The Small-Cap Cycle

Why now may be a particularly interesting time for small caps

Welcome back for your weekly dose of Guru Gems insights!

I study the world’s best long-term investors and share what I learn.

I am also building two real-money portfolios based on the Gurus’ wisdom:

Guru Gems portfolio - Quality companies held for the long-term

Magic Formula portfolio - ‘Good’ companies at ‘bargain’ prices held for one year

Last week’s deep-dive covered Norbert Lou, a long-term investing master who runs a very concentrated portfolio.

He recently added PayPal and Crocs to his portfolio and I analyzed why PayPal made it on his Punch Card:

Today’s newsletter is going to be a little different.

While I try to stay away from the day-to-day market noise, I do think it’s important to get a good understanding of some of the long term trends or cycles we are in.

As Howard Marks reminds us, everything is cyclical — and one of the long-term cycles playing out today is the dominance of large-cap U.S. stocks over small caps.

(Large-cap is typically defined as companies above $10B market cap, and small-cap below $2B.)

I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.

— Howard Marks in ‘The Most Important Thing’

After more than a decade of large-cap leadership — powered by low interest rates and mega-tech growth — the pendulum will eventually start to swing back.

Based on recent research from Pzena Investment Management (see also my deep-dive on Rich Pzena), Miller Value Partners, and Jeff Weniger at WisdomTree, I’m convinced we are at an inflection point.

1️⃣ A decade of divergence

Small caps have trailed large caps by one of the widest margins on record. According to Pzena Investment Management, U.S. small caps returned about 9.8% annually over the past decade versus 15% for large caps.

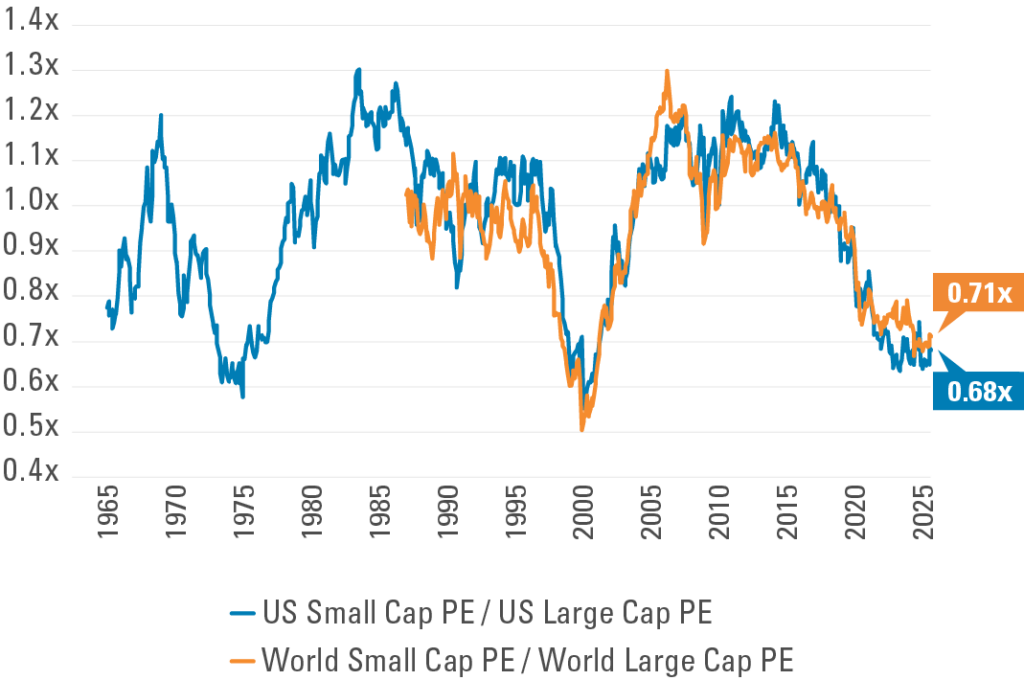

Small caps now trade near record-low valuations relative to large caps, at roughly 0.7× the large-cap P/E multiple — a level seen only twice in 60 years.

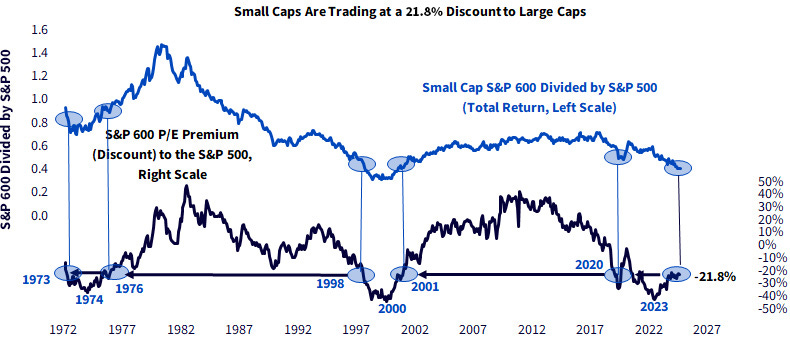

Here is a similar chart from Jeff Weniger at WisdomTree showing small caps’ multi-year struggle, now trading at a 21.8% discount to large caps:

It’s also interesting to note that small caps currently represent just 1.2% of total U.S. market cap, close to a 100-year low and well below the historical average of 3.6%.

🚩 When cycles get this stretched, mean reversion tends to follow.

If you enjoy this newsletter, please help others discover it by clicking 🤍

2️⃣ Fundamentals tell a different story

If large caps were outperforming because of superior fundamentals, the gap might be justified.

But that’s not what’s happening.

Small caps have actually grown free cash flow and dividends faster than large caps — by roughly five percentage points a year.

Here is a chart from Pzena Investment Management’s recent Q3 update where ‘Fundamental Return’ is the combination of free cash flow growth and dividends:

🚩 The divergence has been driven by sentiment and multiple expansion, not performance.

3️⃣ Not all small caps are gems

Of course, not all small caps are created equal. The Russell 2000, for example, contains over 40% unprofitable companies.

Active selection will be critical: avoiding the highly leveraged, low-margin names and focusing instead on profitable, cash-generative businesses temporarily out of favor.

This is also exactly what my Magic Formula Portfolio does — systematically buying good companies at bargain prices.

Interestingly, many of the current Magic Portfolio screen’s top-ranked names are in healthcare and industrial small caps.

In one of my previous updates, I shared the graph below from Jeff Weniger, showing that small-cap healthcare’s current underperformance versus the S&P 500 shows a lot of resemblance with 1999.

🕵️ Conclusion & The Opportunity ahead

Today’s setup resembles the inflection points of the early 1980s and early 2000s — two eras that followed extreme large-cap dominance. Both were followed by long runs of small-cap leadership.

Timing a turn in the cycle is never certain, but history shows that extreme valuation gaps (like today’s) have often been followed by multi-year periods of small-cap leadership

— Pzena Third Quarter 2025 Commentary

Taking advantage of this opportunity

My Magic Formula portfolio already naturally tilts towards small-caps (5 out of 9 are small cap), so I will keep watching for smaller cap stocks that are on top of the screener.

For my Guru Gems portfolio, taking advantage of small cap stocks is a bit more challenging; most of the portfolios analyzed so far have very little small cap stocks. I will continue to look for Gurus who manage smaller size portfolios.

Every once in a while, an up-or down-leg goes on for a long time and/or to a great extreme and people start to say “this time it’s different.” They cite the changes in geopolitics, institutions, technology or behavior that have rendered the “old rules” obsolete. They make investment decisions that extrapolate the recent trend. And then it turns out that the old rules do still apply, and the cycle resumes. In the end, trees don’t grow to the sky, and few things go to zero. Rather, most phenomena turn out to be cyclical.

— Howard Marks - ‘You Can’t Predict. You Can Prepare.”

That’s it for this week! I hope you find these insights valuable and please like or share this post - or leave a comment📝

You can also follow me on X @guru_gems.

Until next week!