3 Guru Gems Stocks I'm watching for 2026

Several stocks on the watchlist are starting to look interesting

Welcome back and Happy New Year!

If you’re new to Guru Gems: I study the world’s best long-term investors and share what I learn.

I wanted to start the new year with an update on the Guru Gems watchlist as some of the names have become more attractive over the past months.

Before we continue…

In my year-end post last week, I introduced a Subscriber referral program.

The main price is a 1-month paid subscription to Michael Burry’s Substack ‘Cassandra Unchained’.

So far, this subscription has really been worth every dollar. Burry has already published some great write-ups and it’s a unique opportunity to read first-hand the thinking process of a great investor.

On the referral leaderboard, there are currently 2 people who made 1 successful referral, so you still have a very good chance of winning!

Now let’s dive in to the Guru Gems watchlist top 3.

3️⃣ Molina Healthcare

Molina Healthcare is a managed care company that provides health insurance through government programs like Medicaid and Medicare.

It's boring (something Peter Lynch would like), and it’s down 50% from its 52-week high.

It's also one of Michael Burry's largest positions

In his latest post earlier this week, Burry covered the stock in great detail.

Here is how he started his post:

Finding a gem of an insurance company stock is not usually a lucky thing.

If the name Molina rings a bell, that is because I added it to the Magic Formula Portfolio in August. With an EV/EBIT of 6.4 and a 3yr ROIC of ~18%, Molina still ranks high on the Magic Formula screener.

What’s interesting is that Burry is essentially saying: here is a stock that is good and cheap, using similar Magic Formula metrics:

Whenever one can buy a durable double-digit ROIC at a single digit normalized owners’ earnings multiple, one should do so, in my opinion.

Bill Nygren is also a fan

Bill Nygren (Oakmark) has also been a buyer of Molina and highlighted in a recent update that they believe Molina’s challenges are temporary.

We believe [the headwinds] are attributable to temporary factors and expect a meaningful earnings recovery in the coming years

To buy or not to buy?

I already own Molina in my Magic Formula portfolio, but given Burry’s conviction, Nygren’s position and strong Magic Formula metrics, I am considering adding it to the Guru Gems portfolio as well.

When laying out the different stress scenarios for Molina, Michael Burry wrote the following:

[…] This could be what drives Molina common stock down, perhaps even to $100/share, where the shares have had some support years ago.

Molina would be a generational buy at that price.

The stock is currently around $178, so if the stock were to drop another 20-30%, I will add it to the Guru Gems portfolio as well.

If you enjoy this newsletter, please help others discover it by clicking 🤍

2️⃣ Uber Technologies

Uber probably needs no introduction. It is the world's largest transportation network company, operating in more than 15,000 cities across 70 countries. With over 180 million monthly users and 7 million drivers and couriers, it has become a global force in mobility.

Guru endorsements

Bill Ackman (a legendary activist investor I’ll cover in a future deep-dive) holds Uber as his largest position at Pershing Square.

Ackman is known for his concentrated, high-conviction approach, buying high-quality companies when they are temporarily undervalued.

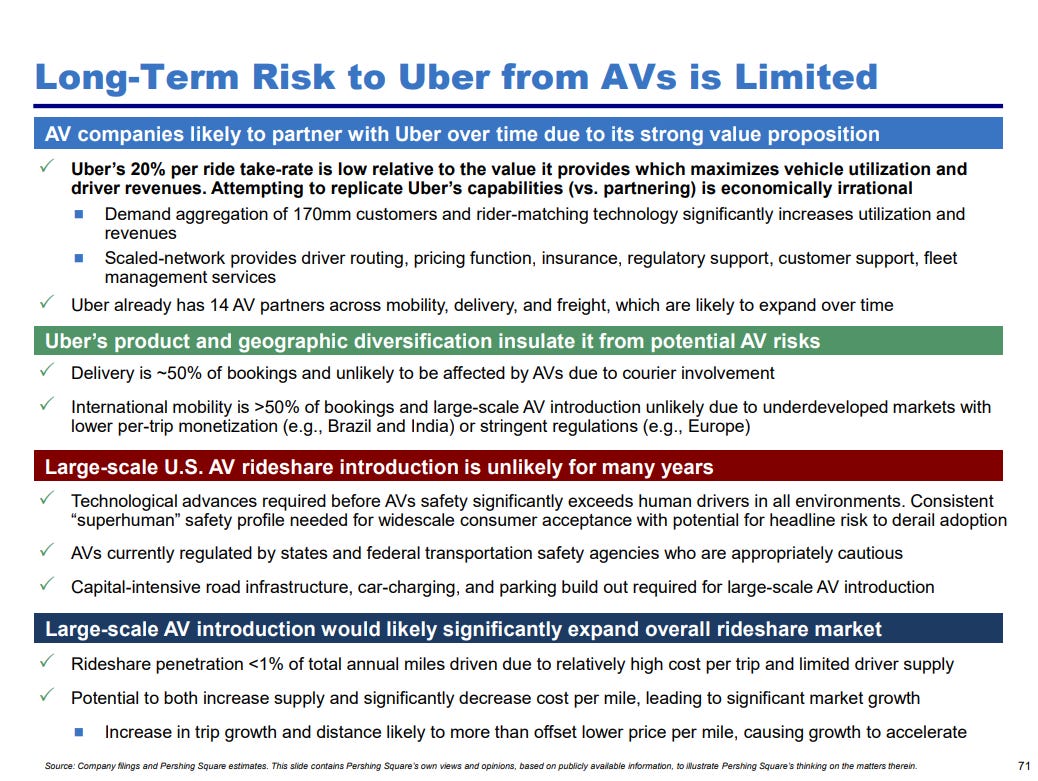

He believes Uber has significant future earnings growth potential. He is also a big fan of Uber’s management team and believes the risk from autonomous vehicles (AV) is overstated:

We believe the long-term risk from AVs is limited and estimate that Uber’s share price is likely to more than double over the next 3 to 4 years

Hinde Group, an investment firm that has strongly outperformed the market since its 2015 inception, also holds Uber as a top position. When a concentrated fund with a stellar track record makes a stock a core holding, it’s worth paying attention.

In their Q1 2025 letter, which was written when the tariffs were just launched, Hinde Group highlighted that the indirect effects of trade policies on Uber should be limited.

In fact, they note that even in a weaker macro environment, Uber could prove more defensive than many expect

“Uber should prove to be a highly recession-resilient business over time for a variety of reasons and is well positioned to weather any adverse impact on the global economy from the trade war Trump has launched.”

To buy or not to buy?

The stock has pulled back ~20% from its highs in October and early November, and at current levels around $82, it’s getting close to where Ackman bought it.

If it drops further below $80, I’m thinking of adding it to the Guru Gems portfolio.

1️⃣ Copart

My #1 watchlist stock for 2026 is Copart.

Copart is a global leader in online auto auctions, specializing in selling salvage and used vehicles.

The stock is down roughly 40% from its 52-week high, driven by revenue & volume misses and economic headwinds.

At the same time it is a favorite among many ‘Quality’ Gurus. It is held by Akre Capital, Wedgewood Partners, Rockbridge Capital, and Tsai Capital.

Guru endorsements

Peter Keefe wrote extensively about Copart in his inaugural Rockbridge investor letter, calling it a “multi-year, possibly multi-decade compounding opportunity.” He highlighted management’s 20-year thinking and their early bet on online auctions.

You can read more about Peter Keefe and Copart in my August post

Christopher Tsai increased his position in Q3 2025, showing continued conviction despite the pullback.

Finally, Chuck Akre and Wedgewood Partners have owned it for years, treating it as a core long-term holding.

To buy or not to buy?

While it's already down 40%, I want to see it stabilize before initiating a position.

The stock is currently at $38 which is just 1% above its 52-week low. I will wait until it goes 10-15% above its 52-week low before buying it.

2️⃣0️⃣2️⃣6️⃣ My 2026 Resolution

I want to end this first newsletter of the year with a resolution.

In 2025, we saw a lot of FOMO (Fear Of Missing Out) return to the market with the AI boom.

To arm myself against this FOMO, my resolution for 2026 is simple:

Stick to the Checklist.

In November, I published the Guru Gems Intelligent Investor Checklist based on the wisdom of Benjamin Graham.

It forces me to go through a list of questions before buying a stock (for example: “Do I understand what could go wrong?”)

I commit to run every potential addition through this checklist before pulling the trigger. I encourage you to do the same.

Here is to finding more Gems in 2026!

“I try to be more knowledgeable each year as an investor” — John Templeton

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!