The Akre Way

On compounding machines and intelligent solutions

Welcome back and welcome to the new subscribers!

Today we return to our usual format with a Guru deep-dive and a potential Gem to add to the portfolio.

In case you missed previous editions:

#1 Cloning the world’s best investors (start here if you are a new subscriber)

#5 The Davis Discipline (latest deep-dive - Chris Davis)

Follow me on X @guru_gems for more investing insights

As always, the goal is to build a focused portfolio of 8–12 stocks — the Gems — that can compound and hopefully perform very well over the long term.

Here is what you can expect in today’s edition:

Guru in the spotlight: Chuck Akre

The Akre Way unpacked

Is CCC Intelligent Solutions our next Guru Gem?

Let’s dive in …

Guru in the spotlight: Chuck Akre

Chuck Akre might not be as well-known as Warren Buffett or Peter Lynch to the general public, but among investment professionals, he’s seen as one of the most consistent and disciplined long-term investors in the game.

Founder of Akre Capital Management, he’s best known for his "three-legged stool" approach to investing — a simple but powerful model that guides his search for what he calls compounding machines.

Since founding Akre Capital in 1989, his focus has remained very consistent: owning high-quality businesses with high returns on capital (remember the Magic Formula?), led by top-tier management teams, bought at fair prices.

His long-term track record is outstanding. From its inception up until Akre’s 2020 retirement, the Akre Focus Fund compounded capital at ~16% annually, significantly beating the S&P 500.

The Akre Way: The Three-Legged Stool

Chuck Akre is famous for his “three-legged stool” investment framework which he uses to identify so-called compounding machines. The three legs of the stool stand for the key elements he looks for in a business:

🪑 1/ Extraordinary Business

The business should have an identifiable, sustainable competitive advantage, difficult to disrupt and with enduring, predictable high Return on Equity (ROE) and Free Cash Flow (FCF). These are preferably also businesses with high pricing power.

🪑 2/ Talented Management

Akre looks for owner-operators or management teams with integrity, capital allocation skill, and a long-term orientation. He especially values firms where insiders have significant skin in the game.

🪑 3/ Reinvestment Runway

Finally, the company must be able to reinvest retained earnings at attractive rates for years — ideally decades. This is the compounding engine that turns time into wealth.

Like many of the great long-term investors that I have studied so far, Chuck Akre also emphasizes patience and the power of letting quality businesses do the heavy lifting.

“Our timetable is five and ten years ahead, and quarterly “misses” often create opportunities for the capital we manage”

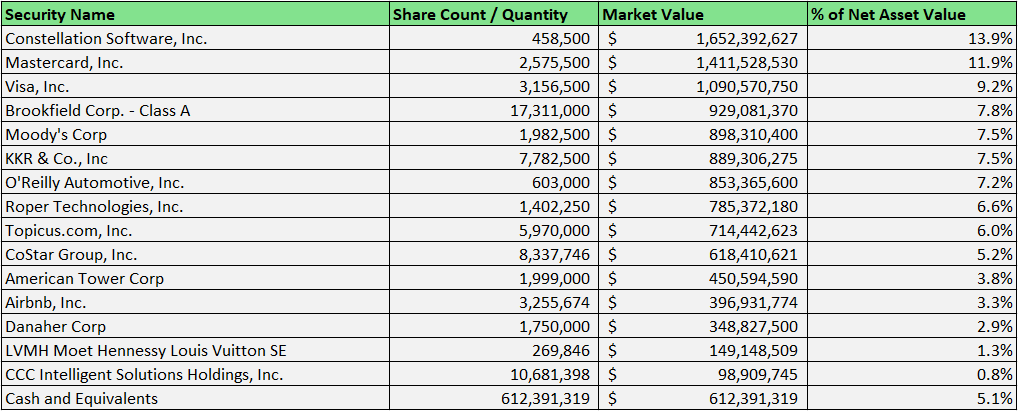

Akre portfolio

Here is an overview of the Akre Focus Fund portfolio taken from their website (holdings on 30 April 2025).

The 3 largest positions (Constellation Software, Mastercard and Visa) make up around one third of the fund.

Akre also has a position in LVMH, which was the first gem I added to the portfolio (see here). While LVMH is only 1.3% of the Akre portfolio, the position significantly increased form the earlier reporting in Oct 2024.

Compounding in the Cloud: CCC Intelligent Solutions

One of the lesser-known positions in Akre Fund’s portfolio is CCC Intelligent Solutions Holdings (Ticker: CCCS) — a cloud-based software company serving the auto insurance and repair industries.

CCCS provides essential digital infrastructure that powers claims processing, collision repair estimates, parts procurement, and AI-driven workflows for a massive ecosystem of insurers, repair shops, and more.

It’s a relatively new position in Akre’s portfolio and currently still a small one. You could argue that this doesn’t reflect a lot of conviction. However, CCCS is a mid-cap company ($6B market cap), and with the Akre Focus Fund having a size of nearly $12B, any large position might bring them above specific holding threshold. These thresholds may trigger additional disclosure requirements, which is typically something investors want to avoid.

Now let’s evaluate CCCS through our Terry Smith-inspired framework (whilst also checking for Akre’s three legs of the stool):

To buy or not to buy

1/ Buy good companies

Strengths:

Network effects & Switching costs (Leg 1)

With over 35,000 connected businesses, CCCS benefits from powerful network effects where the platform becomes more valuable as more participants join, creating natural barriers to entry.Recurring revenue & High retention (Leg 1)

Over 90% of revenue is subscription-based, with renewal rates well above industry average. Their net revenue retention is consistently over 100%, meaning they are able to retain and grow revenue from existing customersTalented Management (Leg 2)

Under CEO Githesh Ramamurthy's leadership, the company has successfully transformed into a cloud-based AI leader while maintaining profitability and growth. Strategic acquisitions like the most recent one of EvolutionIQ, shows that they are buying companies that enhance the existing platform rather than random diversifications.R&D investments (Leg 3)

The company invests heavily in Research and Development (R&D) to maintain its software solution leadership, with R&D expenses totaling 21% of revenue in 2024.

Weaknesses and Risks:

Customer Concentration

While CCCS serves more than 300 insurers, a few large insurance clients represent a substantial portion of revenue — a risk if contracts are lost or renegotiated.Regulatory dependency

The insurance industry is heavily regulated, and changes in regulations regarding AI use, data privacy, or claims processing could significantly impact operations.Market evolution

Rapid advances in autonomous vehicles, electric vehicles, or alternative transportation models could fundamentally impact the auto insurance landscape.

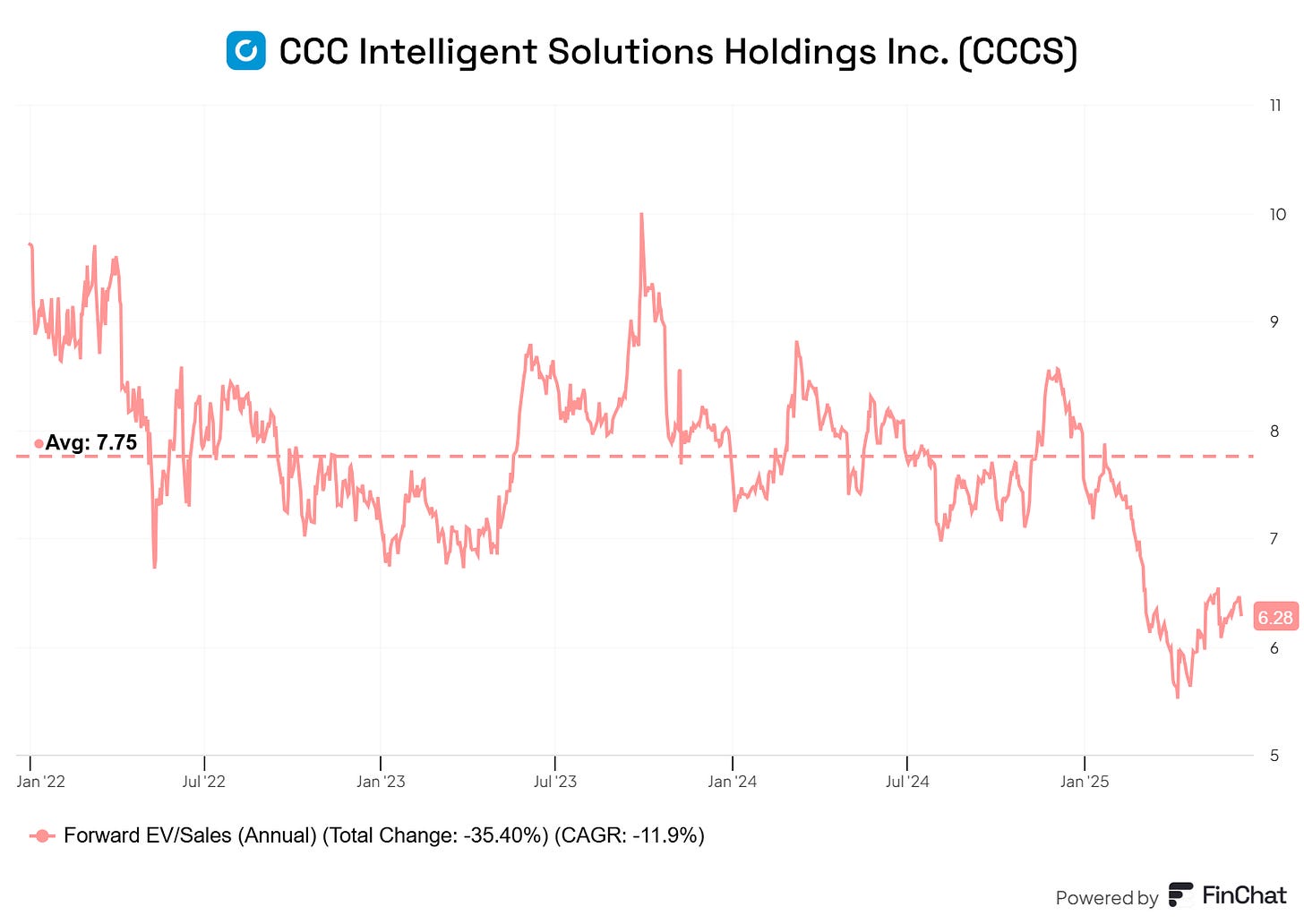

2/ Don’t overpay

A valuation metric often used for Software as a Service (SaaS) businesses is ‘Enterprise Value (EV) / Sales’.

CCCS’s Forward EV / Sales is currently 6.3 which is nearly 20% below it’s 3-yr average, which might indicate that it is currently undervalued:

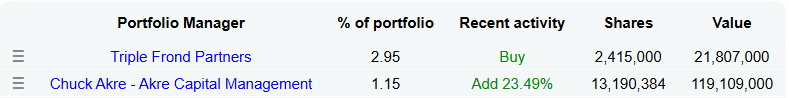

The Akre Fund first bought CCCS in the first quarter of 2024 when the share price was around $11 or higher and they have added in the following quarters, when the stock was trading in the same price range.

The current price is just below $9, so at this price I could buy it cheaper than Akre Fund bought it.

3/ Final decision

Based on my initial research, I believe CCCS could be an interesting company to add to the Guru Gems portfolio.

The company seems to be well positioned to be a dominant player in the insurance technology sector:

✅ Network Effects

✅ AI Leadership

✅ Strong customer retention

✅ Long reinvestment runway

With the recent acquisition of EvolutionIQ, CCCS is also diversifying to different insurance areas.

Finally, there is another Superinvestor who started a position in CCCS: Triple Frond Partners. I haven’t been able to find much info on this investor, but looking at their portfolio, they manage a concentrated portfolio of 10 stocks and many of the positions have been held for many years (including Alphabet), which is a great sign.

📌 Decision: CCCS added to the Guru Gems Portfolio

I will start with a 2-3% position and possibly add if the price goes lower in the following weeks.

That's it for this week's edition! As always, thank you for reading and following along on this journey.

Until next week!