The Magic Portfolio - Round 3

Adding 3 new stocks to the Magic Portfolio

Welcome back!

This week, I continue with Round 3 of building my Magic Formula Portfolio.

As you know, while studying investing masters, I am creating two separate portfolios to put the learnings into practice:

1 - Guru Gems Portfolio - Can I build a portfolio that outperforms over the long term by cloning the best long-term investing masters?

This portfolio is built around ‘Gems’ I uncover in Guru portfolios. The goal is simple: buy high-quality businesses and hold them for years, letting compounding do the heavy lifting. Read more here.

2 - Magic Formula Portfolio - Does Joel Greenblatt’s Magic Formula of buying good companies at bargain prices still work?

The approach here is to build a portfolio of ~25 stocks that rank highest on a combination of ‘good’ (high Return on Capital) and ‘cheap’ (high Earnings Yield).

If you want to learn more about Joel Greenblatt’s formula, read my post below:

A few months ago I started putting the Magic Formula into practice and bought the first 3 companies:

Six weeks later, I added the next 3 companies:

If you enjoy this newsletter, please help others discover it by clicking 🤍

Current performance

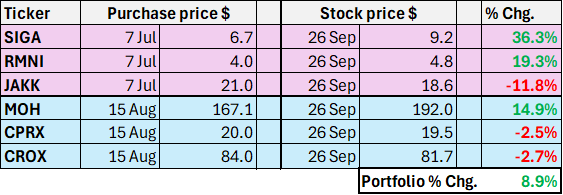

Here is how those first 6 stocks have performed since I started the Magic Portfolio:

Overall, the portfolio returned 8.9% so far, which is slightly better than the S&P500 over the same time period (6.6%). Of course, this is not very meaningful yet as I only started this portfolio 3 months ago and I will still add about 20 other stocks to it.

SIGA is my best performer so far after reporting strong earnings in early August. Surprisingly, it currently still ranks highest on Greenblatt’s criteria (ROCE 5yr Avg of 45% and EV/EBIT of 4.7x)

New Magic Stocks

As I explained in more detail in my earlier edition, I use Joel Greenblatt’s screener on his Magic Formula website, as well as data from Fiscal.ai to get the top 3 stocks in terms of combined rank for Return on Capital and Earnings Yield.

The companies I will be adding to the Portfolio on Monday are:

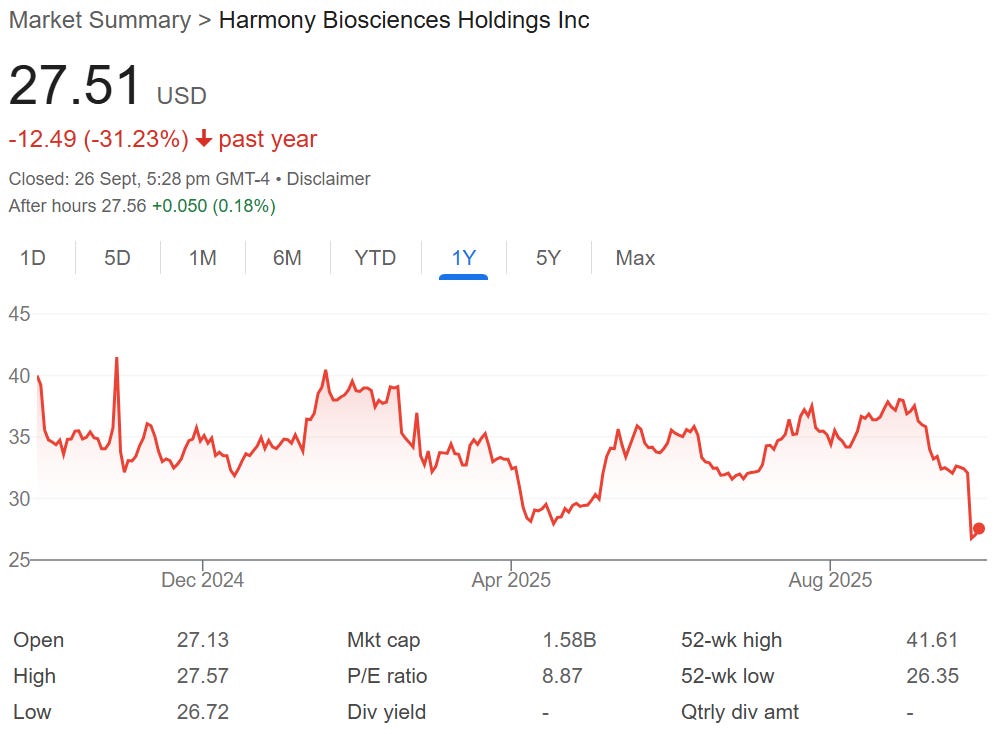

Harmony Biosciences Holdings (HRMY) - A commercial-stage pharmaceutical company that develops and commercializes therapies for patients with rare neurological disorders.

The stock experienced a drop of more than 15% earlier this week when they announced that one of their Phase 3 studies failed to meet its primary endpoint.

Abercrombie & Fitch (ANF) - A specialty retailer offering an assortment of apparel, personal care products, and accessories for men, women, and children under the Hollister, Abercrombie & Fitch, Moose, Seagull, Gilly Hicks, and Social Tourist brands.

H&R Block (HRB) - A company providing assisted income tax return preparation and do-it-yourself (DIY) tax return preparation services and products to the general public primarily in the United States, Canada, and Australia.

On Monday, I’ll be adding these names to the Magic Formula Portfolio and hold them for one year, as Greenblatt prescribes.

That brings me to 9 holdings so far, on the way to a full ~25-stock portfolio.

And once built, I’ll let the magic unfold…

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

Until next week!