Portfolio Update 4: Staying the Course with my Gems

Guru Gems Portfolio monthly update

Welcome back — and a warm welcome to all new subscribers!

This week I’m sharing my fourth monthly portfolio update. With markets still volatile and new headlines every week, it’s easy to get caught up in the noise.

But as we’ve learned from the long-term Gurus, the key is to stay focused on quality companies and let them compound over time.

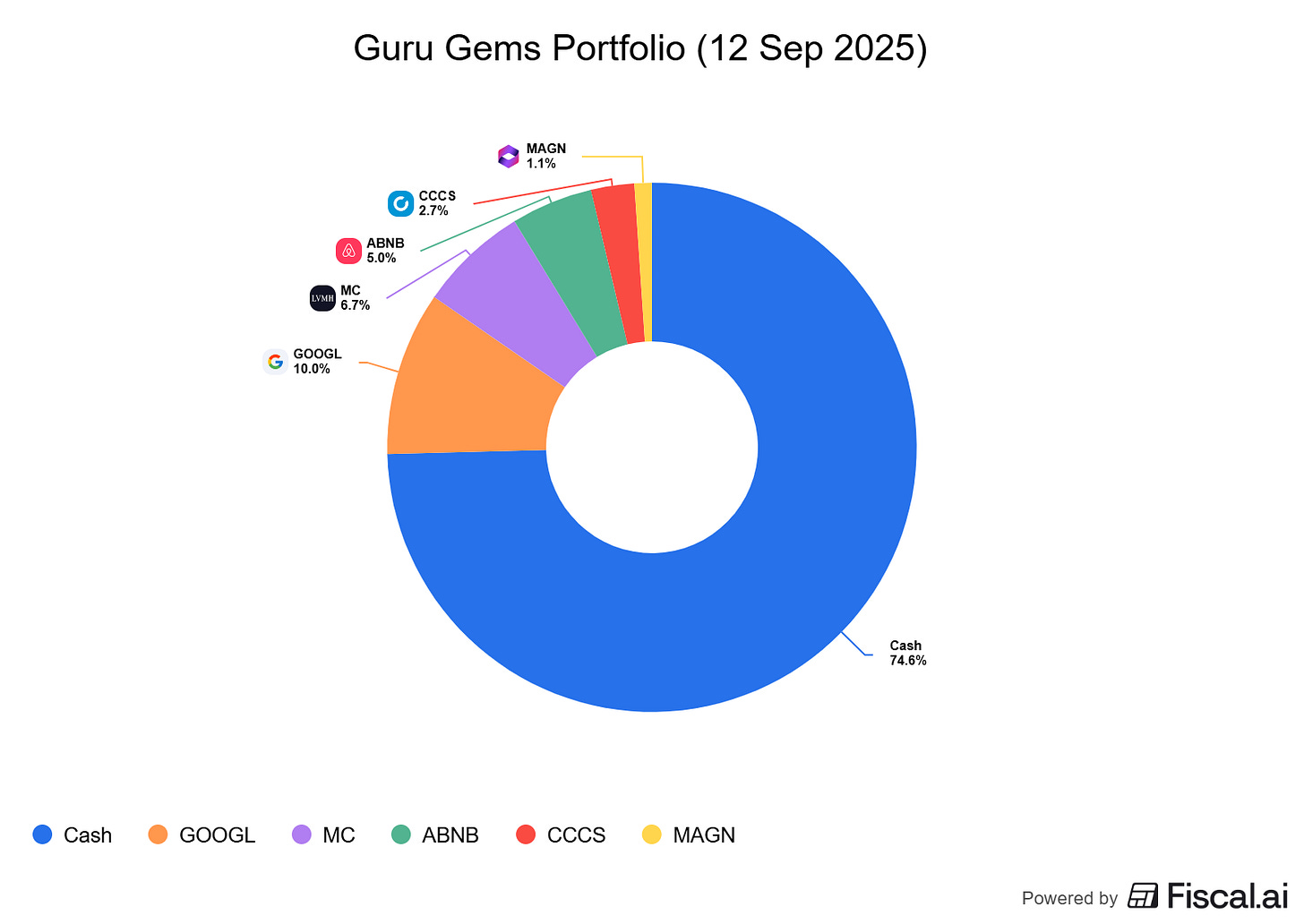

Here’s the latest on the Guru Gems portfolio:

Guru Gems portfolio overview

Current holdings

Comments

The return on the capital invested so far over the first 5 months is 14.6%, driven primarily by Alphabet’s strong performance during this period.

My invested capital is still small (~25%), and I am waiting for a good opportunity to buy some of the companies on the watchlist or add to current positions.

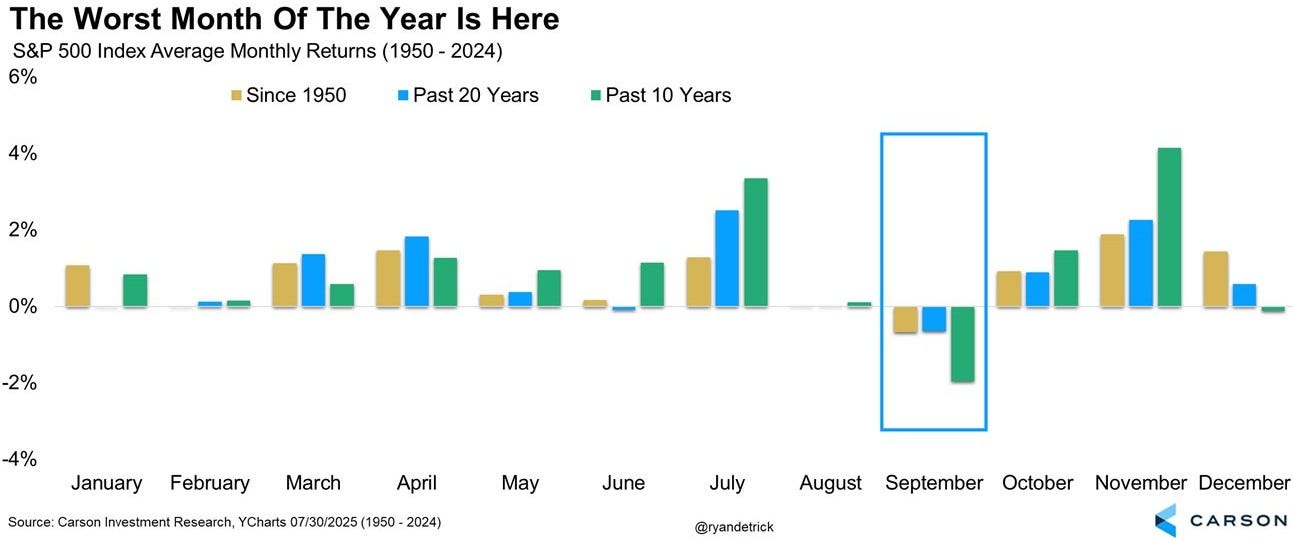

This opportunity may come soon as September has historically been the worst performing month on average for the S&P 500…

If you enjoy this newsletter, please help others discover it by clicking 🤍

🔎 Alphabet (+53%)

Alphabet remains my star performer, mainly driven by the recent court ruling that spared Google from the most severe penalties in its antitrust case, including a forced divestiture of its Chrome browser and Android operating system.

The stock is up nearly 53%(!!) from my average purchase price of 157.7

With the legal uncertainty clearing, investors’ focus is now back on the company's growth potential, particularly in its AI initiatives.

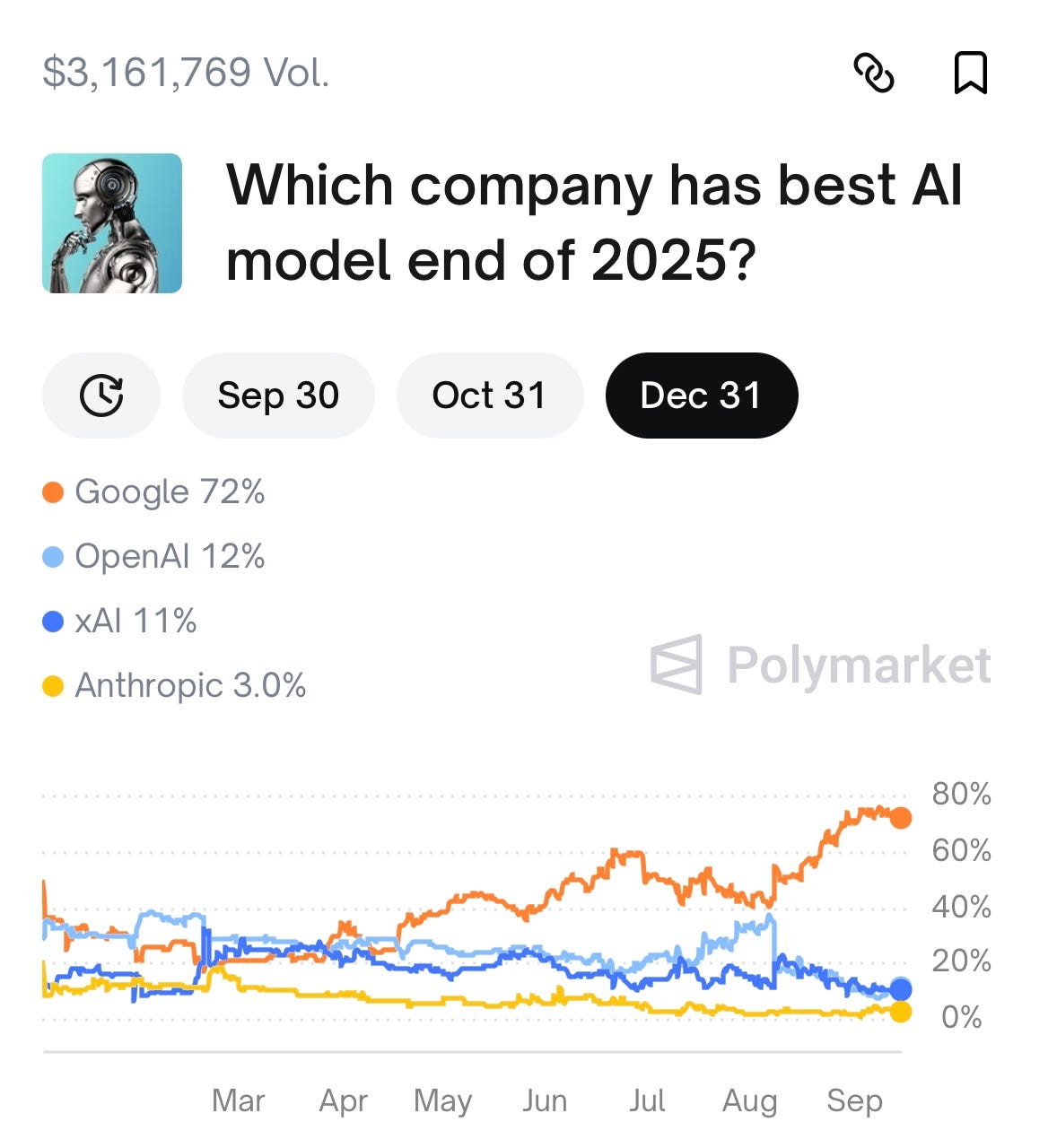

On Polymarket, “The World’s Largest Prediction Market”, Google is still leading by a wide margin on having the best AI model by end of 2025.

👜 LVMH (-3.5%)

LVMH, my second largest position, has recovered a bit over the past months, but is still 3.5% below my average purchase price.

Bernard Arnault continued to buy LVMH shares, with transactions as recent as 4 and 5 September (~0.5M EUR each)

Interestingly, LVMH was named as one of three “potential partners” in Giorgio Armani’s will as he instructed his heirs to sell an initial 15% stake in his famous Italian fashion house.

Arnault commented that “LVMH would be committed to further strengthening its global presence and leadership”, though no concrete moves have been announced yet.

L'Oréal and EssilorLuxottica are the other two preferred partners.

🏕 Airbnb (-6.1%)

Despite a strong second quarter that saw earnings beat expectations and sales growth accelerate, Airbnb also cautioned that growth rates may not keep up later this year.

The stock was down nearly 7% following the Q2 earnings call and I took this opportunity to add to my position, bringing my average purchase price to 130.56

As highlighted in my recent Gurus’ Q2 portfolio update, both Bill Nygren’s Oakmark Select Fund and Akre Capital Management further added to their position, which strengthens my belief that Airbnb remains a strong candidate for compounding over the next years.

🚙 CCC Intelligent Solutions (+10.6%)

CCC Intelligent Solutions (CCCS) is my second best performing stock and is up just over 10% versus my purchase price of 8.84

The recent momentum may have been helped by positive commentary at a few investor conferences and the company’s announcement of several new AI-driven workflow features.

Its sticky subscription model and strong net retention rates continue to validate Akre’s thesis of a “compounding machine”

🏭 Magnera (-13.1%)

Magnera Corp has had a tough quarter, with its recent earnings missing analyst estimates despite a strong increase in revenue.

This has led to a drop in the stock and several analyst downgrades, indicating decreased investor confidence.

Magnera is my smallest holding (~1%) and despite the recent price drop, I currently don’t feel comfortable adding to the position.

“The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are."”

— Warren Buffett

That’s it for this week…thanks for reading and I’ll be back next week with a new edition!