The Tsai Thesis

On the power of compounding and digital moats

Welcome to a new edition of Guru Gems, where I study the world’s long‑term investing masters and build a portfolio of exceptional companies based on these Gurus’ wisdom.

In today’s edition:

🔍 Guru in the spotlight: Christopher Tsai

📈 Compounding with resilience and discipline

📰 Tsai Capital Q2 ‘25 portfolio

📱 Should I add Meta Platforms to the portfolio?

If you enjoy this newsletter, please help others discover it by clicking 🤍

If you are new to Guru Gems and want to know more about my journey, start here.

Guru in the spotlight: Christopher Tsai

Christopher Tsai is President and CIO of Tsai Capital. On its website, it states:

Christopher [Tsai] pursues a value-oriented investment approach and seeks high-quality growth companies that offer significant upside potential and a margin of safety at the time of purchase.

Tsai’s philosophy balances capital preservation with the exponential power of compounding.

In his essay The Power and Challenges of Compounding, he emphasizes that while compounding is simple in concept, it is incredibly difficult in practice because human psychology struggles with exponential growth.

The real challenge isn’t finding compounders—it’s holding them through volatility without emotional interruption.

Christopher Tsai has a direct connection to Peter Keefe, a guru I recently featured in my weekly newsletter.

These two highly successful investors have known each other since long and have a shared philosophy of long-term compounding, concentration in true quality, and resisting the temptation to act unnecessarily.

"In my experience, during times of uncertainty and volatility, it's almost always better to refrain from selling. That's because market timing is a fool's game."

The above is what Terry Smith would refer to as “Do Nothing”.

Compounding with resilience and discipline

Based on his writings and approach, Tsai's investment framework centers on:

High-Quality Growth Companies: Businesses with durable moats and strong fundamentals

Margin of Safety: Buy these businesses at attractive valuations

Long-Term Holding: Ideally owning businesses for a decade or more to fully benefit from compounding

Emotional Discipline: Rather than reacting to stock price fluctuations, individuals should instead focus on shifts in business fundamentals.

Like Peter Keefe, Tsai believes there are very few truly great ideas worth holding. But once found, the task is simple—own them for as long as they can compound.

Tsai Capital portfolio

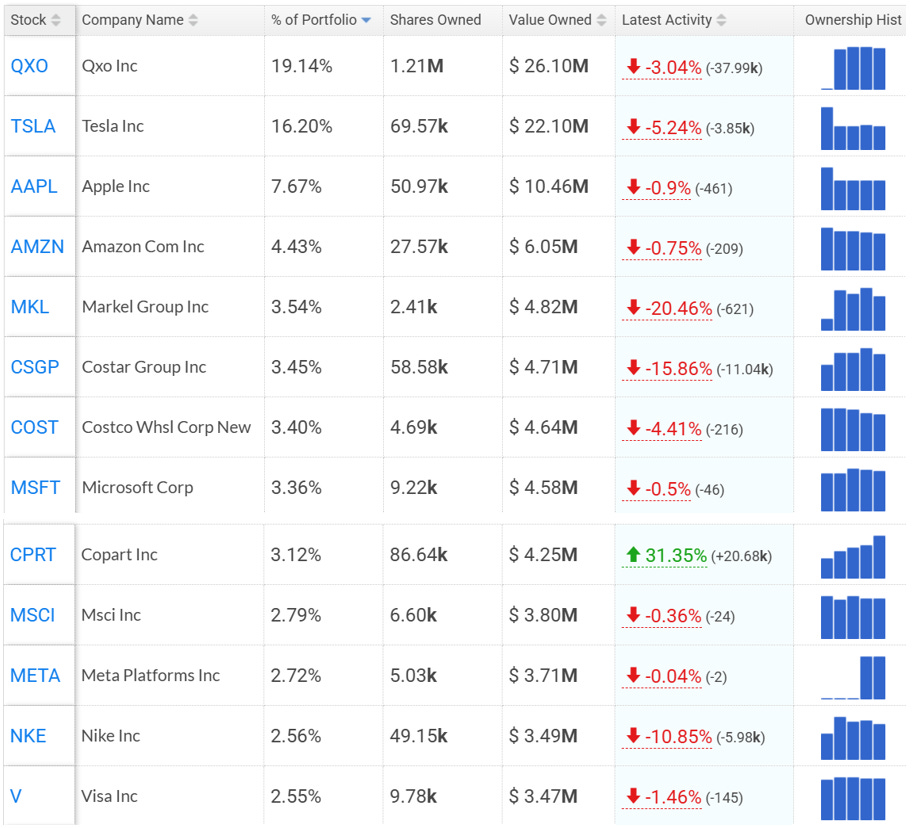

Here's an overview of Tsai Capital’s portfolio based on their most recent 13F filing (positions as of 30 Jun 2025):

Let’s highlight a few companies from this list, starting with his 2 largest positions:

QXO

From what Tsai has shared in interviews, his conviction in QXO - a distributor in building products - is driven by his admiration for its CEO Brad Jacobs, who founded and led five public companies prior to QXO.

Here is what Tsai wrote about Jacobs:

I've known Brad Jacobs ($QXO) and followed his career for 25+ years. […] Wall Street consistently underestimates how quickly he transforms industries and builds companies—often from scratch. With James Hardie’s $8.7B acquisition of The Azek Company announced today, a consolidation frenzy in building products distribution may just be beginning. Expect Brad to move swiftly—yet with his signature discipline.

Tesla

Tsai started buying Tesla in Feb 2020 during the Covid sell-off and has made an incredible return on his investment so far. He calls it “one of the most misunderstood companies I have seen in my 25 years of managing money for others”.

There are a few good interviews where he lays out his full Tesla thesis. Here is Tsai on one of my favorite investing podcasts ‘Richer, Wiser, Happier’:

Copart

The only position that was increased in Q2 was Copart, a company Peter Keefe owns as well and which I discussed in my recent newsletter.

With Christopher Tsai owning it too, this gives me extra conviction to add it to the Guru Gems portfolio.

I had already added Copart to my watchlist and will look for an attractive entry point.

Meta

Finally, let’s look at a recent new position from Q1: Meta Platforms.

The Social Network Empire: Meta Platforms

Meta Platforms (META) needs no introduction. It is the world’s largest social media company, owning Facebook, Instagram, WhatsApp, and Messenger. Together, these platforms connect nearly 4 billion people—almost half of the world population.

Its core business model is advertising, powered by unmatched scale, engagement, and data.

But Meta is also evolving into a diversified technology platform, with early bets on AI infrastructure and the metaverse.

Let's evaluate Meta through our Terry Smith-inspired framework.

To buy or not to buy

1/ Buy good companies

✅ Unmatched network effects

With billions of users across its ecosystem, Meta enjoys perhaps the strongest network effect in the digital world. Advertisers go where the users are, creating a self-reinforcing flywheel that is extremely difficult for competitors to disrupt.

✅ Multiple growth engines

Instagram Reels is now a serious challenger to TikTok, WhatsApp is beginning to monetize through business messaging, and Meta has started testing advertising in AI-driven assistants. Each represents a scalable revenue stream on top of its core business.

✅ AI leadership

Meta has become one of the largest investors in AI infrastructure, deploying tens of billions into custom chips, data centers, and open-source AI models. This infrastructure not only enhances its advertising precision but positions Meta as a backbone of the next computing era.

✅ Owner-operator management

Mark Zuckerberg has been controversial at times, but few founder-CEOs have compounded at his scale. With a dual-class share structure, Zuckerberg’s alignment is clear: long-term dominance over short-term gains.

⚠️ Risks

Regulatory scrutiny remains a constant risk in the U.S. and Europe.

Heavy capital spending in AI and metaverse initiatives compresses near-term free cash flow.

Platform maturity slows user growth in developed markets, forcing Meta to rely more on monetization improvements and emerging market expansion.

Competition from TikTok and emerging platforms keeps user engagement dynamics fluid.

2/ Don’t overpay

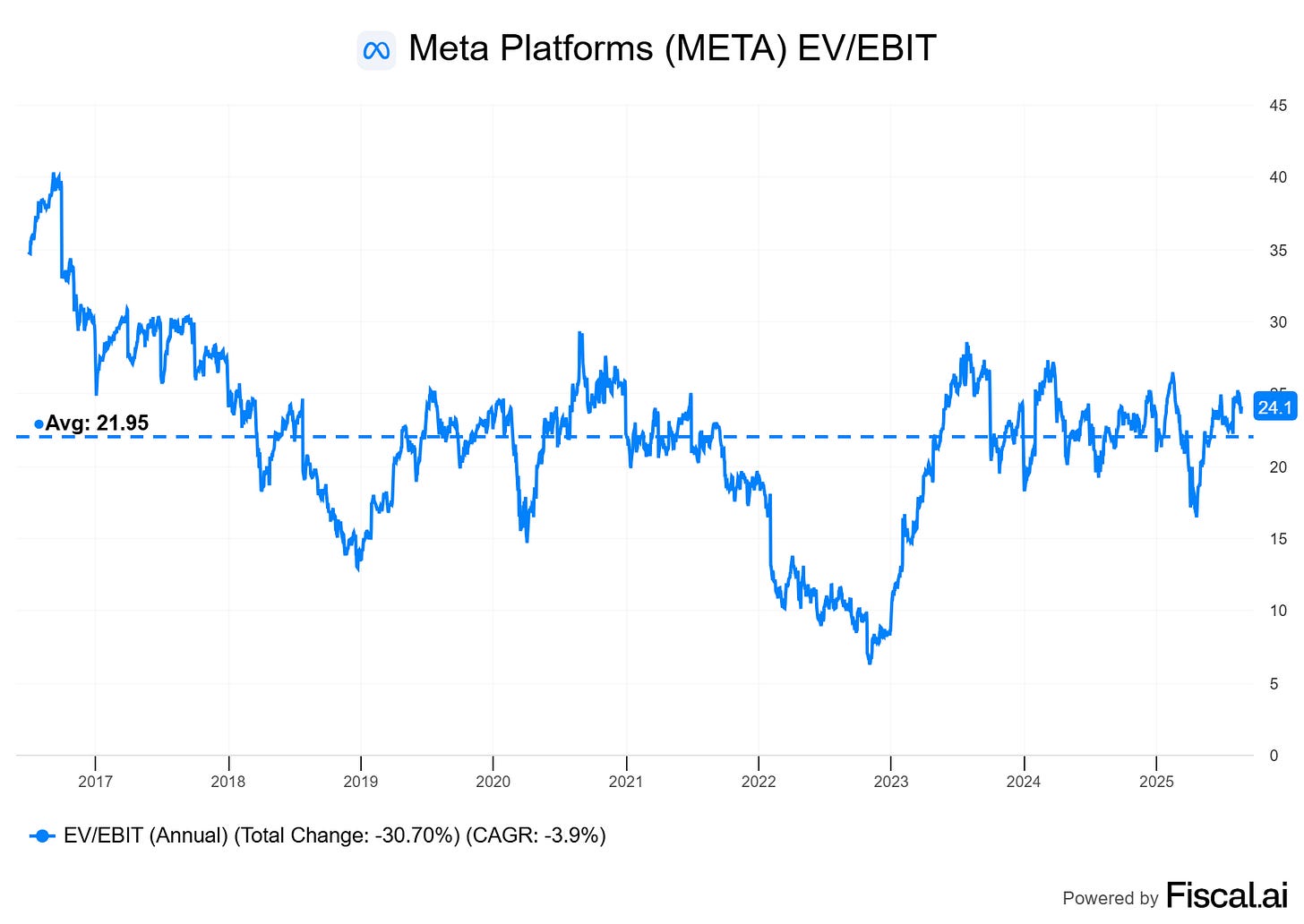

Meta trades at ~26× forward earnings and EV/EBIT of ~24, both slightly above their long-term average

Meta has the second “cheapest” valuation of the ‘Magnificent 7’ stocks, after Alphabet.

As I wrote in last week’s update, while Alphabet is still the most owned stock among superinvestors, Meta is definitely a strong contender, with some superinvestors having a significant position in Meta.

Finally, Christopher Tsai started his position during Q1 2025, when Meta’s share price ranged between $576 - $736. Assuming Tsai bought at the lower end of this range, the current share price of $783 is already quite a bit above Tsai’s margin of safety, so probably not an ideal entry point.

3/ Final decision

Meta exemplifies what Tsai calls a “long-term compounding machine”: durable moat, multiple growth drivers, and a management team willing to reinvest aggressively for the future.

I believe it would be a great company to add to the Guru Gems portfolio, but it’s not exactly cheap. Early April would have been a fantastic time to pick up the stock (it’s up more than 40% since then), so I think I’ll wait for another opportunity to pick up this Gem.

📌 Decision: Meta Platforms (META) not yet added to the Guru Gems portfolio

That's it for this week's edition. As always, thank you for reading and following along on this journey. Follow me on X @guru_gems for more Guru Gems insights.

Until next week!