The Magic Portfolio - Round 5

Adding 3 small-cap stocks to the Magic Formula Portfolio

Welcome back!

Today is Round 5 of building my Magic Formula Portfolio.

As a reminder, while studying investing masters, I am creating two real-money portfolios to put my learnings into practice:

Guru Gems Portfolio - Can I build a portfolio that outperforms over the long term by cloning the best long-term investing masters?

→ This portfolio consists of ‘Gems’ I uncover in Guru portfolios. Read more here.

Magic Formula Portfolio - Does Joel Greenblatt’s “Magic Formula” of buying good companies at bargain prices still work?

→ This portfolio will have 20-25 stocks that rank highest on a combination of ‘good’ (high Return on Capital) and ‘cheap’ (high Earnings Yield).

You can read more on Joel Greenblatt and his Magic Formula here.

🎁🎁In the spirit of the festive season, I am happy to gift you my Joel Greenblatt e-book:

Current portfolio performance

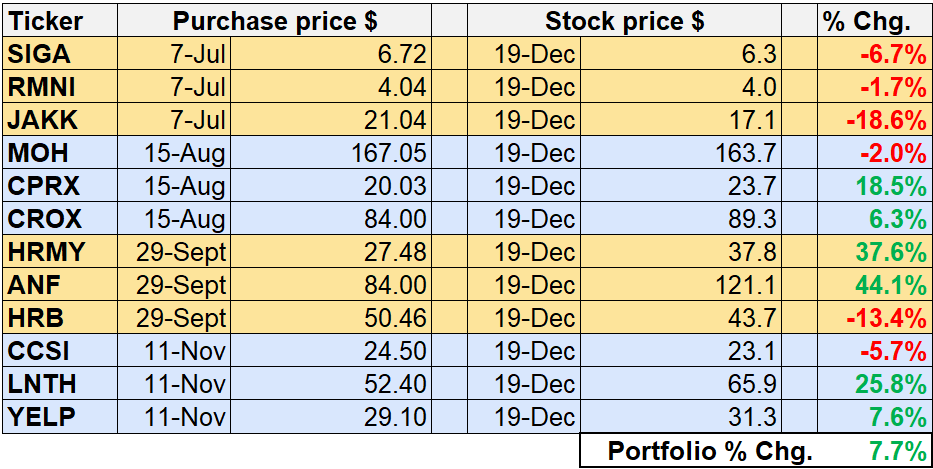

My Magic Portfolio has recovered quite a bit since my last update in early November, driven by a few significant winners:

Abercrombie & Fitch (ANF) stock surged post Q3 earnings, which drove optimism for recovery from tariff impacts. Broker upgrades then gave the stock additional momentum over the past weeks.

Harmony Biosciences (HRMY) exceeded Q3 earnings estimates, and raised their full-year 2025 revenue guidance

Here is how the portfolio has performed to date:

The overall performance is currently +7.7%, compared to +9.7% for the S&P500 over the same time period.

While going from an underperformance of 12% in my last update to just 2% now is a bit of a relief, it is still underperformance nonetheless.

I need to stick to the formula and the real test will be a timeframe of 3 years as that is where Greenblatt observed outperformance 100% of the time:

“[…] every three-year period tested (169 of 169) beat the market averages. That’s right. The magic formula beat the market averages in every single period!”

—Joel Greenblatt in ‘The Little Book That Beats The Market’

If you enjoy this newsletter, please help others discover it by clicking 🤍

New Magic Formula Stocks

Here are the 3 companies I will be adding to the Magic Portfolio on Monday:

(Read my first Magic Portfolio post for my step-by-step approach of selecting the companies)

Rigel Pharmaceuticals (RIGL) - A biotechnology company dedicated to discovering, developing and providing novel therapies to treat hematologic disorders, cancer, and rare immune diseases.

RIGL currently ranks highest on the Magic Formula with a 3yr ROCE of 30% and EV/EBIT of 5.6

From now on, I will also include an LLM ‘Deep Research’ report for each of the stocks.

The LLM report says RIGL “appears to be a convincing BUY for investors with a one-year time frame”:

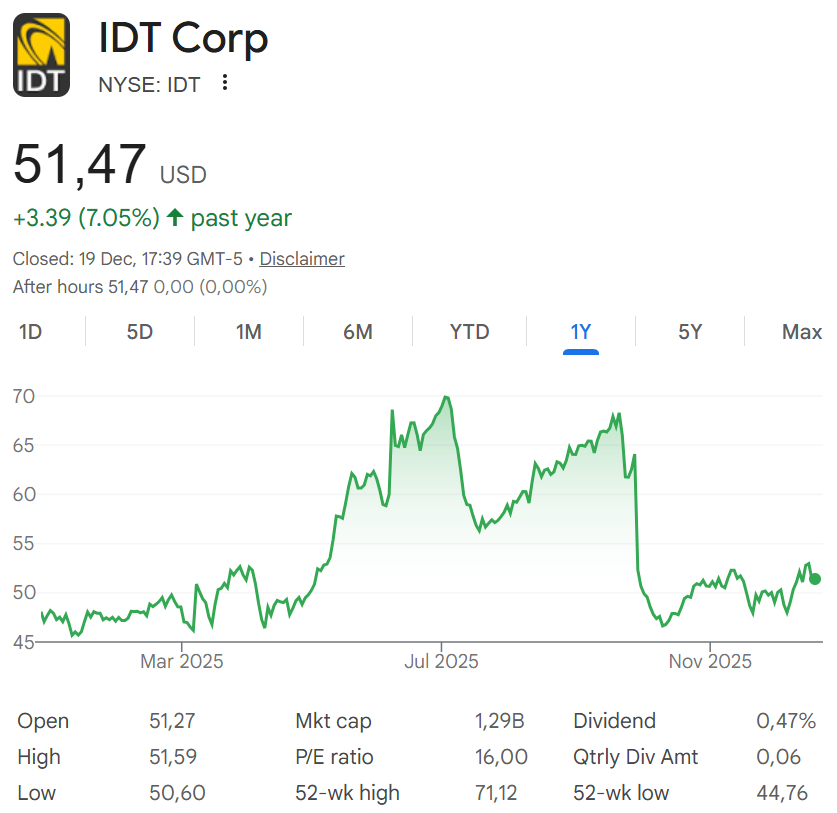

IDT Corporation (IDT) - IDT is a multinational provider of cloud communications, point of sale systems, unified communications, and financial services foreign exchange services.

3yr ROCE is 32% and EV/EBIT is 10

The LLM ‘Deep Research’ report concludes that “IDT Corporation is a compelling BUY”:

Perdoceo Education Corporation (PRDO) - Perdoceo Education Corporation operates for-profit universities that offer postsecondary degree programs (primarily online) to working adult students.

3yr ROCE is 18.4% and EV/EBIT is 6.9

The LLM ‘Deep Research’ report concludes that “PRDO represents a compelling value opportunity in the education sector”:

All three companies are small-cap stocks (<$2B market cap) and RIGL will be the 5th small-cap healthcare company in the portfolio, potentially taking advantage of the extreme valuation gap that currently exists in small caps, especially in healthcare.

Timing a turn in the cycle is never certain, but history shows that extreme valuation gaps (like today’s) have often been followed by multi-year periods of small-cap leadership

— Pzena Third Quarter 2025 Commentary

On Monday, I’ll be adding these 3 names to the Magic Formula Portfolio and hold them for one year, as Greenblatt prescribes.

That brings me to 15 holdings, and the goal is to get to a full 20-25 stock portfolio.

And once built, I’ll let the magic unfold…

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

That’s it for this week! Please like or share if you enjoy reading Guru Gems.

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!