The Nygren Edge

Value Meets Growth in Airbnb

Welcome to another edition of Guru Gems, where I study the world’s long‑term investing masters.

In today’s deep-dive:

Guru in the spotlight: Bill Nygren

Bill Nygren’s investment principles

Should I add Airbnb to the portfolio?

Follow me on X @guru_gems for more investing insights and make sure to subscribe for weekly deep-dives

Last week I reviewed a timeless classic in investing: One Up on Wall Street

Guru in the spotlight: Bill Nygren

When it comes to legendary value investors who have consistently beaten the market over decades, Bill Nygren stands among the very best.

As Chief Investment Officer for U.S. equities at Harris Associates, he oversees about $25 billion in assets and is co-manager of two of their flagship mutual funds: Oakmark Select & Oakmark Fund.

What sets Nygren apart is his ability to blend traditional value investing principles with an appreciation for growth and quality. He looks beyond just the financial metrics and dives deep into understanding the underlying business.

“Most of our portfolio are more traditional value stocks; single-digit P/E companies like Citigroup and General Motors, but we also try to invest in what we call the intersection of growth and value.

There are a lot of investors who think of value and growth as opposites, and we think that value is the opposite of expensive and growth is the opposite of no-growth. usually high-growth companies bring high prices, but sometimes they don’t.”

Bill Nygren’s investment principles

Bill Nygren has highlighted in different interviews that there are 3 essential principles he and the Harris Oakmark team look for in a business:

1/ Buy business at a large discount to intrinsic value

This is the core of their philosophy and often leads them to acquire businesses that are temporarily out of favor or whose value isn't fully appreciated by the broader market.

Nygren wants to pay no more than 60% of the company’s intrinsic business value. You can think of this as the private market value, or the value one would pay to buy up the whole company.

2/ Companies that are expected to grow per-share value over time

The combination of dividend income and expected per-share value growth should at least match what they expect from the S&P500.

He's not looking for exponential "growth at any cost," but rather sustainable, intelligent growth that translates to shareholder value.

3/ Exceptional management

Management should be aligned with outside shareholders in having a goal of maximizing long-term per share business value. He also expects the management to be excellent capital allocators.

This last one is especially important given their long term time horizon (average holding period is 5-7 years).

“If you buy a stock expecting to hold it for five years, like we do, capital allocation becomes critically important.”

Oakmark Select Fund portfolio

Here is an overview of the Oakmark Select Fund top 10 positions, which account for ~60% of the portfolio (holdings on 31 March 2025).

The largest holding in the fund is IQVIA Holdings, a company focused on health information technology and clinical research.

Second position is Alphabet, a company we find back in many Superinvestors’ portfolios as we’ve discussed before:

Disrupting Hospitality: Airbnb Inc.

One of the more recent positions in Oakmark's portfolio is Airbnb (Ticker: ABNB)

Everyone knows Airbnb, the company that successfully convinced people to sleep in strangers' homes. Airbnb became a pillar of the ‘sharing economy’, just like Uber.

Its primary revenue comes from fees collected from both hosts and guests, typically around 3% from hosts and 12% from guests.

At first glance, Airbnb might seem like an unusual pick for a value investor. It's a technology platform, it doesn't own physical assets, and it trades at valuations that would make old-school value investors uncomfortable.

But through Nygren's lens, Airbnb represents exactly the kind of quality business trading at a discount to intrinsic value that fits his investment criteria.

Using Terry Smith’s framework, let's examine why this disruptive platform caught the attention of one of the most disciplined value investors in the business.

To buy or not to buy

1/ Buy good companies

Strengths

Network effects & Platform dynamics

Airbnb benefits from powerful network effects — more hosts attract more guests, which attracts more hosts. With over 4 million hosts and 1 billion guest arrivals since inception, the platform has achieved massive scale that creates significant barriers to entry.Asset-light business model

Unlike traditional hotels, Airbnb doesn't own real estate. The company acts as an intermediary, taking a commission on bookings while hosts provide the inventory. This capital-light model generates strong returns on invested capital and impressive cash flow margins.Global market leadership

Airbnb dominates the short-term rental market with presence in over 220 countries and regions, with potential for deeper penetration into more countries globally. The ‘sharing economy’ trend shows no signs of slowing, and Airbnb is positioned as a clear winner in this space.Expanding beyond core business

The company is diversifying with ‘Airbnb Experiences’ (local activities) and longer-term stays, expanding its total addressable market beyond traditional vacation rentals. The potential introduction of advertising and sponsored listings from hosts could also be an additional source of revenue.

Weaknesses and Risks

Regulatory headwinds

Cities worldwide are implementing restrictions on short-term rentals, from licensing requirements to outright bans in certain areas. These regulatory changes could significantly impact growth. Fortunately, no single city accounts for more than 2% of Airbnb's total revenues, diversifying its vulnerability.Economic sensitivity

Travel and leisure spending is cyclical. During economic downturns or crises (like COVID-19), demand for Airbnb's services can decline sharply.Consumer trust

Properties not meeting expectations or last-minute host cancellations are a significant concern. To address trust issues, Airbnb has delisted over 300,000 low-quality properties in the last year and also promotes ‘Superhosts’ in its algorithm to redirect bookings to reliable, high-quality hosts.Stock-based compensation

Stock-based compensation has diluted shares, though its impact is expected to decrease as IPO-related restricted stock units (RSUs) vest. Airbnb is very well capitalized ($9B net cash) which puts them in a good position to repurchase their own stock, something they have already started doing.

2/ Don’t overpay

With a current P/E of ~34, Airbnb doesn’t look very cheap at first sight. However, here is what Bill Nygren recently said in an interview about Airbnb’s valuation:

“GAAP* accounting makes them take all of their long term investment spending right through the income statement. It looks like the stock is selling at 30-40 times earnings today, but if they have the same take rate** that Booking.com has - and we think Airbnb probably has more leverage with their providers - it would sell at a below market multiple.

They are also spending a lot of money trying to get experiences, so their R&D expense is very high. If they brought that down to an industry-average level, it would be below a market multiple, and that’s a great growth business.”

*GAAP accounting refers to ‘Generally Accepted Accounting Principles’ which set the criteria for reporting financial statements in the U.S.

**‘Booking take rate’ refers to the percentage of revenue a platform earns from each transaction

Airbnb share price closed at $134.52 this week, which is more than 10% below where it was a year ago, and a bit below where it started trading nearly 5 years ago at the time of it’s IPO (Dec 2020).

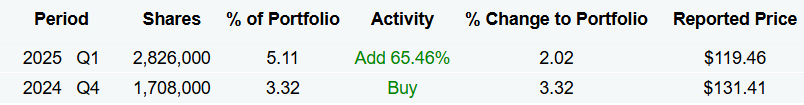

As we learned, Bill Nygren likes to buy a stock at ~60% of what he believes is the intrinsic value. He started the position in Q4 2024 when the share price ranged between $125-$141. Assuming they bought at the lower end of this range, then the current share price is just slightly above what Nygren paid for the original position.

They then added more in Q1 2025, possibly at prices around $120.

3/ Final decision

While I am a bit concerned about some of the risks stated above, I do believe Airbnb fits the criteria of a high-quality business with long-term compounding potential.

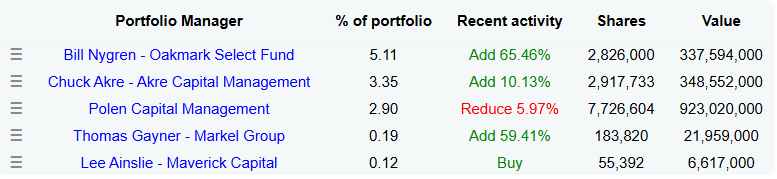

Looking at other Superinvestors who hold Airbnb, I was pleased to see Akre Capital Management in the list, the firm founded by Chuck Akre, a long-term investing master we reviewed in our previous edition:

📌 Decision: Airbnb added to the Guru Gems Portfolio

With 2 long-term investing masters who see Airbnb as an undervalued high-quality business with a strong moat, I decided to add it to the Guru Gems portfolio.

I will start with a 4-5% position and add if the price goes lower in the following weeks.

That's it for this week's edition! As always, thank you for reading and following along on this journey.

Until next week!