Bill Ackman & The Pershing Square Playbook

UBER - A High-Conviction Compounder in Plain Sight

Welcome back for your weekly dose of timeless investment wisdom from the world’s greatest capital allocators. Start here if you are new to Guru Gems.

In today’s edition:

👤 The Guru: Bill Ackman

🏛️ The Philosophy: Pershing’s concentrated capital allocation strategy

💎 The Gem: Uber Technologies (UBER)

Here is the 2-minute AI version if you’re short on time:

👤 Guru in the spotlight: Bill Ackman

Bill Ackman needs little introduction. He is a very well-known (and sometimes controversial) billionaire investor and the founder and CEO of Pershing Square Capital Management, one of the most closely followed hedge funds in the world.

Founded in 2004, Pershing Square has generated a ~16% compound annual return since inception, despite several high-profile ‘mistakes’ along the way.

Ackman is often labeled an “activist investor”, but over the past decade, his style has evolved.

Here is Pershing’s investing objective (from Pershing’s website):

Acquiring and holding significant (but generally not controlling) positions in a concentrated number of large capitalization companies. PSH’s objective is to maximize its long-term compound annual rate of growth in intrinsic value per share.

In 2018, after a difficult stretch (Valeant, Herbalife), Ackman famously declared a “Return to Our Roots”, recommitting to holding fewer positions and of higher quality, with greater predictability and less reliance on financial engineering.

Ackman moved away from the traditional hedge fund model of raising external capital and instead committed to growing permanent capital through investment returns alone, not through asset gathering.

“We focus on growing our permanent capital base through returns, not by growing AUM.”

Since that shift, Pershing Square Holdings (PSH) has delivered a 22.6% annualized return over the last 8 years, significantly outperforming the S&P 500 index over the same period.

If you enjoy this newsletter, please help others discover it by clicking 🤍

And if you learned something useful, consider buying me a virtual coffee ☕

🏛️ Pershing Square’s Core Principles

Ackman calls himself a student of Graham and Buffett. He summarizes his investment approach as following:

“We try to find those rare companies where you can predict what they are going to look like over a very long period of time.”

Here is an interesting clip from an interview with Lex Fridman, where he explains in more detail his investment approach, and why Universal Music Group (UMG) is a perfect illustration of what he is looking for in a company.

In Ackman's most recent Annual Investor Presentation (published just earlier this week), he lays out the clear and simple set of core principles Pershing Square looks for when investing in a company.

1️⃣ Simple, predictable, free-cash-flow-generative businesses

Ackman wants to understand exactly how a business makes money. He prefers companies with straightforward business models and strong, recurring cash generation.

2️⃣ Formidable barriers to entry

Moats matter. Ackman seeks businesses where competition is structurally difficult: Network effects, brand dominance, regulatory moats, switching costs.

3️⃣ Strong financial profile

Low debt and the ability to self-fund growth. Ackman wants his companies to have minimal capital markets dependency.

4️⃣ Exceptional management & governance

Great operators with integrity who treat shareholders as partners.

5️⃣ Attractive valuation

Ackman wants a fair price “as is”, but gets really excited when he sees a substantial discount to what the company could be worth if optimized.

Learning from mistakes: The Netflix episode

One of Ackman’s most recent significant mistakes came in 2022

In January 2022, Ackman made a big, public bet on Netflix. He invested over $1.1 billion in the streaming giant after its stock had dropped significantly on slowing subscriber growth.

In his January 2022 Letter to Investors, Ackman praised Netflix’s management team, calling Netflix a high-quality business with exceptional growth potential trading at a meaningful discount to intrinsic value.

Then came the Q1 2022 earnings report. Netflix revealed it had lost 200,000 subscribers — its first decline in over a decade — and forecast an even steeper drop ahead. The stock crashed more than 25% in a single day.

Ackman sold everything. The very same day. After just three months of ownership, Pershing Square exited the entire position, locking in a $400 million+ loss.

Ackman wrote a letter to his shareholders explaining his decision:

We require a high degree of predictability in the businesses in which we invest due to the highly concentrated nature of our portfolio. While Netflix’s business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company’s future prospects with a sufficient degree of certainty. Based on management’s track record, we would not be surprised to see Netflix continue to be a highly successful company and an excellent investment from its current market value. That said, we believe the dispersion of outcomes has widened to a sufficiently large extent that it is challenging for the company to meet our requirements for a core holding.

— Pershing Square Letter to Shareholders 20 Apr 2022

And here is where it gets painful…

After bottoming near $175 (pre-split) in mid-2022, Netflix made a very remarkable comeback. The password-sharing crackdown, content strategy adjustment, and ad-supported tier turned out to be massive growth drivers.

The stock rallied over 500% from those lows to its all-time high of $1,340 (pre-split) in June 2025. Netflix did a 10-for-1 stock split in November 2025.

And even now at $77 (Netflix stock is down more than 40% since that June 2025 peak), the stock is still worth nearly 3 times what Ackman had sold it for.

So what are the lessons from this?

First, even the greatest investors make mistakes.

Ironically, Ackman referenced his earlier Valeant Pharmaceuticals disaster (where holding on too long cost his fund billions) as the reason he sold quickly. In his words:

“One of our learnings from past mistakes is to act promptly when we discover new information that is inconsistent with our original thesis.”

Second (and this is the lesson that matters most for the UBER discussion below), being “right” about the quality of a business doesn’t help if you sell too soon. Ackman correctly identified Netflix as a great business. He was right about the management team. He was right that the ad tier and password crackdown were sensible strategies. But he let short-term uncertainty override his long-term conviction.

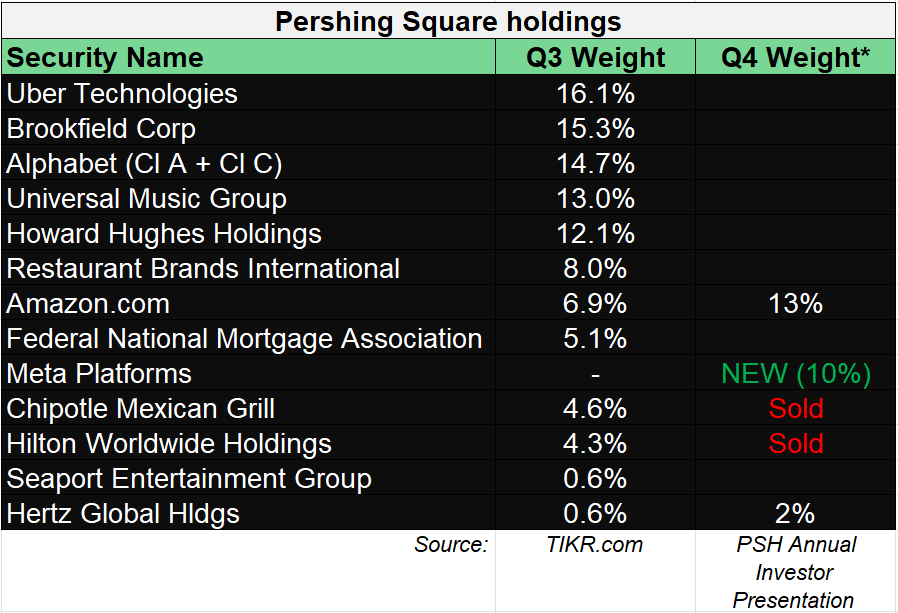

Pershing Square portfolio

Below is an overview of Pershing’s stock portfolio at the end of Q3 2025 (with some Q4 updates form their Annual Investor Presentation). Full Q4 portfolio should become available in the next few days.

His top 5 positions made up more than 70% of the roughly $16 billion portfolio in Q3.

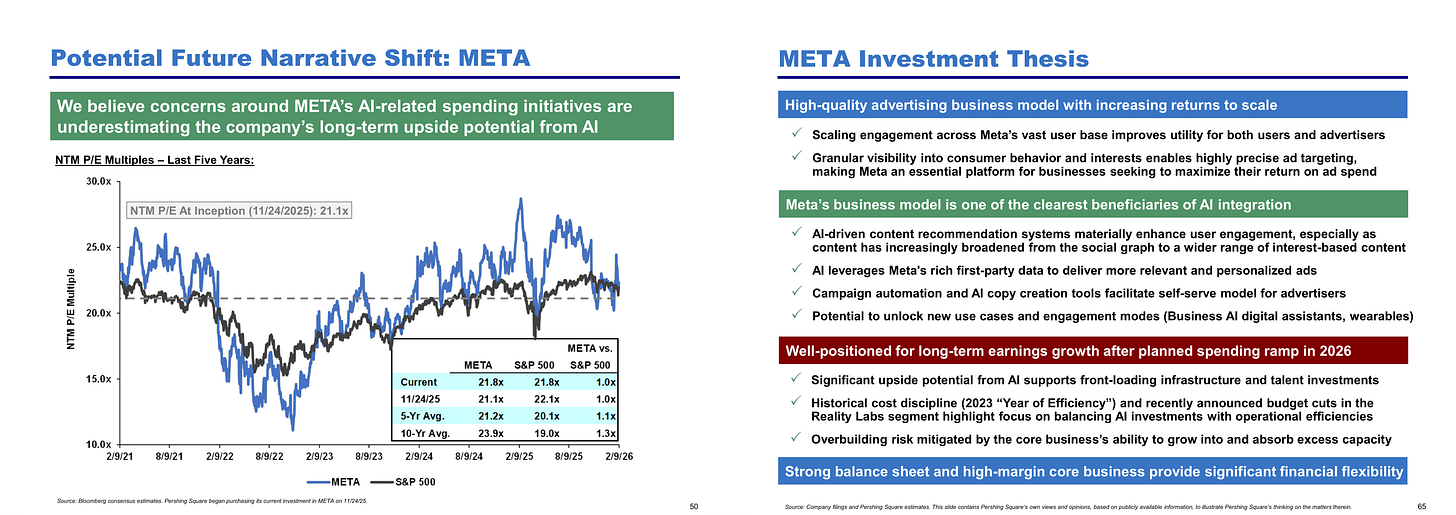

The biggest news was a significant new stake in Meta Platforms, reflecting Ackman’s belief that the tech giant’s stock is undervalued.

After my deep-dive on Christopher Tsai in August last year, I had already decided to put Meta on the Guru Gems watchlist.

Based on the latest 13F filings, Tsai further increased his Meta position significantly during Q4, and now with Ackman buying the stock as well, I am strongly considering adding Meta to the Guru Gems portfolio…

We believe Meta’s current share price underappreciates the company’s long-term upside potential from AI and represents a deeply discounted valuation for one of the world’s greatest businesses - Pershing Investor Update

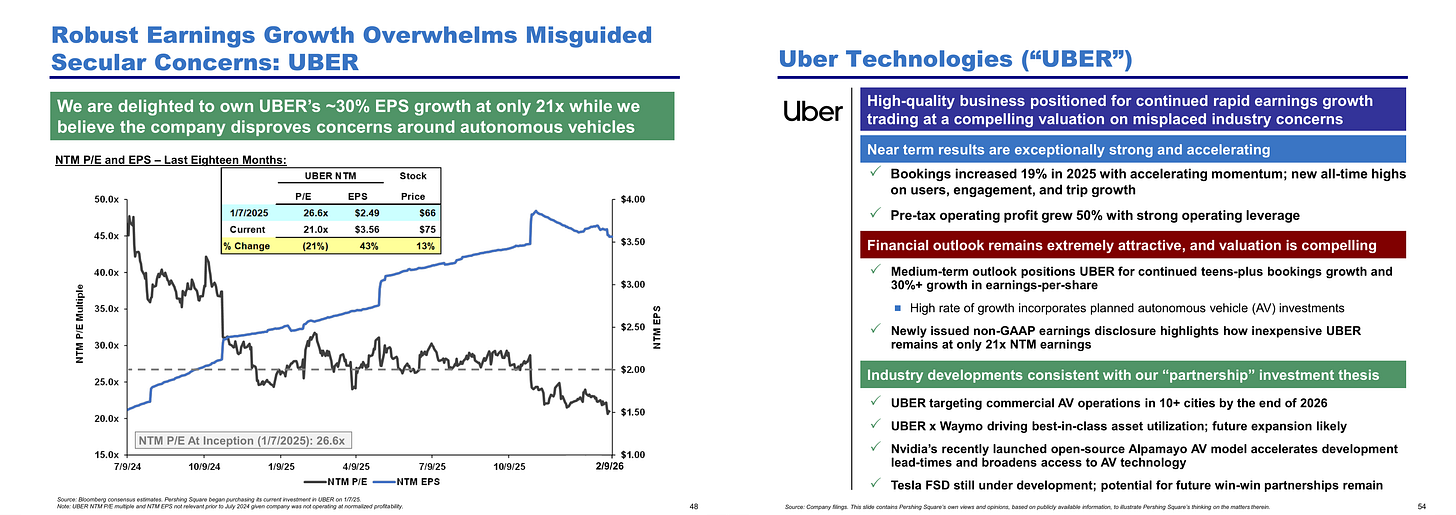

💎 The Gem: Uber Technologies (UBER)

In my update last week, I already shared that I initiated a position in UBER, after flagging it also as one of the Guru stocks to watch for 2026

The recent pullback and further drop after earnings were a perfect opportunity to add an impressive business with attractive growth profile and significant cash flow to the portfolio.

Since I already made the decision to purchase the stock, instead of my usual "To Buy or Not to Buy" section, I will focus here on why Ackman is convinced that UBER is such an attractive opportunity.

There are some really good write-ups of UBER on Substack and X. Here are two accounts that I would highly recommend following:

Fundamentally Sound by Manu Invests (@ManuInvests on X)

CapexAndChill (@CapexAndChill on X)

Now let’s evaluate Uber through the Pershing Square Playbook

1️⃣ Simple, predictable, free-cash-flow-generative businesses

Uber has evolved from a cash-burning disruptor into a global mobility + delivery platform with strong operating leverage and expanding free cash flow.

Ackman states that Uber’s “Near term results are exceptionally strong and accelerating”.

At the same time, he believes the long-term risk to Uber from Autonomous Vehicles (AV) is limited. The biggest bear case for Uber is that AV companies do not need to pay drivers and that AV companies will develop exclusive applications cutting Uber out of the entire market.

Ackman, and with him many others, believe that AV companies are actually likely to partner with Uber over time due to its strong value proposition. If autonomy becomes widespread, Uber can become the dominant demand aggregator.

2️⃣ Formidable barriers to entry

Uber’s business model has strong network effects that reinforce supply and demand growth

More drivers → shorter wait times → more riders

More riders → higher utilization → more drivers

Replicating this at global scale is extraordinarily difficult.

In addition, regulatory licenses, brand recognition and data scale have further widened the moat.

3️⃣ Strong financial profile

From Pershing’s presentation:

Uber has generated significant earnings growth since turning profitable in 2023. We believe the company’s rapid earnings growth is likely to continue as it maintains high revenue growth and leverages its fixed cost base

The company has transitioned from “growth at any cost” to disciplined capital allocation.

4️⃣ Exceptional management & governance

From Pershing’s presentation:

Industry-leading management team, led by Dara Khosrowshahi, has vastly improved operational discipline and capital allocation

Management targets imply +30% annual EPS growth over the next several years driven by mid-to-high-teens revenue growth, robust margin expansion, and share repurchases

5️⃣ Attractive valuation

From Pershing’s presentation:

Newly issued non-GAAP earnings disclosure highlights how inexpensive UBER remains at only 21x NTM earnings

Uber seems to be priced for moderate growth due to industry concerns and this mismatch is exactly the opportunity according to Ackman

Final Thought

I've already initiated a position in Uber during the recent pullback, and studying Ackman's thesis has only strengthened my conviction.

The Uber opportunity reminds me of when I bought Alphabet in April last year amid fears that AI would kill Google Search. Instead, Alphabet turned out to be a huge AI winner and the stock has since doubled in my portfolio.

I see a similar setup here with the market saying AVs will kill Uber, but Uber could well become the primary platform through which AVs reach consumers.

That’s it for this week’s edition!

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!

Good post. Appreciate the shout. Thank you 🙏🏻