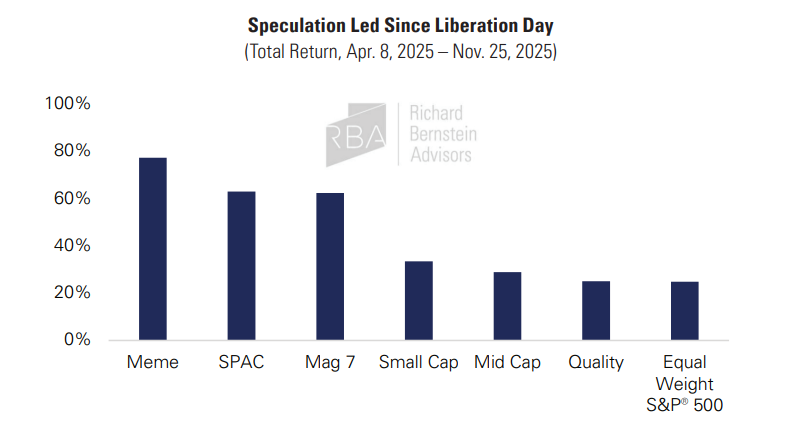

And like Terry Smith, David Rolfe faced the exact same structural headwinds in 2025: index fund momentum, AI mania, and a market that rewarded speculation over quality, especially since ‘Liberation Day’, as can be seen from the chart below.

Concentration Risks

Rolfe highlights the extreme concentration in the market. He points out the absurdity that the top eight stocks in both the S&P 500 and the Nasdaq 100 are now identical.

Despite these risks, he continues to hold companies like Alphabet and Meta because they have been “cloud-native for over a decade” and can fund their AI buildout with internal cash flow, unlike newer entrants who are relying on debt.

Wedgewood believes AI is ‘real’ in the sense that the opportunity is massive, but capital intensity, infrastructure constraints, and returns on invested capital still matter.

The setup for 2026

In their latest letter, Wedgewood Partners warn that the 2025 risks are still very real.

As we enter 2026, the crowded AI trade and historically rich valuations haunt prudent investing. Even most non-Magnificent Seven stocks fail to scream “bargains.” Further, speculative leverage remains historically high. Even the 2026 mid-term political season speaks to curbed enthusiasm.

But despite the difficult year, Wedgewood is optimistic about their positioning going forward.

On the growth front, our portfolio fundamentals, prospective earnings growth rates, profitability measures, and balance sheet strength are notably superior to the S&P 500 Index. […]

We like these odds for a performance reversal in 2026.

🥇 François Rochon - Giverny Capital

If I had to recommend one investor letter for someone serious about long-term investing, this one would be it.

François Rochon manages the Rochon Global Portfolio, which has achieved a 15.1% annualized return since July 1993. This is a total return of over 8,300% versus 1,800% for his weighted benchmark. 32 years of exceptional performance.

What makes Rochon’s letters special is the combination of transparency, humility, and long-term thinking.

In his letters, he shares a ‘Post-mortem’ of stocks bought 5 years ago, discusses what he believes is the ‘Flavor of the day’ in investing, and highlights his top 3 errors from the past years in his ‘Podium of Errors’.

I’m eagerly waiting for the 2025 letter to be published, but here is the 2024 letter to give you a flavor.

"Our mission at Giverny Capital is to be long-term owners of around twenty above-average companies and to remain unfazed by the vicissitudes of the economy, geopolitics and financial markets."

30 Years of Staying the Course

In his 2023 letter (celebrating 30 years of investing), Rochon reflected on his journey:

“I have now been investing in the stock market for over 30 years. I first read the writings of Ben Graham and Peter Lynch in November 1992 and discovered a rational approach to investing in the market. I read all of Warren Buffett’s writings at the beginning of 1993 and discovered a philosophy of selecting quality companies with a very long-term horizon. I decided to try to put Mr. Buffett’s concepts into practice with my own money from that moment on.”

Over those 30 years he hasn’t changed his philosophy and remained committed to his three core principles which he learned from Ben Graham and Warren Buffett:

Think of buying stock as the act of owning a business (not speculating)

The stock market is manic-depressive - focus on intrinsic value, not price fluctuations

Maintain a margin of safety in your business evaluation

Learn more about Ben Graham and The Intelligent Investor in my post below

Why Rochon’s letters are my favorite

Just like Buffett, Rochon’s letters feel timeless.

His letters are a reminder that great investing is simple but not easy:

Find high-quality businesses with sustainable competitive advantages

Buy them at reasonable prices

Hold them for a very long time

Never try to predict the market

"The lesson that remains king of all lessons is this: the best stock selection philosophy is futile if you try to predict the stock market. The worst mistake made by stock market investors is trying to predict the direction of the market over the short term (a few years or less)."

His 30+ year track record proves that this approach works.

I am currently re-reading all Giverny letters going back to 2010, in preparation of a future post on François Rochon…stay tuned for that one!

🅱️ Bonus

Here are some other investor letters I enjoy reading each year:

Tom Gayner (Guru Gems) - Markel - Letters to shareholders

Christopher Tsai (Guru Gems) - Tsai Capital - Investor Letters

Akre Capital (Guru Gems) - Commentary

Chris Bloomstran (Guru Gems) - Semper Augustus - Client Letters

What other letters should I read? Let me know in the comments.

That’s it for this week! Please like or share if you enjoyed this post.

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!

Nick Sleep’s Nomad letters were great.

You got a winner when a letter endures time, not as performance reports, but as long-form thinking exercises. Smith and Rolfe, not just for their long-term records but for how they handle the rough stretches. It's that area of investing where the process has to overcome negative outcomes.