Key Takeaways from Gurus' latest 13Fs (Q3)

Distinguishing signal from noise - Considering adding 2 names to the portfolio

Welcome back!

Friday was the deadline for Superinvestors ($100M+) to report their US positions held on 30th September 2025 (so-called 13F filings).

Today I’ll share my key takeaways from the latest changes in the portfolios of Gurus covered until now:

Gurus are trimming the Magnificent 7 and buying out-of-favor quality stocks

Alphabet remains the ultimate Guru Gem — even Berkshire has joined the party

What this means for the Guru Gems portfolio

As highlighted in my very first post (link below), the information from 13F filings is not perfect and comes with a delay, but focusing on those long-term investors who make little changes quarter over quarter, can give us interesting signals.

1️⃣ Gurus are trimming the Magnificent 7 and buying out-of-favor quality stocks

Across the board, several of the Gurus covered so far — Terry Smith, François Rochon, Christopher Davis, Peter Keefe — have been scaling back exposure to some of the Magnificent 7 names (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) and reallocating toward quality names whose stock price have been under pressure.

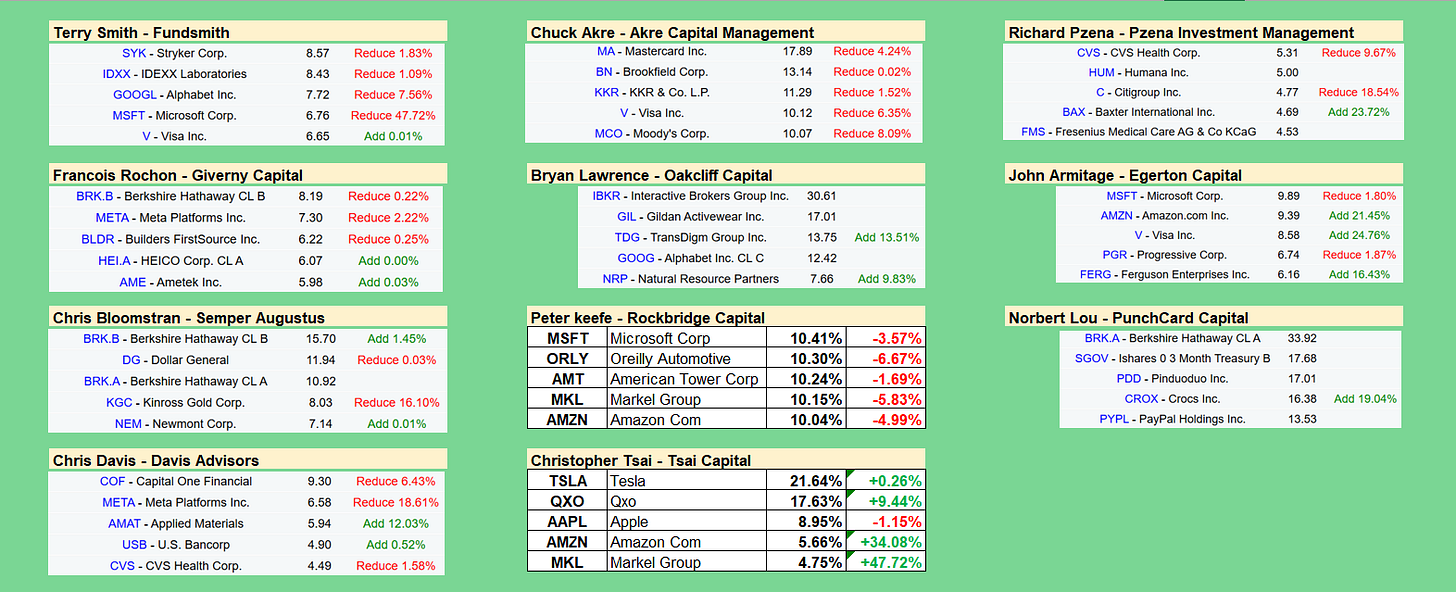

Here is an overview of the top 5 Q3 positions of most of the Gurus covered in my previous posts:

A few notable highlights:

Terry Smith significantly reduced his holdings of Microsoft (-48%) and Meta (-56%) during Q3, while adding (for a third consecutive quarter) to Zoetis and Intuit.

François Rochon slightly reduced his Alphabet position and trimmed Meta. He sold all of Starbucks and added to Kinsale Capital, a company I have on my watchlist.

Chris Davis reduced his position in Meta (-18%), Amazon (-4%) and Alphabet (-3%), and added to Applied Materials (+12%)

Akre Capital trimmed most of their main positions like Mastercard (-4%) and Moody’s (-8%), while adding significantly to FICO and Copart. It’s worth noting that Constellation Software (CSU), one of their largest positions, is not showing on the 13F as it is a Canadian company.

In their recent Q3 update, they wrote an extensive section on CSU, following the stock’s strong drawdown, emphasizing that they remain confident in Constellation’s potential to keep compounding:

“we have no fundamental concerns about Constellation Software or its position size in the portfolio.”

Peter Keefe, a close friend of Chuck Akre, trimmed or reduced nearly all of his positions, except for Copart, which he increased slightly. Copart is down 36% from its 52-week high, so this could be a great time to pick up what Keefe calls an ‘inherently superior’ business. Read more on Keefe and Copart in my deep-dive from August 👇

Christopher Tsai increased many of his top 10 positions (QXO +9%, Amazon +34%, Markel +48%, Nvidia +38%), but his most significant increase was also Copart (+62%) which is now 4.4% of his portfolio.

Rich Pzena further added to Baxter (+23%) as he is convinced that the current pessimism around Baxter is temporary.

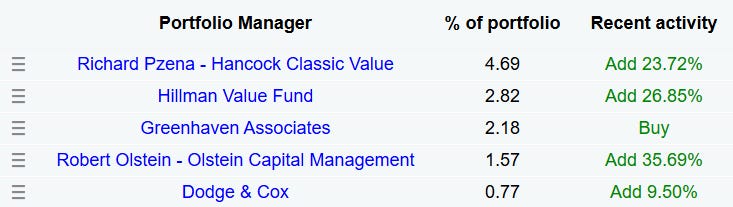

I added Baxter to the Guru Gems portfolio in September. It looks like a few other investors share the same sentiment as Pzena; 13F filings only show increasing positions or new buys for Baxter in Q3:

Finally, Norbert Lou, who I covered in detail a few weeks ago, further added to Crocs (+19%) and started a small position in Fiserv (1.5%). His PayPal position remains unchanged.

If you enjoy this newsletter, please help others discover it by clicking 🤍

You can also follow me on X @guru_gems for interesting Guru insights.

2️⃣ Alphabet remains the ultimate Guru Gem — even Berkshire has joined the party

Back in April, I asked “Is Alphabet the ultimate Guru Gem?” as it was the most owned stock among long-term Superinvestors.

Adding it to the Guru Gems portfolio at $157 when the market was worried about search threats and regulatory issues turned out to be my best decision so far - the stock is now up 75% (!) from my purchase price. I’m sure a pullback can be expected at some point, but even a 50% increase over 8 months is something I would sign up for any time.

Alphabet is once again the most-owned stock across the Gurus I track. And the most striking update came from Berkshire Hathaway — which initiated its first-ever position in Alphabet in Q3.

Berkshire rarely initiates new tech positions

Outside of Apple, Berkshire rarely ventures into big tech. Opening a position in Alphabet signals genuine long-term confidence in the business.

It reinforces Alphabet as the “one tech stock everyone agrees on”

Across Smith, Rochon, Davis, Nygren, Lawrence, Tsai and now Berkshire, Alphabet is the mega-cap that consistently appears in almost every Guru portfolio.

Alphabet represents everything a long-term investor wants:

dominant network effects

incredible free cash flow generation

industry-leading AI capabilities

optionality across multiple high-growth domains (Search/Gemini, Cloud, YouTube, Android, Waymo)

and still, remarkably, a valuation that makes sense

Alphabet truly is the ultimate Guru Gem.

💎 What this means for the Guru Gems portfolio

I am strongly considering adding Copart to the portfolio. When multiple Gurus are buying at a time when the stock price is down 36% from its 52-w high, it’s probably worth paying attention.

Copart is expected to report earnings this comping week, so it will be good to see if the current negative sentiment is justified or if the fundamentals are still strong.

I wrote in my deep-dive on Norbert Lou that I was strongly considering buying PayPal and after their solid Q3 earnings report, I decided to add PayPal to the Guru Gems portfolio

I will also be adding a bit to 3 current positions, taking advantage of a further decline in share price: CCC Intelligent Solutions, Baxter, and Constellation Software.

Finally, while it is tempting to take a bit of profits from the Alphabet position, I will leave it as is for now. While a pullback is likely to happen at some point, the current valuation seems to be still reasonable.

That’s it for this week, … thanks for reading and I will be back next week with a new Guru and a potential new Gem to look into!