Year-End Special: Giveaways + Portfolio Performance + Michael Burry's view on Alphabet

How the portfolios finished 2025, what Michael Burry thinks of Alphabet, and a holiday gift for you.

Welcome back, and Happy Holidays! Hope you’re enjoying some time off with family and friends.

Writing Guru Gems this year has been an incredible journey. 8 months of studying investing masters, building two portfolios, and sharing everything I learn with this community.

Someone recently asked me why I keep writing every week?

As I mentioned in my very first post, I’m doing this in the first place for myself. Writing updates every week helps me structure my thoughts or capture the insights from articles/books/podcasts/… I’m consuming.

When I come across something interesting, I usually capture it in different ways: highlights on my Kindle, quick notes on my phone, emailing myself articles, creating a playlist on Spotify with the best Guru interviews, etc.

I still do all those things, but writing down and publishing my research helps me to keep myself accountable and to make sure I stick to my rules or decisions.

So as we close the books on 2025, I wanted to say a massive THANK YOU to everyone who started following me and who is getting something out of Guru Gems.

In today’s year-end edition:

🎁 Special subscriber referral giveaway

📊 Guru Gems Portfolio: 2025 wrap-up & Burry’s view on Alphabet

🏁 The ‘Portfolio Race’ Update: Guru Gems vs Magic Formula

Let’s get into it.

🎁 The Guru Gems Referral Giveaway

Before we talk about portfolios, I want to try something new and fun.

I am launching a Subscriber Referral Program!

The idea is very simple: Refer potential subscribers to Guru Gems, and win prizes.

How it works

1. Share Guru Gems. When you use the referral link below, or the “Share” button on any post, you’ll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends, colleagues, or fellow investors.

2. Earn benefits. When more people use your referral link to subscribe, you’ll receive special benefits.

Get access to the Guru Gems Watchlist for 5 referrals

Get access to small-cap ideas write-ups for 15 referrals

Get a copy of Richer, Wiser, Happier by William Green for 25 referrals

🎁✨January special ✨🎁

Whoever will be at the top of the leaderboard by 31st of January 2026, will get an additional special price: a one-month paid subscription to Michael Burry’s Substack ‘Cassandra Unchained’. The runner-up will get a copy of Richer, Wiser, Happier.

My subscriber count is still relatively low, so even a few referrals may get you the top spot by the end of January!

My deep-dive on Norbert Lou is my most popular post so far, so this could be a good one to share (Share button is at the end of the article).

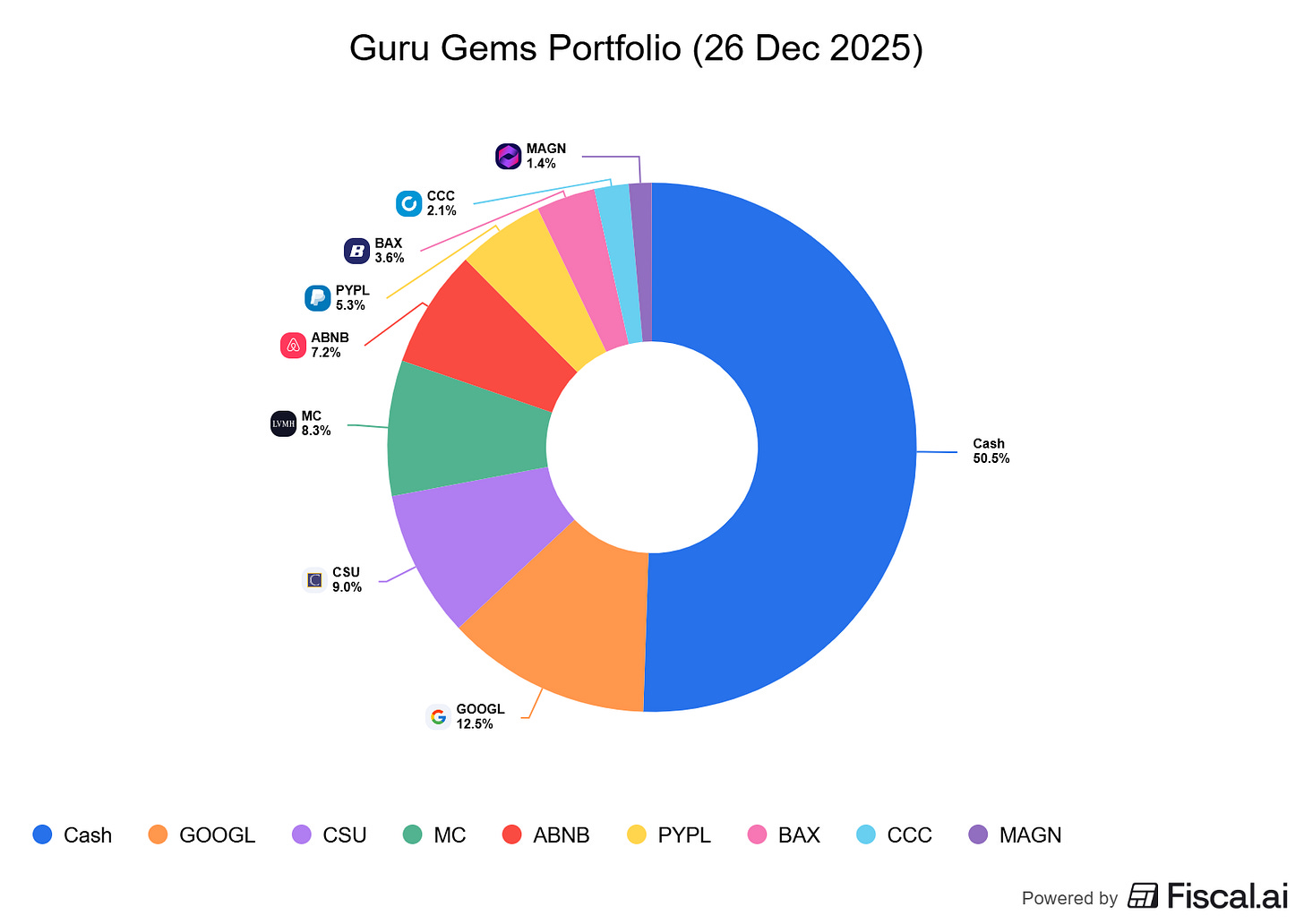

💎 Guru Gems portfolio overview

Portfolio Comments

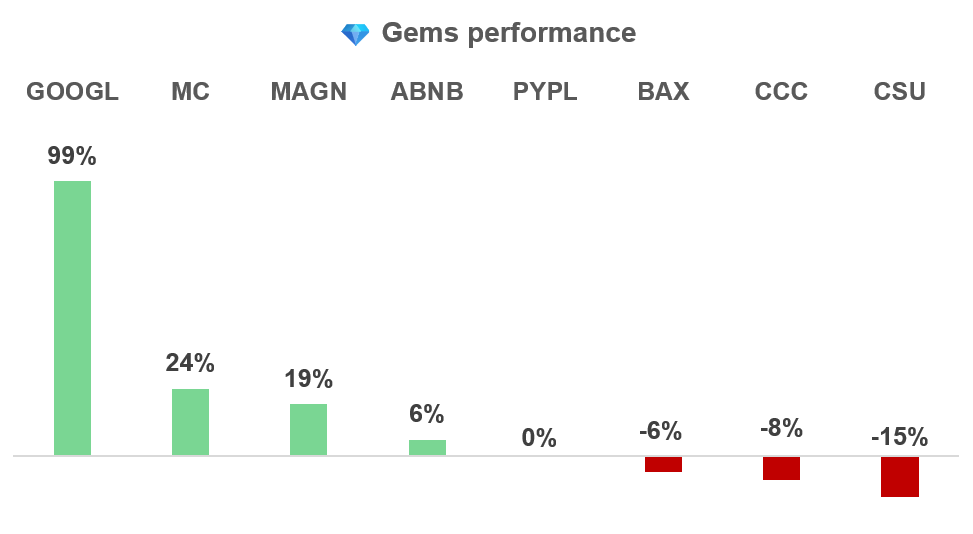

The return on the capital invested over the first 8 months is 17%, driven primarily by LVMH (+24%) and Alphabet’s phenomenal performance (+99% !!).

2025 Winner: Alphabet

When I bought Alphabet in April at $157, the narrative was all doom and gloom ("ChatGPT will kill Google" + regulatory threats), but at the same time it was the most held name in Gurus’ portfolios.

This validates the entire thesis of Guru Gems: look closely at what long-term investing masters are holding, buy quality when it's unloved, and focus on business fundamentals

2025 Detractors: CCC Intelligent Solutions & Constellation Software

While the portfolio is up overall, not everything is working. CCC Intelligent Solutions (CCC) is down 8% and Constellation Software (CSU) has pulled back 15%. I am not (yet) worried about either.

Constellation has been in a significant drawdown over the past months, driven primarily by a change in leadership and AI disruption fears. It would be impossible to buy at the exact low point, so I am happy to keep holding it through the dip as I believe the business fundamentals are still strong and the stock should recover over time.

2026 Gameplan:

I’m still sitting on ~50% cash, waiting patiently for the right opportunities.

With valuations stretched in many areas and bubble warnings from Ray Dalio and Michael Burry, I’m not in a rush.

Several names I’ve added to the watchlist over the past months are starting to look more interesting. In my post next week I will review the watchlist and look more closely at some of these names.

Michael Burry’s view on Alphabet

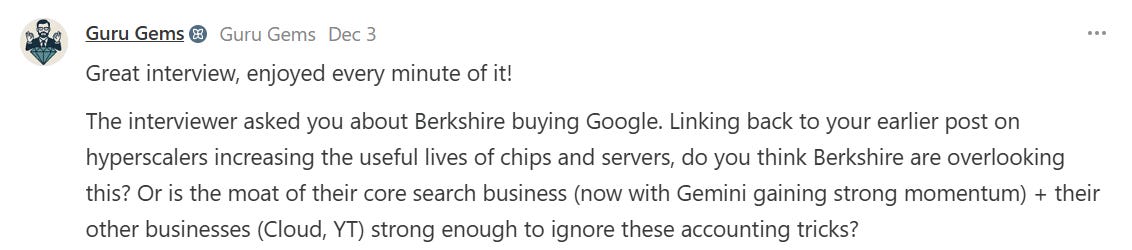

After getting a reply from Michael Burry on my question about JD and MELI, I tried my luck again asking for his thoughts on Berkshire buying Alphabet.

On a recent podcast with Michael Lewis (author of The Big Short), they touched on this, but only briefly, and I was curious to know if he believes Berkshire made a mistake buying Alphabet:

Unfortunately, no luck this time… but then someone asked a similar question earlier this week and Burry posted a Note with his thoughts on this topic:

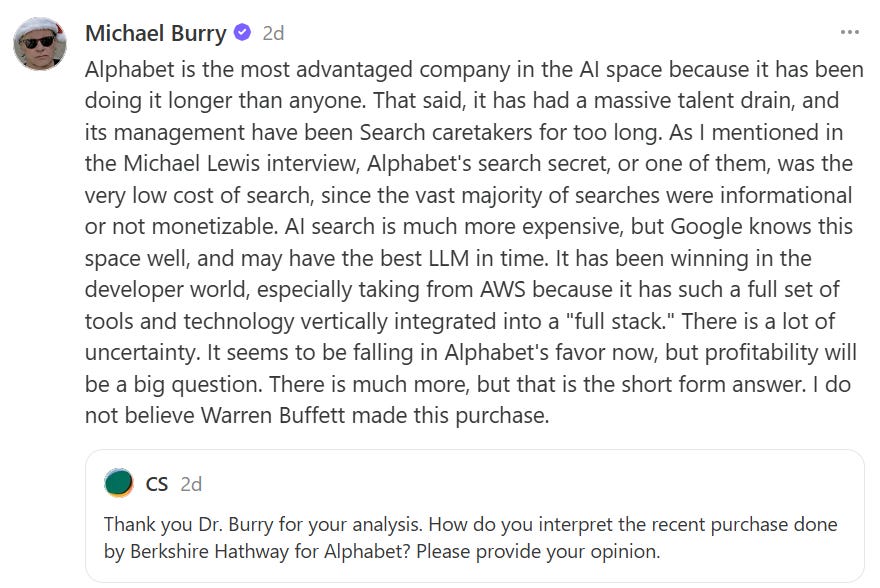

Burry points out that with AI search being much more expensive than ‘traditional’ search, profitability will be a key element to watch for Alphabet shareholders.

And as many other Berkshire experts have highlighted, Burry suggests that while Buffett may have given his blessing for the Alphabet purchase, it was probably one of Berkshire’s investment managers (Todd Combs or Ted Weschler) who made the purchase.

If you enjoy this newsletter, please help others discover it by clicking 🤍

🏁 Guru Gems vs Magic Formula

When I started this journey, I created two separate portfolios to test different approaches:

Guru Gems Portfolio: High-conviction positions from studying superinvestors

Magic Formula Portfolio: Joel Greenblatt’s quantitative approach (cheap + good, held for one year)

The 2025 Winner? Guru Gems

Guru Gems Portfolio: +17% (excluding cash)

Magic Formula Portfolio: +7%

The Guru Gems portfolio was carried by Alphabet, one of the “Magnificent 7” stocks.

My Magic Formula portfolio on the other hand, naturally tilts towards healthcare small-caps, which have been significantly underperforming the S&P 500.

The underperformance shows a lot of resemblance with 1999. From 2000 onwards, small-cap health care beat the market for nearly 20 years.

Of course, there is no guarantee that this will happen again, but as Howard Marks has often pointed out that “just about everything is cyclical” and that “nothing goes in one direction forever”.

🎉 Happy New Year!

Thank you for becoming a Guru Gems subscriber this year, and for being part of this small but growing community.

In 2026, I will stick to the plan: Study the masters, share what I learn, ignore the hype, and buy Gems when they go on sale.

🎁 Don’t forget to share Guru Gems to win the Michael Burry subscription or a copy of Richer, Wiser, Happier!

See you in the new year!

2026 is going to be an interesting year! Just tried out some market analysis and advice with Gemini, Claude and ChatGPT. Fed it some different scenarios and all of them are pointing me towards ETFs like JEPI. Check it out ;-)