Gurus' Q2 Portfolios: My 2 Takeaways

Distinguishing signal from noise

Welcome back!

In today’s Guru Gems issue, I share my key takeaways from the latest changes in the portfolios of some of the Gurus I have covered until now.

Last week was the deadline for superinvestors to report their US positions held on 30th June 2025 through the so-called 13F filings.

As highlighted in my very first post (link below), the information from 13F filings is not perfect and comes with a serious delay, but focusing on those long-term investors who make little changes quarter over quarter, can give us interesting signals.

Before I continue…

If you enjoy reading this newsletter, please help others discover Guru Gems by liking this post (🤍 at the bottom) and subscribe for weekly deep-dives.

In a recent deep-dive I covered a lesser known but highly succesful investor Peter Keefe.

You can also follow me on X @guru_gems for interesting Guru insights.

Here are my 2 key takeaways from the recent 13F filings:

1️⃣ Minimal changes in superinvestors’ largest positions

Overall, top positions from Gurus studied so far have not changed significantly in Q2, which is a good sign and confirms the value of patience and conviction.

A couple of changes that caught my eye:

Akre Capital Management

Added further to Airbnb (ABNB) and CCC Intelligent Solutions (CCCS), two positions I own in the Guru Gems portfolio.

Bill Nygren - Oakmark Select Fund

Oakmark also added significantly to Airbnb (ABNB).

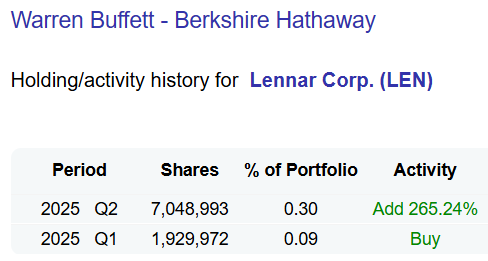

Bryan Lawrence - Oakcliff Capital

Added to Lennar Corp (LEN), a position he started in Q1, which I highlighted in my deep-dive.

Interestingly, Berkshire also started a position in this US homebuilder.

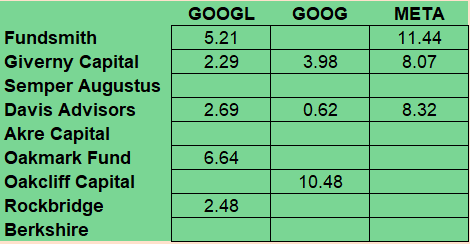

2️⃣ Alphabet is still the ultimate Guru Gem (though Meta is a strong contender)

Back in April, I called Alphabet the “ultimate Guru Gem” as it was the most owned stock among (long-term) superinvestors.

Adding it to the Guru Gems portfolio at a time when the price & valuation were under pressure by fear of a threatened search business and regulatory worries, turned out to be a great decision (so far at least…).

I still think Alphabet is a great company to hold long-term and it seems like the narrative has been shifting recently, which is reflected by the share price being up more than 20% over the past 3 months.

Alphabet is still the most owned stock, but it’s also worth mentioning Meta Platforms (META), which represents a significant share in the portfolio of 3 of the Gurus studied so far (see table below).

Meta is Fundsmith’s largest position for example, and probably also their best investment in recent years as they purchased Meta at a time when it was very out of favor (they started buying in 2018 when the Cambridge Analytica data scandal broke out).

Meta’s performance has been impressive since and it’s certainly a company I should add to my watchlist. At the current valuation however, I don’t think there is enough margin of safety to start a position now.

That’s it for this week… thanks for reading and I will be back next week with a new Guru and a potential new Gem to look into!