Portfolio Update: More good news for Alphabet, More fear for Constellation Software

Updates on GOOGL, CSU, PYPL and adding a new Gem

Welcome back!

In today’s edition:

📉 Japan bonds are scaring investors and tariffs are back (nvm, they’re gone again)

🆕 A new Gem: Adding a Guru favorite to the portfolio

💎 Portfolio update: The Good (GOOGL), the Feared (CSU), and the Unloved (PYPL)

Start here if you are new to Guru Gems.

🧧 FINAL REMINDER: last week to win a one-month subscription to Michael Burry’s Substack or a copy of Richer, Wiser, Happier, by referring new subscribers to Guru Gems. 🧧

🎁 Find more details here - Just one successful referral may get you the price!

📉 The Macro Shock: Japan & Tariffs

The past week was quite volatile: Japan bonds are scaring investors and tariffs are back.

If you spend 13 minutes a year on economics, you've wasted 10 minutes

—Peter Lynch

With Peter Lynch in mind, here is the 30-seconds version of what happened this week:

The Japan Bond Sell-off

Japanese government bond yields hit record highs after the Prime Minister called a snap election and proposed tax cuts.

Why this matters:

Japan has the highest debt-to-GDP ratio (235%) of any advanced economy

A further rise in interest rates could trigger a debt crisis that spills over globally

The Tariff Threat

Adding fuel to the fire, US tariff threats against NATO allies briefly spooked markets before being dropped.

This shows how fragile sentiment currently is.

Staying focused on quality

As mentioned before, I will not be dwelling too much on the global economy with Guru Gems.

My main takeaway of the current situation is that still having half of the portfolio in cash is maybe not a bad thing…

Let me close this section with some wise words from François Rochon:

As always, we remain agnostic regarding the economic and stock market outlook for the coming year.

Our companies continue to navigate the choppy waters of the global economy despite the many sources of worry that create sleeplessness for many investors. The current year will most likely see its share of uncertainties, disappointing economic data and geopolitical (or political) fears.

We remain tooth and nail convinced that our companies should continue to enrich investors at rates above the average over the long run.

Last week I wrote about my 3 favorite investor letters and why Rochon’s letters are my favorite.

And now, back to our Gems!

→ If you enjoy this newsletter, please subscribe and like this post 🤍

→ If you find value here, consider buying me a virtual coffee ☕

🆕 Adding a Guru favorite to the portfolio

On Monday, I’m adding Copart to the Guru Gems portfolio.

Copart runs online vehicle auctions, primarily for salvaged and total-loss cars. Insurance companies rely on Copart to efficiently dispose of vehicles, while buyers around the world compete for inventory through Copart’s digital platform.

Several long-term investors have owned Copart for years, and for good reason: it has compounded capital through multiple cycles without relying on leverage or hype.

Why this is a Guru favorite:

Network effects: More buyers → higher auction prices → attracts more sellers (insurance companies) → more inventory → attracts more buyers

Strong balance sheet: With cash piling up, this offers opportunities for buybacks and/or acquisitions

Long runway: Increasing vehicle complexity and repair costs means more cars are written off

I first wrote about the stock in my review of Peter Keefe and his Rockbridge Capital portfolio.

In his July 2024 Letter, Keefe wrote:

Copart’s business model, its capable and long term oriented management, and an unassailable business franchise add up to a multi-year, possibly multi-decade, compounding opportunity.

I also highlighted the stock earlier this month as one to watch for 2026, as it was down roughly 40% from its 52-week high, driven by revenue & volume misses and economic headwinds.

I wrote:

The stock is currently at $38 which is just 1% above its 52-week low. I will wait until it goes 10-15% above its 52-week low before buying it.

CPRT closed the week at $41.40, which is 10% above its 52-week low. I will initiate a small position (2-3%) and build it up over the next weeks/months.

💎 Guru Gems Portfolio: The Good, the Feared… and the Unloved

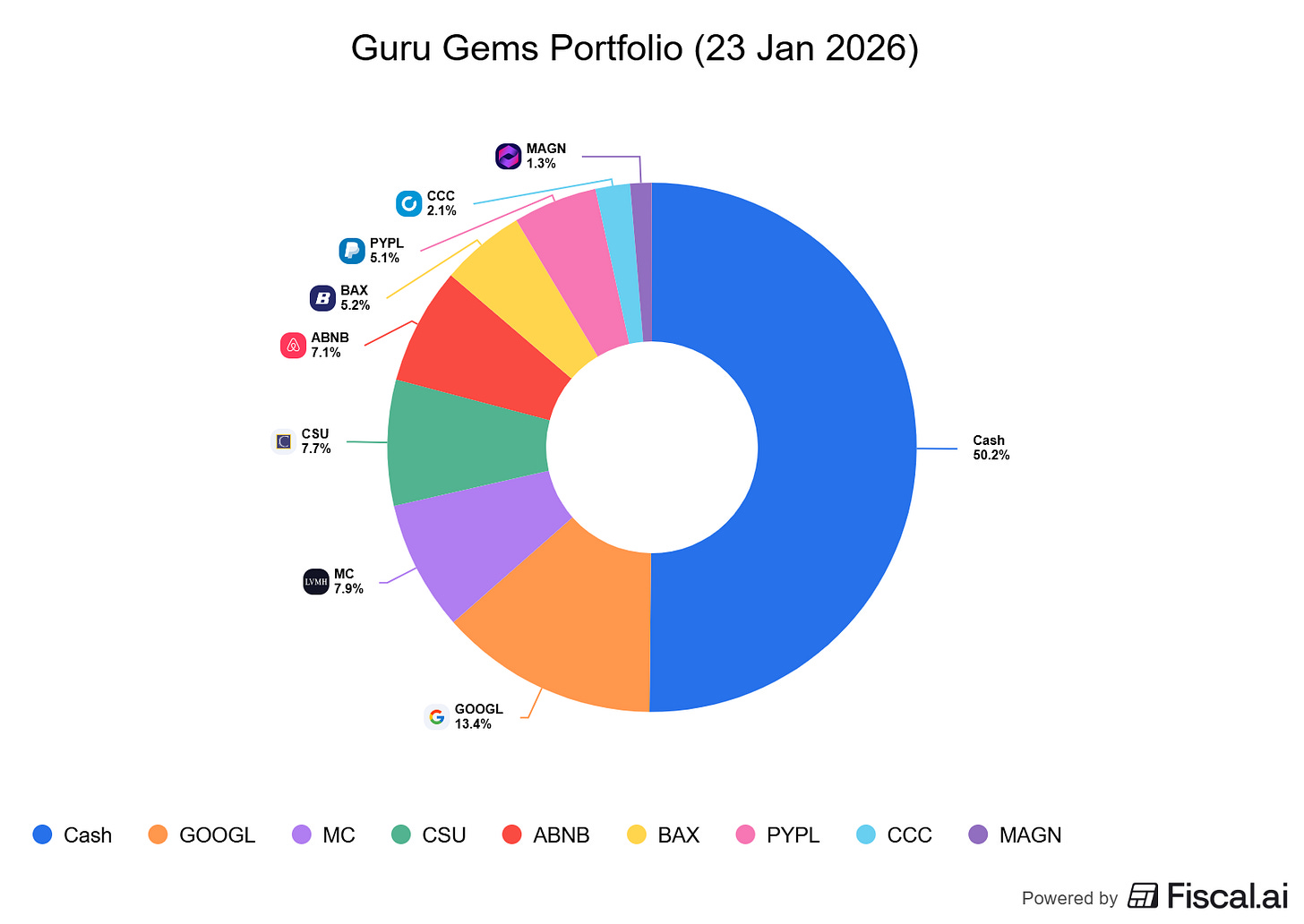

The return on the capital invested over 9 months is 11.6%, compared to 27% for the S&P500 over the same period.

I am making my portfolio and its performance accessible to everyone in a Google Sheets document. You can access it here.

Alphabet (GOOGL): the good news keeps coming

Alphabet continues to be the star of the portfolio. It recently joined the $4 trillion market cap club, driven by growing investor optimism about its AI efforts.

Last week, there was an announcement that Apple had entered into an exclusive multi-year partnership with Google to license Gemini and Google Cloud to support their AI models.

After careful evaluation, Apple determined that Google's Al technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users.

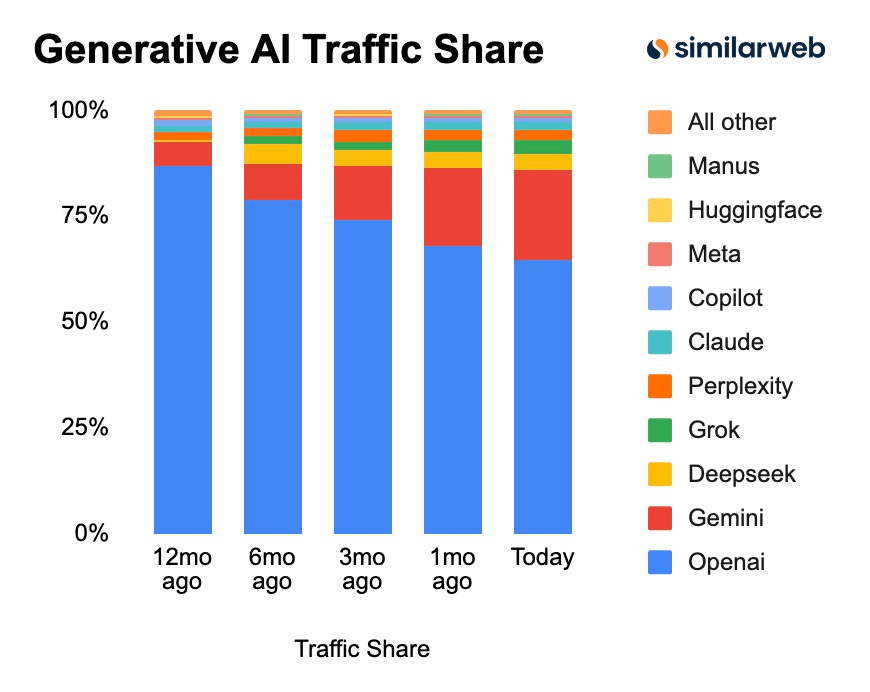

Another interesting update came from Similarweb, a digital intelligence platform, who released a research report on ‘ The Top 100 Most visited Websites in the World (December 2025)’

Google.com is still taking the top spot. ChatGPT.com is in the top 5, but its web traffic declined for a second consecutive month.

What’s interesting is that Gemini.google.com was one of the fastest-growing sites in the entire top 100, and for the first time, it entered the top 20 most-visited websites in the world, following the launch and expansion of Gemini 3.

Similarweb’s Generative AI traffic share data also shows that Gemini keeps increasing its share at the expense mostly of ChatGPT.

Constellation Software (CSU): the fear is real

Constellation Software acquires and manages vertical market software (VMS) businesses. These are industry specific software businesses providing specialized and mission-critical software solutions.

Constellation Software is down more than 25% since I bought it in October—my worst-performing position.

What went wrong?

The stock has been in freefall since May, driven by two fears:

AI disruption - Will AI-powered tools replace Constellation’s niche software?

Leadership transition - Legendary founder Mark Leonard stepped down in September due to health reasons

What is really happening?

The AI fear is likely overblown:

Constellation’s software serves industries where AI adoption will be slow

Many businesses are sticky, mission-critical systems deeply embedded in operations

Constellation could use AI to improve their software, not be disrupted by it

The leadership transition looks solid:

Mark Miller, Leonard’s successor, has been with Constellation for 30 years

He knows the Constellation playbook inside out

Nothing has materially changed in how the business operates

It’s obviously not very comfortable to be down nearly 30% on this position, but since nothing fundamental has changed about the business, I’m not panicking. If the business shows actual deterioration (not just sentiment), I'll reassess.

PayPal (PYPL): not very loved

After adding PayPal in November, the stock has struggled to find momentum and a few warning signs have come up:

1. Market sentiment deteriorating

Analyst downgrades and ongoing concerns about competition and declining branded checkout volumes have kept the stock under pressure.

2. Wedgewood Partners trimmed their position

In their Q4 letter, Wedgewood Partners (who have owned PayPal for over a decade) wrote:

“We trimmed our PayPal positions during the quarter as we believe the combined slowing of transaction volumes and heightened expenses will result in slower profit growth than we previously expected.”

When a patient, long-term holder like Wedgewood trims, that's a yellow flag.

3. Michael Burry isn't interested

Burry recently posted a deep-dive on the payments industry and shared that he is not very interested in PayPal.

“PayPal is not interesting to me. I find its owners’ earnings far below reported earnings, and I worry about pricing power and work culture.”

Later in the comments he mentioned he will do an in-depth post on Block (XYZ) and PayPal (PYPL). I will be watching that one closely!

I will also be watching Norbert Lou’s 13F very closely (released in next few weeks) as well as PayPal’s upcoming Q4 2025 Earnings Call on 3 February.

That’s it for this week…thanks for reading and I’ll be back next week with an update on the Magic Portfolio!