The Keefe Standard

On disciplined investing and salvage cars

Welcome to a new edition of Guru Gems, where I study the world’s long‑term investing masters and build a portfolio of exceptional companies based on their wisdom.

In today’s deep-dive:

🔍 Guru in the spotlight: Peter Keefe

📊 The Rockbridge investing philosophy

🚗 Should I add Copart (CPRT) to the Guru Gems portfolio?

If you enjoy this newsletter, please help others discover it by clicking 🤍

If you are new to Guru Gems and want to know more about my journey, start here.

You can also follow me on X @guru_gems for more Guru Gems insights

Guru in the spotlight: Peter Keefe

Peter Keefe spent over three decades at Avenir Corporation, a value oriented investment firm known for its fundamental, long-term approach to investing. Most recently Avenir’s Executive Chairman, Keefe left Avenir in 2024 to launch Rockbridge Capital Management — his own long-term focused investment firm.

Keefe is not widely known outside of professional investing circles, but his track record of outperformance makes him an excellent candidate to study in more detail.

One of Keefe’s first jobs was at a brokerage firm, where he was hired by one of the great long-term investors Chuck Akre, who I covered in a previous newsletter:

Keefe and Akre built a lifelong friendship and Keefe eventually took over from Akre as director of research when Akre left to form his own investment firm.

Peter Keefe is also a disciple of Warren Buffett. His most recent investor letter is fully dedicated to Buffett and how the Oracle of Omaha influenced him and his investing style:

My paper file on Buffett goes back to 1986 when he was not well known and I was a total know-nothing as it related to the investment process. Since then, no one has been more influential in my business life, both directly and indirectly, […]

There aren’t many interviews with Peter Keefe, but this one on the Richer Wiser Happier podcast is really excellent:

Great Businesses, Great Managers, Great Prices

In May 2024, Keefe launched Rockbridge Capital Management, a new firm designed around the same timeless principles he spent decades refining:

✔️ High-quality businesses

✔️ Long holding periods

✔️ Sensible valuations

✔️ High insider alignment

In his first ‘Investor Letter’ from July 2024, Keefe lays out the What?, Why? and How? of Rockbridge Capital:

Rockbridge was founded on the simple belief that inherently superior businesses run by honest, competent managers and capital allocators will compound at above-average rates. Purchased at a bargain price, such businesses will create wealth at above-market rates over the long-term.

Rockbridge's investment philosophy can be distilled into three simple but powerful criteria. As Keefe explains, every investment decision is driven by:

🏆 1/ Sustainably high return on invested capital

Keefe looks for businesses that generate exceptional returns on the capital they deploy — think 15-20%+ ROIC consistently over time. These are companies with genuine competitive advantages.

👥 2/ Excellent shareholder-friendly management

Management quality is non-negotiable. Keefe wants leaders who think like owners, allocate capital intelligently, and operate with complete integrity.

💰 3/ Bargain valuation at time of acquisition

Even the best business becomes a poor investment if you overpay. Keefe insists on buying wonderful companies at reasonable prices, not at any price.

Rockbridge believes the obvious. Active management is not worth the cost unless it generates above-average returns over the long run. Only a handful of investors, most notably Warren Buffett, have done this. Rockbridge aims to be among them.

Rockbridge Capital portfolio

Here's an overview of Rockbridge's portfolio based on their most recent 13F filing (positions as of 30 Jun 2025):

With 10 positions representing 80% of the portfolio, this represents exactly the kind of concentrated, high-conviction approach that Keefe advocates.

Not surprisingly, this portfolio contains many stocks we also find back in Avenir Corp, the firm where Keefe spent more than 30 years before starting Rockbridge.

There is also a good overlap with the Akre Capital Fund, highlighting the close connection between Peter Keefe and Chuck Akre: Mastercard, O’Reilly Automotive, American Tower, Visa and CCCS to name a few.

Let’s have a closer look at 2 interesting stocks from Rockbridge’s portfolio…

Amrize AG - Special situation stock?

One of Rockbridge's newest positions is Amrize (Ticker: AMRZ), which is a spin-off of Holcim, a Swiss-based global building materials company. Amrize is the spin-off of Holcim’s North American business, which was recently completed in June.

It feels like this could be a Joel Greenblatt type ‘special situation’, so it’s something I will research a bit more closely and also look for other potential Gurus who might pick up this stock.

Copart - The ultimate Keefe stock

Copart is a global leader in online auto auctions, specializing in selling used, wholesale, and salvage vehicles. They facilitate the sale of these vehicles through online auctions, primarily to buyers like dismantlers, body shops, dealers, and individual consumers.

Copart makes money from fees charged to both buyers and sellers participating in its online auctions.

To buy or not to buy

As always, we'll evaluate this candidate using a Terry Smith-inspired framework.

1/ Buy Good Companies

For this section, I will quote from Rockbridge’s 2024 investment letter:

(Bold emphasis added by me)

The company thinks in 20-year terms, unlike most publicly traded companies who are thinking about the next quarter’s earnings. For instance, to support its insurance company customers, Copart has accumulated more than 200 storage facilities (yards) around the country since its founding in the 1980s. Copart made the critical decision decades ago to absorb the short-term pain of buying instead of leasing its locations. Its main competitor did the opposite. […]

Copart also had the foresight to invent the online auction market for salvage vehicles, which allows buyers to transact from their computer screen or mobile device instead of strolling through lanes of cars at physical locations. […]

Copart has net profit margins in the 30%+ range and returns on invested capital in the high teens and low 20% range. These are multiples of the average S&P 500 company and more resemble a software business than one anchored by 200 yards full of salvage vehicles. The balance sheet is awash in cash. Importantly, the enormous cash flow generated by the business is reinvested for the long term by extraordinarily gifted managers and capital allocators. Copart’s business model, its capable and long term oriented management, and an unassailable business franchise add up to a multi-year, possibly multi-decade, compounding opportunity.

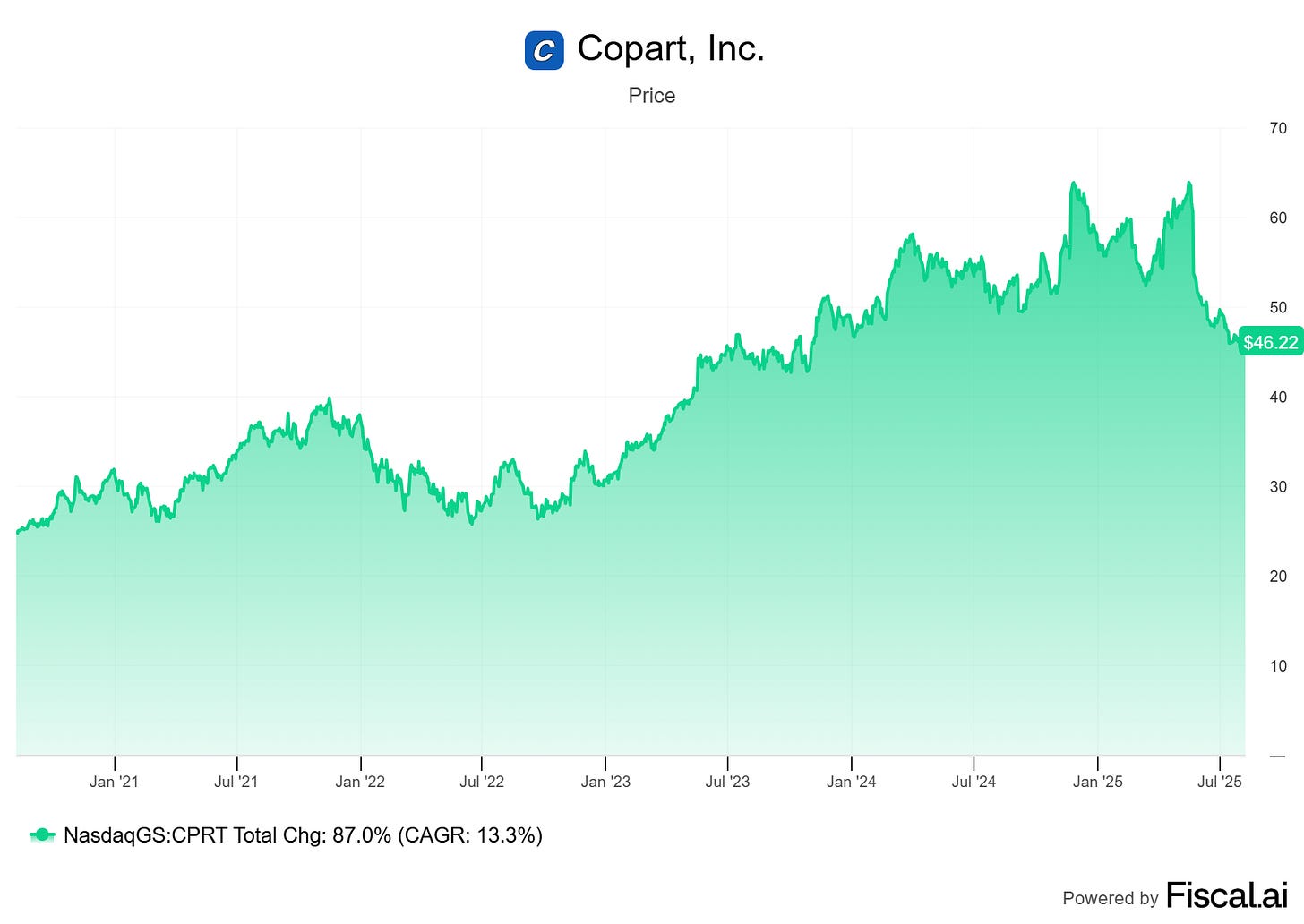

Copart has created incredible value for shareholders since its IPO (1994) with a CAGR of ~17%. Its most recent 5-year CAGR is at 13%.

2/ Don't Overpay

Copart is a high-quality business — and the market knows it.

While the stock price has significantly declined over the past 6 months - and it could therefore be a good moment to buy - it seems still to be fairly valued based on its historical EV/EBIT ratio (second chart below)

Copart will likely remain a fantastic business regardless of short-term market movements, but buying it at a discount could make the difference between good and great long-term returns. I will therefore wait to see if the price drops further to add it to the Guru Gems portfolio.

3/ Final decision

I am not adding Copart to the Guru Gems portfolio (yet).

Just like with QSR, a possible Gem from Chris Davis’ portfolio, I will add Copart to my watchlist, and wait for a potentially more attractive entry point.

That's it for this week's edition. As always, thank you for reading and following along on this journey.

Until next week!

I hadn't heard of Keefe before, really interesting. Thanks for sharing :)