The Magic Portfolio - Round 2

Buying 3 new stocks for my Magic Portfolio

Welcome back!

In one of my first Guru Gems editions, I wrote about legendary investor Joel Greenblatt and his Magic Formula:

Last month I decided to put the Magic Formula to practice and started my own Magic Portfolio:

For a refresh on the Magic Formula, here is Joel Greenblatt explaining how he came up with it:

The central idea is to rank stocks based on two key metrics:

Return on Capital (a measure of quality) and;

Earnings Yield (a measure of value).

Before I continue…

If you enjoy this newsletter, please help others discover it by clicking 🤍

Last week I covered a lesser known but highly succesful investor Peter Keefe.

You can also follow me on X @guru_gems for interesting Guru insights.

Back to our Magic Portfolio.

How I Started

In his book ‘The Little Book that (Still) beats the Market’, Joel Greenblatt suggests:

to own a basket of 20-30 stocks - since we expect the magic formula to work on average, so holding many stocks that are ranked highly by the magic formula should help keep us close to that average over time and;

to buy this basket over the course of a year or so, meaning buying a few stocks every month or every other month.

In early July, I bought the first 3 stocks based on Greenblatt’s formula:

SIGA Technologies (SIGA) - A pharmaceutical company developing medicines to prevent and treat emerging infectious diseases

Rimini Street (RMNI) - A global provider of end-to-end enterprise software products, services, and support for various industries

JAKKS Pacific (JAKK) - A toy manufacturer best known for producing licensed action figures, playsets, dolls, plush toys and dress-up sets.

All 3 are small cap stocks (Market Cap below $2B), and all 3 have had a wild ride in just a month and half since I bought them:

SIGA reported strong earnings in early August and jumped nearly 40%, then lost some of those gains in the past week.

RMNI street announced a settlement agreement with Oracle just one week after I bought it.

Oracle sued RMNI in 2015 for copyright infringement and the two companies had been in a legal battle since.

RMNI stock jumped 30% on this news. In the month that followed however, the stock declined significantly and is now back to the level where I bought it.

JAKK is down nearly 20% since I added it to the Magic Portfolio due to a mix of tariff costs and missed earnings.

New Magic Stocks

As I explained in more detail in my earlier edition, I use Joel Greenblatt’s screener on his Magic Formula website, as well as data from Fiscal.ai to get the top 3 stocks in terms of combined rank for Return on Capital and Earnings Yield.

A few interesting companies showed up in the list:

SIGA Technologies and JAKKS Pacific are still ranked top 5 when applying the formula

United Healthcare (UNH) - A lot has been written and debated on social media about this troubled insurer that had fallen more than 50% over the last year. When the news came earlier this week that Berkshire had bought a stake in the company, the stock jumberd nearly 20%.

The companies I ended up buying following the Magic Formula’s ranking are:

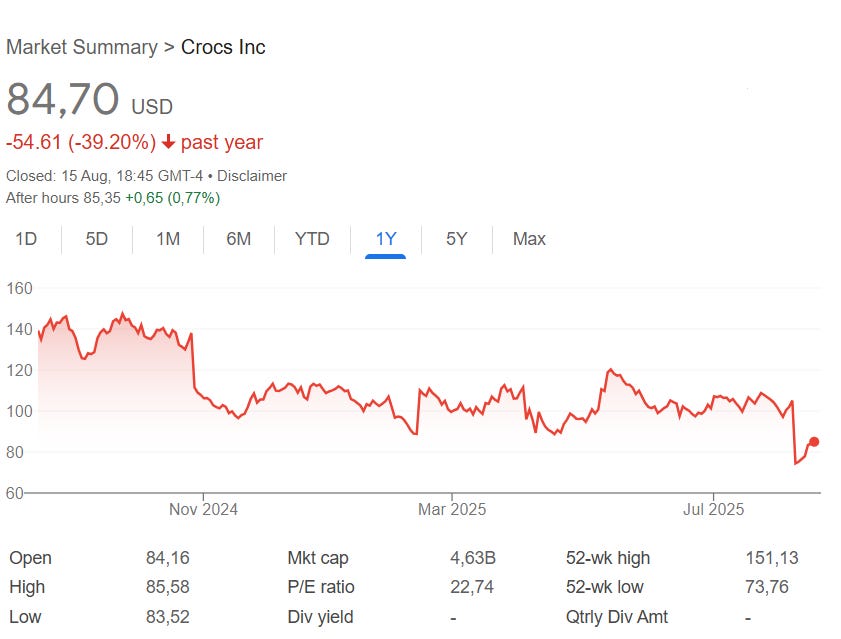

Crocs Inc (CROX) - An American footwear company based in Broomfield, Colorado. It manufactures and markets the Crocs brand of foam footwear.

Norbert Lou, an investor who runs Punch Card Management, just reported a big purchase of CROX during Q2.

What’s interesting is that in 2004 Lou was encouraged by Joel Greenblatt to start a fund of his own with seed capital from Gotham Assset Management.

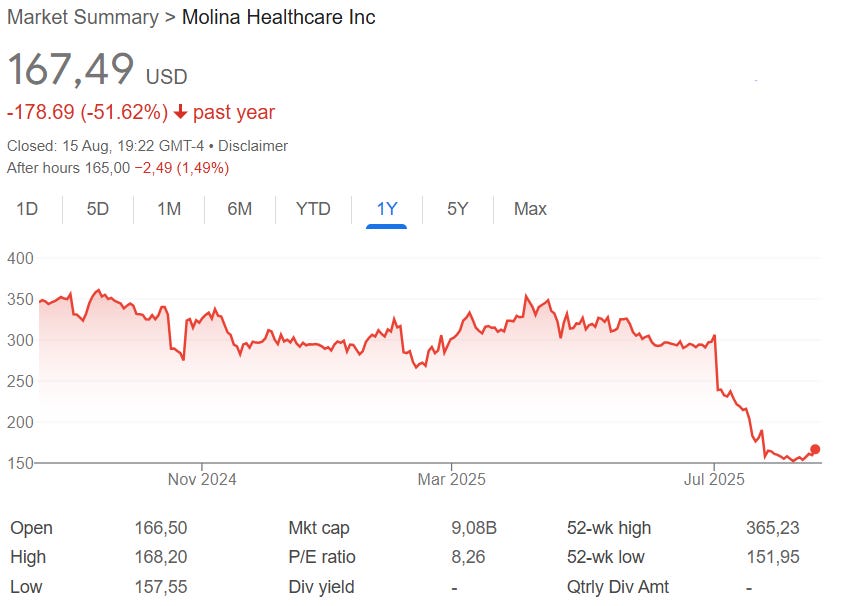

Molina Healthcare (MOH) - A managed care company headquartered in California. They provide health insurance through government programs such as Medicaid and Medicare.

Bill Nygren, a Guru I reviewed in detail a few weeks ago, just reported that MOH was added to the Oakmark Fund in Q2.

Catalyst Pharmaceuticals (CPRX) - A biopharmaceutical company focused on developing and commercializing therapies for people with rare diseases.

I purchased shares of these companies this Friday and plan to hold them for exactly 1 year as Greenblatt suggests.

There are now 6 companies in my Magic Portfolio and I will repeat this process until I have ~25 companies.

That’s it… and now we wait for those 30% returns :-)

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

I will be back next week with an update on the Gurus’ Q2 portfolios and any changes in my Guru Gems portfolio!