Portfolio Update 3: Alphabet strongest performer

Guru Gems Portfolio monthly update

Welcome back! Hope you’re enjoying the summer if you are in the Northern Hemisphere :)

Today I’m sharing my third monthly update on the Guru Gems portfolio. Here is what I’ll cover:

Overall performance to date

Updates on current holdings

Adding a potential Gem to the watchlist

If you enjoy reading this newsletter, please help others discover Guru Gems by liking this post (🤍 at the bottom) and subscribe for weekly deep-dives.

Last week I covered super investor Bryan Lawrence who manages a very concentrated portfolio of quality companies at Oakcliff Capital.

You can also follow me on X @guru_gems for interesting Guru insights.

Guru Gems portfolio overview

Current holdings

Comments

I started the Guru Gems portfolio 3 months ago.

The return on the capital invested so far over the first 3 months is 6%, though I don’t think this is very meaningful as some of the positions have been in portfolio for only a month or less.

My invested capital is still small (22%), but I am in no rush and I will keep looking for the best opportunities from the Gurus’ portfolios.

2 stocks paid out cash dividends during the past 3 months, LVMH and Alphabet, so I’m adding these dividends back in the cash part of my portfolio.

🔎 Alphabet

Alphabet is currently my largest position, and also the one that has performed best since I bought it.

The stock is up nearly 18% versus my average purchase price of 157.7, and getting closer to its all time high of 208 from January.

Alphabet is still caught between two narratives: a threatened search business and regulatory worries on the one hand; an undervalued AI leader and digital advertising giant on the other hand.

It looks like the sentiment over the past few weeks has been shifting towards the latter.

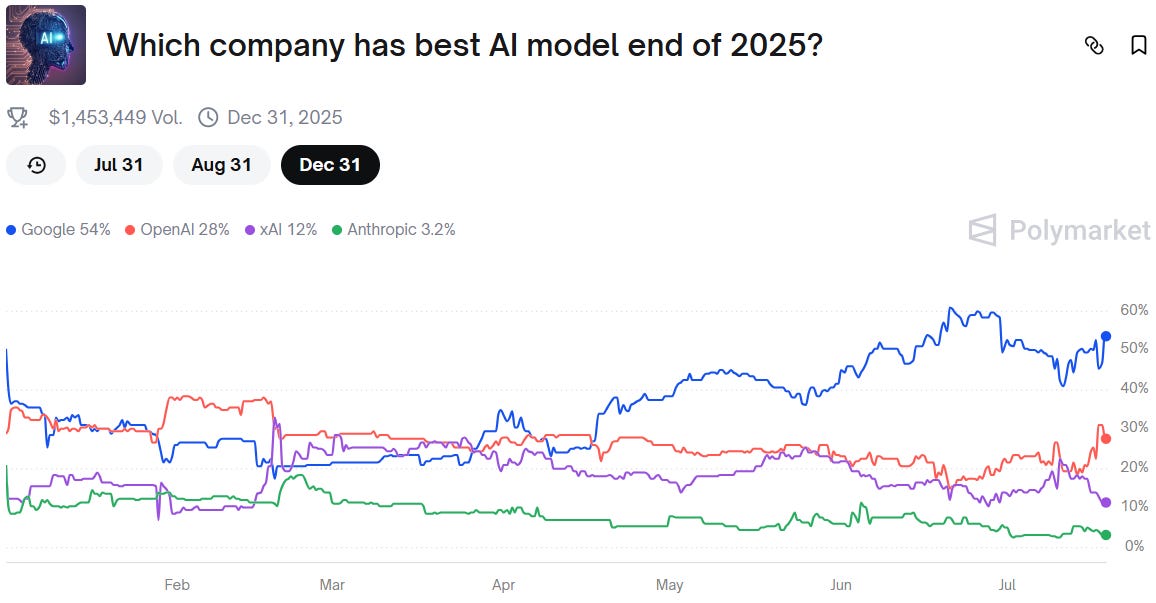

For what it’s worth: on Polymarket, “The World’s Largest Prediction Market” as they call themselves, Google has the best odds of having the best AI model by end of 2025.

Alphabet will announce earnings this coming Wednesday 23rd July.

👜 LVMH

LVMH, my second largest position, hasn’t really moved much versus last month, and is still 7% below my average purchase price.

Bernard Arnault continued to aggressively buy LVMH stock, and he scooped up shares worth EUR 70M throughout June, adding to his more than 300M purchases in April and May.

Next week’s earnings report will be highly anticipated, and analysts will be looking for any signs of recovery, especially in the Chinese market.

🏕 Airbnb

Airbnb is my most recent position and is up just over 4% since I bought it on the 30th of June at 133.7

If you missed my deep-dive on Bill Nygren and why he believes Airbnb is undervalued, make sure to read my post:

🚙 CCC Intelligent Solutions

CCC Intelligent Solutions (CCCS) is my second best performing stock and is up 10% versus my purchase price of 8.84

If you want to learn more about this company, I covered the stock when studying Chuck Akre and his ‘three-legged stool’ framework:

CCCS recently appointed Barak Eilam to its Board of Directors. An experienced technology executive who brings more than two decades of experience in analytics and AI enterprise-software experience.

🏭 Magnera

Magnera is my smallest position and this was a Joel Greenblatt-style ‘special situation’ investment:

The stock is still in the price range of where I bought it, and there hasn’t really been any noteworthy news around the stock.

“The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are."”

— Warren Buffett

Adding this animal health company to my checklist

With Q2 behind us, we can expect superinvestors to start releasing their 13Fs (deadline is 13 August) with their positions on June 30th.

In the Q1 portfolios update, I highlighted a significant increase in Terry Smith’s portfolio of Zoetis, the world's largest producer of medicine and vaccinations for pets and livestock.

Wedgewood Partners, a firm I will be analyzing in more detail in a future edition, shared in their Q2 client letter that they also initiated a position in Zoetis.

“We believe that, over the long term, reality tends to win; high-quality businesses earn the valuations they deserve at some point and will outperform the broad market. We believe we have been given the opportunity to do this with Zoetis now.”

With 2 long-term investors initiating or accumulating shares, this stock has piqued my interest and I will add it to my watchlist for further study.

Let me know what you think about this stock and let me know if you have any suggestions for Gurus to cover in future newsletters ;)

That’s it for this week…thanks for reading and I’ll be back next week with a new edition!