The Pzena Philosophy

On buying deeply out-of-favor businesses and waiting for the rebound

Welcome to a new edition of Guru Gems, where I study the world’s long‑term investing masters and build a portfolio based on these Gurus’ wisdom.

This week I reached 100 subscribers! I’m very grateful for this and it’s certainly a great motivation to keep sharing my learnings as I try to become a better investor.

If you are new to Guru Gems and want to know more about my journey, start here.

In today’s edition:

🔍 Guru in the spotlight: Richard Pzena

📈 Pzena’s deep-value playbook (high-conviction, cycle-aware investing)

🏥 Stock in focus: Baxter International (BAX) — a Pzena holding and potential Guru Gem

Guru in the spotlight: Rich Pzena

Richard “Rich” Pzena is the founder and co-CIO of Pzena Investment Management, a deep value investment firm he established in 1996.

Here is how he describes their approach:

We are deep-value. We're trying to buy stocks that are generally extremely depressed because something has gone wrong in the business. These companies are under-earning versus their historic norms. We believe that they can fix their problems, and that's why we get to buy at a low price.

Pzena was Joel Greenblatt’s Wharton classmate and co-author of their 1979 research project that validated Ben Graham’s stock picking formula.

Here is a great recording from a few years ago where both friends were interviewed on a range of topics around value investing:

There was another similar fireside chat earlier this year at the Value Invest conference, but I was only able to find a summary write-up.

“He’s really one of the highest quality, smartest, nicest people I know”

—Joel Greenblatt

Pzena’s Playbook: Deep Value with Discipline

Pzena’s approach is simple yet incredibly difficult to execute consistently: find companies trading well below their normalized earnings potential, conduct extensive research to separate temporary problems from permanent declines, and concentrate when the margin of safety is large.

There are a few consistent themes that keep coming back in Pzena’s letters or interviews:

Normalized earnings: value relative to long-cycle earnings, not the last 12 months, but on average, what's the earnings potential of a business.

Catalyst focus: identify why the market is wrong (operational stumbles, one-off costs, cyclical weakness) and the likely path to normalization.

Contrarian timing: buy when others are selling due to fear or temporary challenges.

Behavioral edge: accept being unloved in the short term; the payoff comes from patience and discipline.

And while Pzena’s philosophy can certainly be labeled as long-term, he is definitely not in the ‘buy and hold forever’ camp:

The buy and hold where you’re buying with the idea of never selling isn’t a concept that fits with what we do. Particularly, when you’re buying the most deeply undervalued companies, they’re there because something’s wrong with the business, and they’re either going to fix it or not fix it. If they fix it and then it’s fairly valued, why do you want to keep holding it when you can find another one that is half price.

So, I’ve never operated under the buy and hold philosophy. I’ve operated under a longer-term hold than a trader might, because the reality is if you want to get something really cheap, the odds that it’s going to turn around in 6 months or 12 months are pretty low. And the odds that I know it and nobody else knows it are pretty much impossible.

If you enjoy this newsletter, please help others discover it by clicking 🤍

Baxter International (BAX) — a Pzena holding worth a close look

Baxter (medical devices, IV solutions, and hospital products) appears in Pzena’s top holdings and has been a meaningful position in recent 13F filings.

Baxter is exactly the type of opportunity that Pzena's approach targets: a quality business with essential products, facing temporary challenges that have created a significant valuation discount.

The company has been dealing with operational issues, supply chain challenges, and margin pressures that have weighed on the stock price.

In 2022, Baxter was hit by a perfect storm of headwinds that impacted all four of its segments in tandem, sending shares down over 50% to an eight-year low. This considerable decline in valuation for a durable business experiencing some cyclical pain was, in our view, an exploitable value opportunity.

— Extract from Pzena Investment Management’s website.

To buy or not to buy

1/ Buy good companies

I will highlight 2 strengths and 2 risks, but would highly recommend reading Pzena’s write-up of the company and why they believe Baxter could be a big opportunity after a ‘perfect storm of headwinds’ has impacted Baxter’s valuation:

✅ Strengths

Essential Healthcare Products: Baxter provides critical medical devices for hospital procedures and surgical operations. These are non-discretionary medical necessities that hospitals require regardless of economic conditions.

Global Market Leadership: Dominant positions in several healthcare segments with significant barriers to entry due to regulatory requirements, established hospital relationships, and specialized manufacturing capabilities.

⚠️ Risks

Operational Challenges: Manufacturing issues and supply chain disruptions have impacted margins and delivery capabilities in recent quarters.

Regulatory Complexity: Healthcare device regulations create compliance costs and potential delays for new product launches.

2/ Don’t overpay

The operational miss and guidance cut caused a meaningful pullback in the stock (Baxter is down more than 70%(!) over the past 5 years):

Pzena started buying Baxter around end 2023 - early 2024 when the share price ranged around $35-40. The stock has been declining further since, and is currently at $23, significantly below his initial purchase price.

A recent 13G filing (a required disclosure when owning more than 5% of a company’s stock) shows that Pzena Investment Management now owns 10.8% of Baxter as of August 31, 2025, vs a prior stake of 7.7%, meaning that Pzena is doubling down on his thesis.

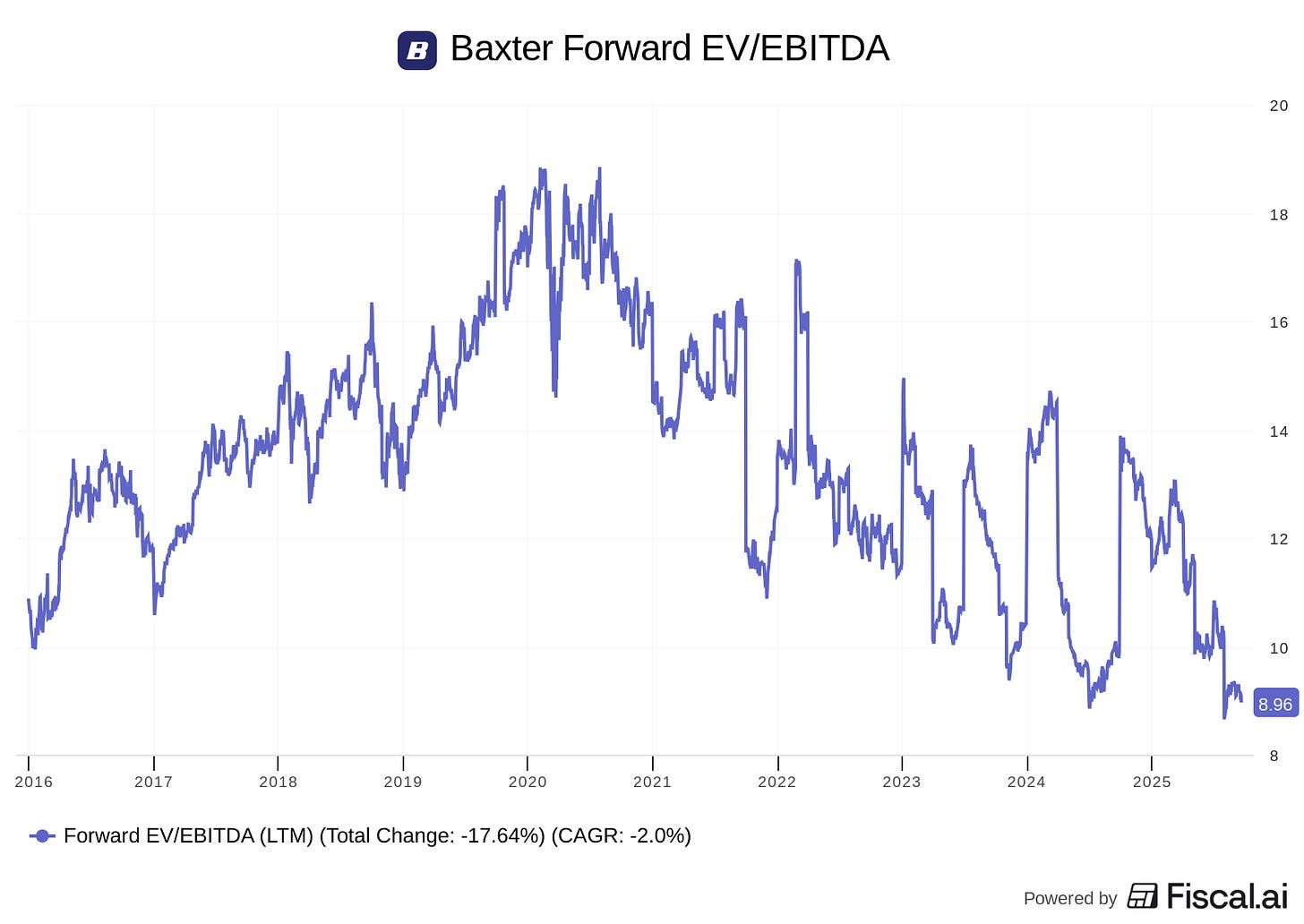

Finally, Baxter’s forward EV/EBITDA multiple, a metric also used by Pzena, is currently at its lowest level in more than 10 years, just below 9x:

3/ Final decision

Pzena’s conviction in Baxter — reflected in a meaningful position size and recent adds — signals that a disciplined deep-value investor sees asymmetric upside vs. downside after the operational shock.

I believe it could be a good opportunity to add Baxter to the Guru Gems portfolio, especially considering that I can buy it even cheaper than the Guru.

📌 Decision: I’m adding Baxter (BAX) to the Guru Gems portfolio as a 2–3% initial position. As for any of my positions, I will be closely monitoring Pzena’s moves and whether any other super investors may pick up the stock.

[Deep-value] is a strategy that requires a lot of patience, has a great long-term track record, but it is less predictable in the short term. So it has to be part of a managed portfolio, but as part of that, it's a really valuable addition to a portfolio.

— Rich Pzena

That's it for this week's edition. As always, thank you for reading and following along on this journey. Follow me on X @guru_gems for more Guru Gems insights.

Until next week!