Portfolio Update 5: Adding a new Gem

Guru Gems Portfolio monthly update - October 2025

Welcome back — and welcome to all new subscribers!

This week I’m sharing my fifth monthly portfolio update.

🆕 Adding Constellation Software to the Portfolio

Constellation Software (CSU) is a Canadian serial acquirer of vertical market software companies that develop solutions tailored for specific industries.

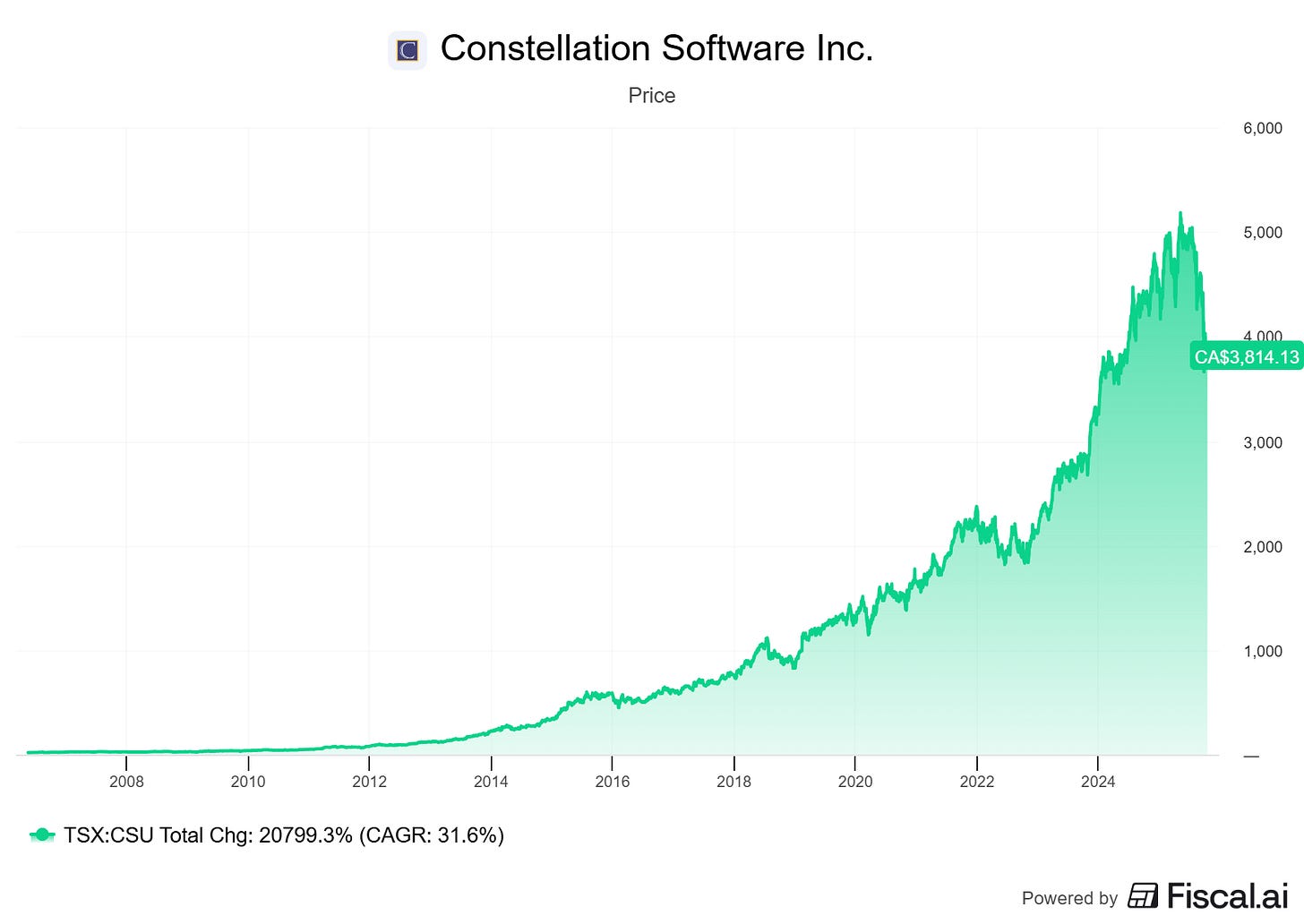

Since its IPO in 2006, CSU shares have compounded at nearly 32% per year.

Constellation has declined more than 25% from its May 2025 highs, creating an attractive entry point for a high-quality compounder.

The selloff was driven by two primary factors:

AI disruption narrative: Growing concerns that AI-native competitors using large language models could disrupt Constellation’s vertical market software businesses

Leadership transition: Mark Leonard’s recent announcement that he would step down as President due to health reasons

Akre Capital’s Q3 2025 letter provided powerful confirmation of my investment thesis. Despite Constellation being their second-largest holding and accounting for nearly their entire -3.65% quarterly decline, Akre Capital remains fully confident.

We believe that Constellation has shown the ability to navigate many periods of technological innovation and should be able to protect its market position from competitors who are leveraging large language models.

[…] In short, we have no fundamental concerns about Constellation Software or its position size in the portfolio. Even the best compounders experience significant drawdowns in share price.

This is the fourth drawdown of approximately 25% or more that we have experienced during our tenure as Constellation Software shareholders, and it will not be the last.

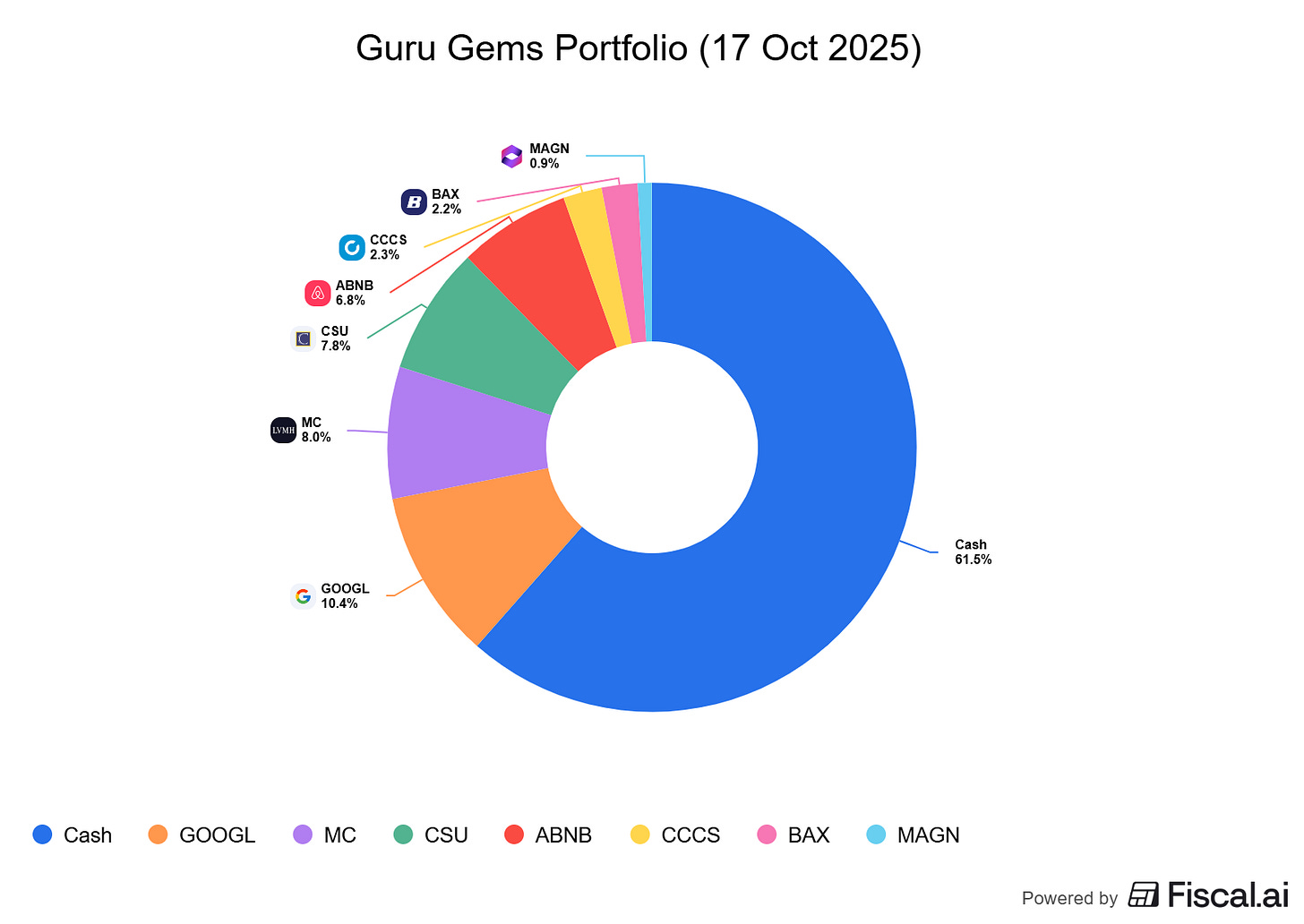

CSU joins the Guru Gems Portfolio as my newest holding, with an initial position of around 7-8%.

Guru Gems portfolio overview

Portfolio Comments

The return on the capital invested so far over the first 6 months is 13.8%, driven primarily by Alphabet’s exceptional performance during this period.

While this is a good performance, the S&P 500 increased by more than 20% over the same period, driven by the very high concentration of technology stocks in the index.

My invested capital is slowly increasing (~39%) and I stay on the lookout for any good opportunities to add other Gems

There are currently 3 companies from the Guru Gems watchlist which are down more than 25% from their 52-week high (Lennar, Zoetis, Copart), so these are companies I am closely monitoring for the moment.

If you enjoy this newsletter, please help others discover it by clicking 🤍

🔎 Alphabet (+60%)

Alphabet remains the star performer in the Guru Gems portfolio

Following the court ruling that spared Google from forced divestitures of Chrome and Android, investor attention has shifted back to growth and AI innovation.

With the stock up 60%(!) since my purchase, it’s tempting to trim the position a bit, but at a forward P/E of ~25 it is still the cheapest of the Mag 7 stocks, together with Meta.

Wedgewood Partners has a good update on Alphabet in their latest Q3 letter:

Alphabet’s core Google search business saw a +12% increase in revenues, thanks in part to its relatively new search results page feature, “AI Overviews,” which reaches over 2 billion users.

AI queries place tremendous strain on computing infrastructure, as we have heard from private AI-labs, particularly OpenAI. It is therefore a remarkable achievement that Alphabet, a company at the forefront of AI hardware and software development for over a decade, possesses the infrastructure to seamlessly roll out such an indispensable service to its users, while putting up record returns on invested capital for shareholders.

[…] Alphabet has had many years’ head-start to build this data center capacity relative to the current, still unprofitable “neo-clouds” and emerging AI labs.

👜 LVMH (+19%)

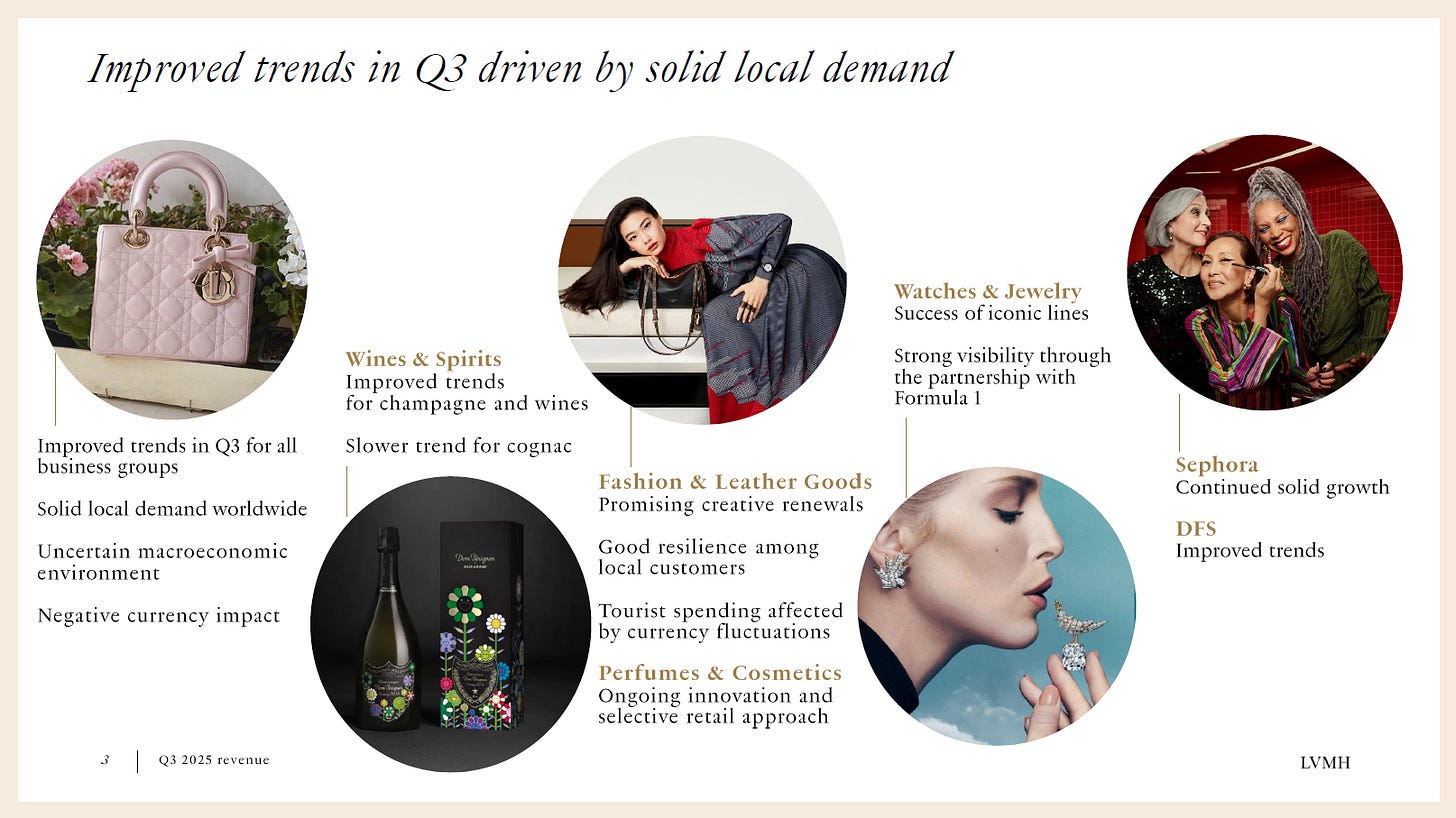

LVMH shares had their best day in over two decades on Wednesday following the release of Q3 earnings

The world’s largest luxury goods group reported the first quarter of growth this year, beating analyst expectations.

There are also signs of improved demand in China, with revenue up 2% for Asia (excl. Japan) region vs 2024.

🏕 Airbnb (-2.5%)

Airbnb’s share price hasn’t really moved much since the decline in August following the Q2 earnings call.

I added another 2% to my position last week, bringing my average purchase price to 129.1 - Airbnb is now ~7% of the portfolio

Q3 earnings are scheduled for 6 November, so I will elaborate a bit more on Airbnb in the next portfolio update

🏥 Baxter (+1.4%)

I added Baxter to the portfolio last month following my deep-dive on Rich Pzena

Pzena Investment Management just released their Q3 update in which they confirm their thesis for Baxter:

“[…] transitory issues…

[…] used this an opportunity to increase our position…

[…] we think it’s extremely attractive at these levels, it’s trading at 9 times earnings”

🏭 Magnera (-13.1%)

This Joel Greenblatt-style ‘special situation’ has so far not played out as hoped. The stock continues to trade below my purchase price with limited positive catalysts on the horizon.

I made the allocation small (~1-2%) for this stock precisely because special situations carry higher risk than quality compounders.

Here is what Capital Kingdom Advisors wrote about Magnera in their Q3 update:

Their business remains stable in the U.S. and Europe, but tariffs have redirected trade flows and pressured their South American business. Management has been proactive on cost takeouts and capacity reductions across their portfolio, and we expect these efforts to shine through when they report their full year results in the coming months.

[…] We are happy with Management’s execution and believe the stock price will eventually follow.

I’m holding for now but will reassess if the situation deteriorates further.

“Our performance doesn’t come from what we buy or sell. It comes from what we hold. So the main activity is holding, not buying and selling.”

— Howard Marks

That’s it for this week…thanks for reading and I’ll be back next week with a new edition!