The Armitage Approach

On concentration, conviction, and Capital One

Welcome to a new edition of Guru Gems, where I study the world’s long‑term investing masters and build a portfolio based on the Gurus’ wisdom.

Friday’s sharp market sell-off on new tariff announcements feels like a déjà vu from April. But as I wrote back then, I won’t dwell on short-term market noise in this newsletter.

I’ll stay focused on what matters: finding quality companies in Guru portfolios.

In today’s edition:

🔍 Guru in the spotlight: John Armitage

📈 30 years of concentrated conviction at Egerton Capital

🏥 Stock in focus: Capital One Financial (COF) — A Guru favorite

🚨 Guru Gems Portfolio alert

If you are new to Guru Gems and want to know more about my journey, start here.

Guru in the spotlight: John Armitage

John Armitage is the co-founder and Chief Investment Officer of Egerton Capital, a London-based hedge fund managing about $19 billion. Since 1994, Egerton has quietly delivered very strong, steady performance using a fundamental, research-driven approach focused on large-cap equities.

His approach is rooted in detailed, bottom-up analysis—he believes the edge comes from understanding businesses better than the market, not predicting macro trends.

Armitage has an incredible track record, beating the index by 7% per year over 30 years, making Egerton one of the longest-running and best-performing major hedge funds in the world.

Here is a great interview with Armitage on the Behind the Balance Sheet podcast by Stephen Clapham

”I think one of the things investors have to have is insatiable curiosity”

—John Armitage

The Armitage Approach: Concentrated Conviction

Unlike many hedge fund managers who run diversified portfolios of 100+ positions, Armitage maintains 35-40 long positions and has become more concentrated in his top positions over time.

His approach centers on a few key principles that enabled his 30-year track record:

Focus on what’s important

As Armitage notes, “you have to focus on what’s important” — and while that seems obvious, in an age of information overload, this discipline separates great investors from mediocre ones.

Fundamental research over data science and models

Armitage takes a fundamental, research-intensive approach. This means their investment decisions are driven primarily by proprietary, company-specific research, focusing on the intrinsic value and quality of the businesses.

As stated on Egerton’s website: Look for quality companies at attractive valuations with significant upside potential

Concentration with caution

While Armitage is relatively concentrated, he is also mindful not to get too familiar with a stock that would make him complacent when it is no longer performing.

“I think that if you concentrate a lot and watch what you’re concentrated in like a hawk, that is a good thing to do.”

“The good thing about owning good companies for a long period of time is that they compound incredibly effectively in your favor. […] The bad thing is that they can change subtly, you don’t notice it, and then one day you realize you’ve underperformed for a year.”

If you enjoy this newsletter, please help others discover it by clicking 🤍

Egerton Portfolio

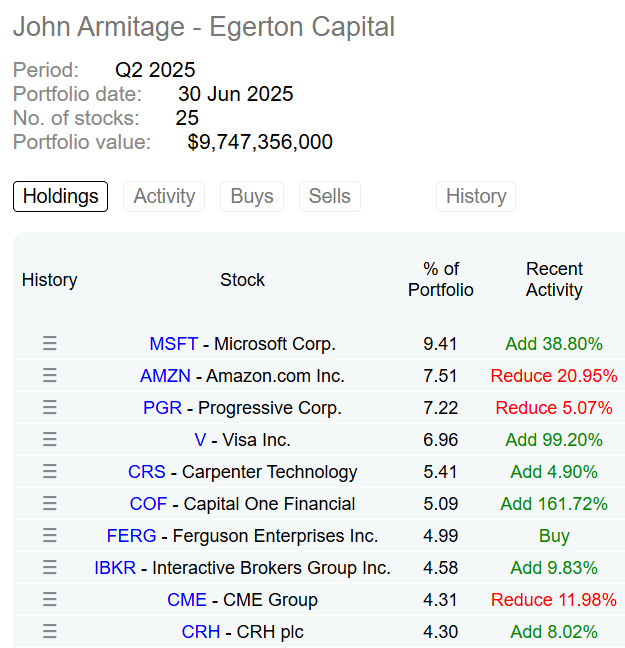

Based on Egerton’s most recent 13F filing (Q2 2025), here is a snapshot of their top holdings:

Capital One Financial (COF), their 6th largest position, represents one of their most significant recent moves, with a 162% increase in Q2 2025.

This significant accumulation caught my attention, especially since Capital One also appears in the portfolios of many other Gurus, including three I have recently studied: Chris Davis (his largest position), Bill Nygren, and Rich Pzena.

Capital One Financial - To buy or not to buy

As always, I’ll evaluate this candidate using a Terry Smith-inspired framework:

1/ Buy good companies

Capital One Financial (COF) is a major US financial holding company, specializing in credit cards, auto loans, banking, and savings accounts.

With the recent completion of its acquisition of Discover Financial Services, Capital One has transformed into the largest credit card issuer in the United States.

“I think that Discover brings us a growth platform, both on the network side and with respect to their card franchise, that allows us to preserve the best of what they do, leverage a lot of Capital One’s capabilities that we bring and build something really special” — Capital One Chairman and CEO Richard Fairbank

✅ Strengths

Market leadership: Now the largest US credit card issuer post-Discover acquisition

Diversified franchise: Capital One spans credit cards, auto loans, and consumer banking—an ecosystem that generates consistent fee and interest income.

Digital edge: Its heavy early investment in technology (particularly cloud technology and AI credit scoring) gives it cost and agility advantages over peers.

⚠️ Risks

Economic Cyclicality: An economic slowdown or persistent high inflation could accelerate credit losses, severely impacting profitability.

Discover Merger Integration: Successfully merging two large, complex financial institutions is a massive undertaking that carries significant execution risk and potential short-term disruption to interest margins and profitability.

Intense Competition: Competition is fierce across all major business lines, either from established players or from newer fintech entrants that are innovating rapidly on customer experience and digital offerings.

2/ Don’t overpay

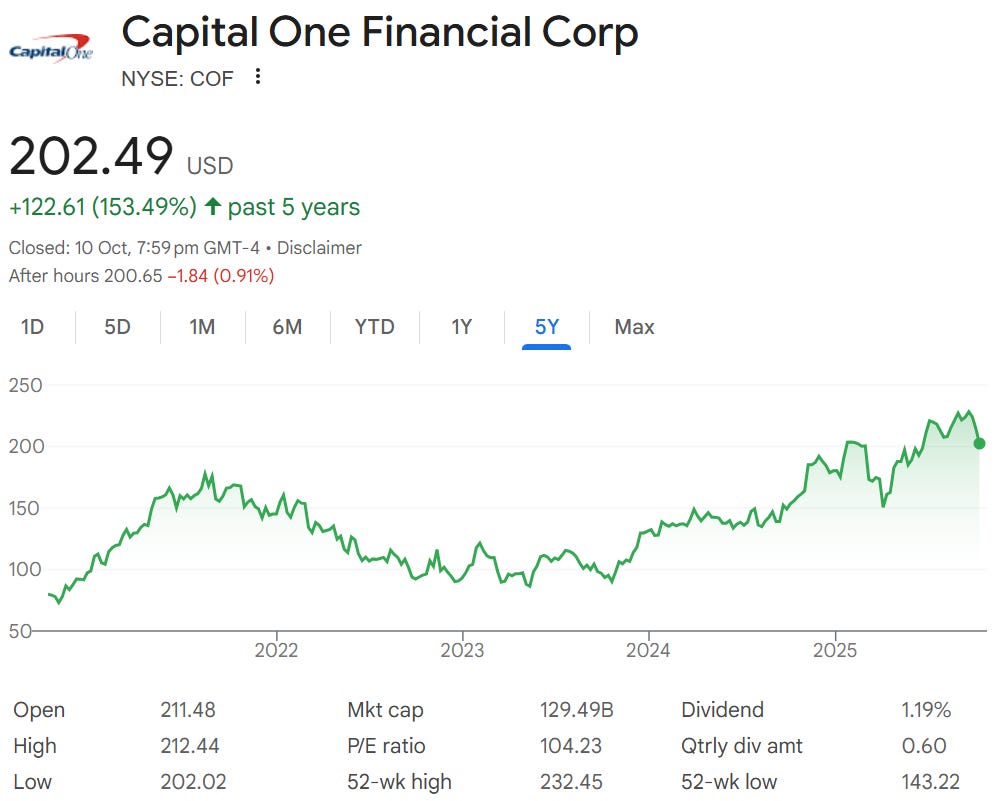

COF is currently trading around 12× forward earnings (significantly below the S&P 500’s ~24x) and ~1.2× book value which is in line with the Finance’s industry average (Price-to-Book or P/B is a commonly used metric for financials comparing the share price to the company’s book value)

The stock is currently trading at ~$202, just 13% below its 52-week high of ~$232

3/ Final decision

📌 I’m not (yet) adding Capital One Financial to the Guru Gems portfolio, but I am certainly adding it to the watchlist.

The stock has bounced from its lows and may offer better entry points.

Armitage significantly increased his position during Q2, when COF traded as low as $150. So the ‘margin of safety’ which they probably estimated at the time of buying is now significantly less at the current price of $202.

🚨Guru Gems Portfolio alert

While I am not adding Capital One yet to the portfolio, I am strongly considering buying Constellation Software (CSU).

CSU is a Canadian serial acquirer of vertical market software businesses which returned 734%(!) over the last decade.

This gem which we find in a few Guru portfolios, is now down 25% from its highs, creating a rare opportunity to buy a high-quality compounder at a more favorable price.

More on this in next week’s Portfolio Update!

As always, thank you for reading and following along on my journey. Follow me on X @guru_gems for more Guru Gems insights.

Until next week!