Portfolio Update: On Bubble Fears, my First Two-Bagger, and my Chat with Michael Burry

Guru Gems portfolio update November 2025

Welcome back, and welcome to all new subscribers!

In today’s edition:

📉 Is the market in a bubble?

👀 Adding 2 Michael Burry favorites to the watchlist

💎 Alphabet becomes my first ‘two-bagger’

🆕 A new Gem: Adding PayPal to the portfolio

New to Guru Gems? Start here.

📉 Is the market in a bubble?

Ray Dalio, founder of the world’s largest hedge fund, thinks so. In a recent interview, he stated:

“There is definitely a bubble in the markets […] but a lot can go up before the bubble bursts”

and a bit later also:

“[…] bubbles have to be pricked [….] don’t sell just because there’s a bubble”

Dalio is not the only one seeing an AI mania

Michael Burry (famous from ‘The Big Short’) recently returned to X under the name ‘Cassandra Unchained’ to warn us that “Sometimes, we see bubbles”.

Burry announced the termination of his hedge fund and the start of a Substack newsletter… Welcome to Substack, Michael Burry 😉 (yes, I did subscribe)

Coming back to something he has always loved, he will write about stocks, market and economic trends, special situations, and investment manias.

“I find myself on an old road not taken” — Michael Burry

I’m really excited to read Burry’s thinking process every week.

A few years ago I read his MSN articles from the early 2000s and I remember thinking it would be really cool to get a sequel of this…now we’re getting it!

👀 Adding 2 Michael Burry favorites to the watchlist

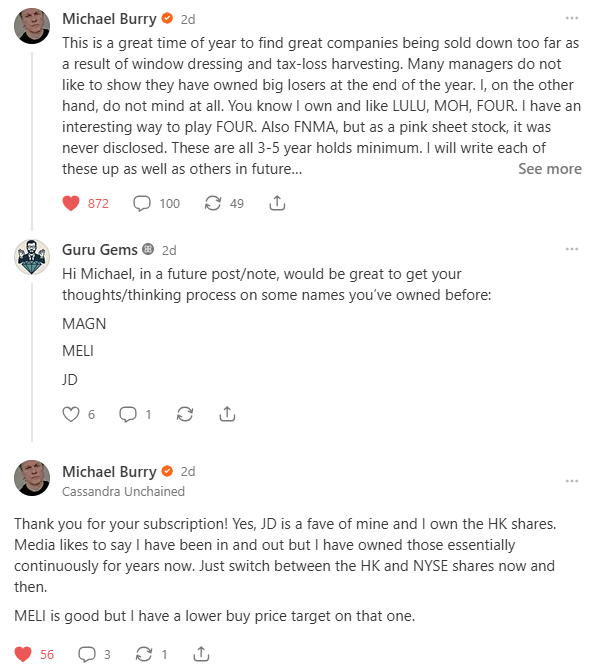

Commenting on one of his notes, I asked Burry for his thoughts on 3 names he owned: Magnera (MAGN), MercadoLibre (MELI, Latin America e-commerce company) and JD.Com (JD, Chinese e-commerce company)

MELI and JD are 2 companies I recently started reading about a bit more, so with Burry’s comments, I am adding both to my watchlist!

Guru Gems isn’t about predicting the macro

Regardless of whether we are in a bubble or not, I remain focused on finding Gems at an attractive price and holding them mostly for the long term.

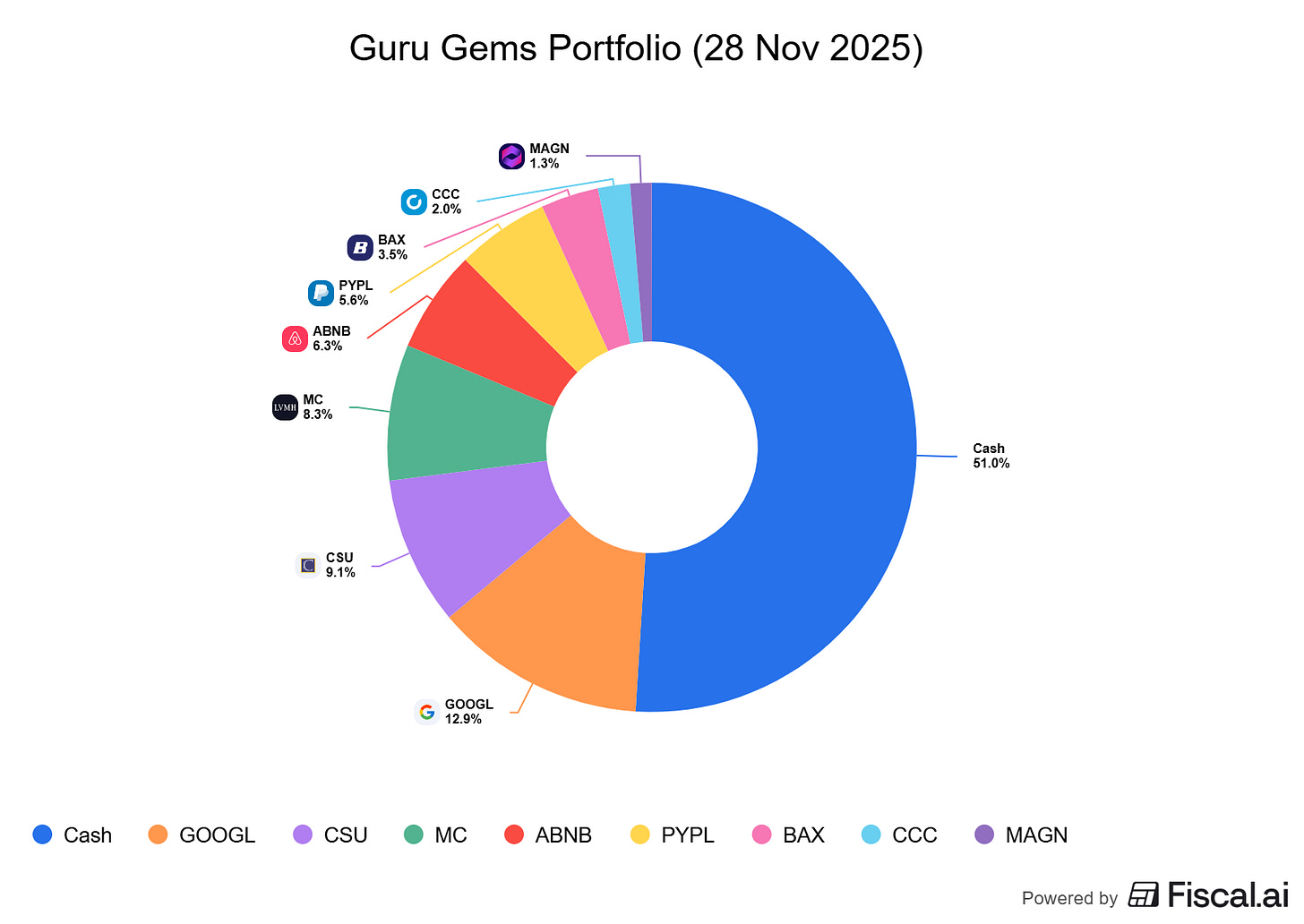

And with more than 50% of the portfolio still in cash, a bursting bubble may actually create some great buying opportunities…

With that, let’s have a look at the Guru Gems portfolio.

If you enjoy this newsletter, please help others discover it by clicking 🤍

💎 Alphabet is my first “two-bagger”

This month, Alphabet (GOOGL) officially became the first “two-bagger” in the Guru Gems portfolio, up 103% since April.

It’s crazy to think that a 2 trillion dollar company can double over a 7 month period. This is a good illustration of Mr. Market in action (if you don’t know about ‘Mr. Market’, check last week’s post!)

Seven months ago, the narrative was “ChatGPT will kill Google” and when I wrote about Alphabet for the first time, the stock was trading well below its historical EV/EBIT average.

But looking at the portfolios of Superinvestors like François Rochon and others, they weren’t selling. They were holding or buying.

Alphabet is still the most-owned stock among the Gurus I track. Even Berkshire started a position, confirming Alphabet’s status as the ultimate Guru Gem.

I believe Alphabet will be a pillar of the Guru Gems portfolio for many years.

🆕 Adding a new Gem: PayPal

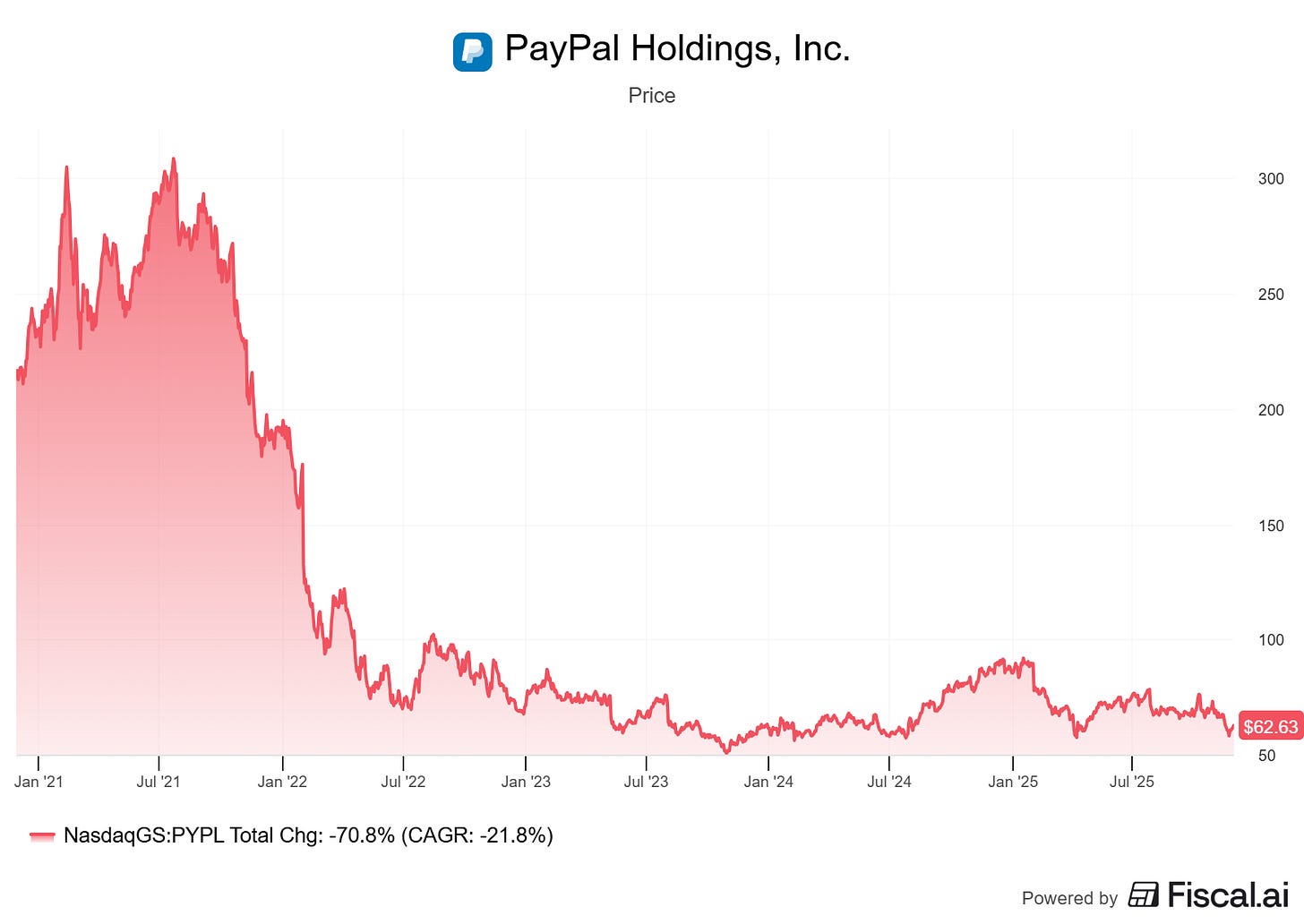

Burry wrote that now is a great time to be looking for “great companies being sold down too far”, and I believe I found one in PayPal (PYPL).

As I wrote in my deep-dive on Norbert Lou, I considered adding PayPal to the portfolio, and after their strong Q3 earnings report, I decided to start a position.

I believe that like Alphabet earlier this year, PayPal is unloved. The market is obsessed with AI and Crypto, leaving “boring” fintech stocks behind.

But looking at the fundamentals, the turnaround promised by CEO Alex Chriss seems to be gaining momentum:

Strong revenue and earnings growth

Free cash flow fully used for share buybacks, and a small dividend

Strategic partnerships with OpenAI and Google, focusing on agentic commerce and AI.

Trading at 11x forward earnings (well below its historical average)

I bought at $62.5 and added more at $58.5 when the stock further dropped later that week.

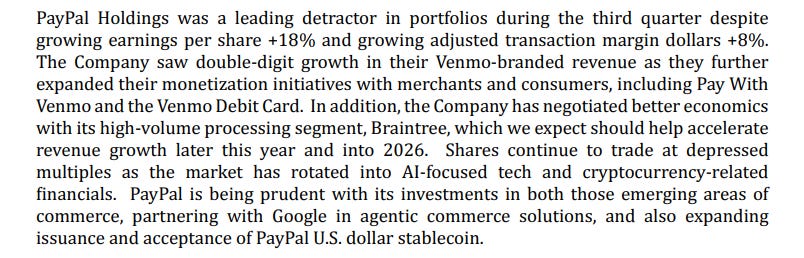

Supporting this, Wedgewood Partners (who have owned PayPal for more than a decade) also reaffirmed their conviction, which acts as an additional signal.

PayPal joined the Guru Gems Portfolio as my newest holding, with a current weight of 5.6%.

Guru Gems portfolio overview

Portfolio Comments

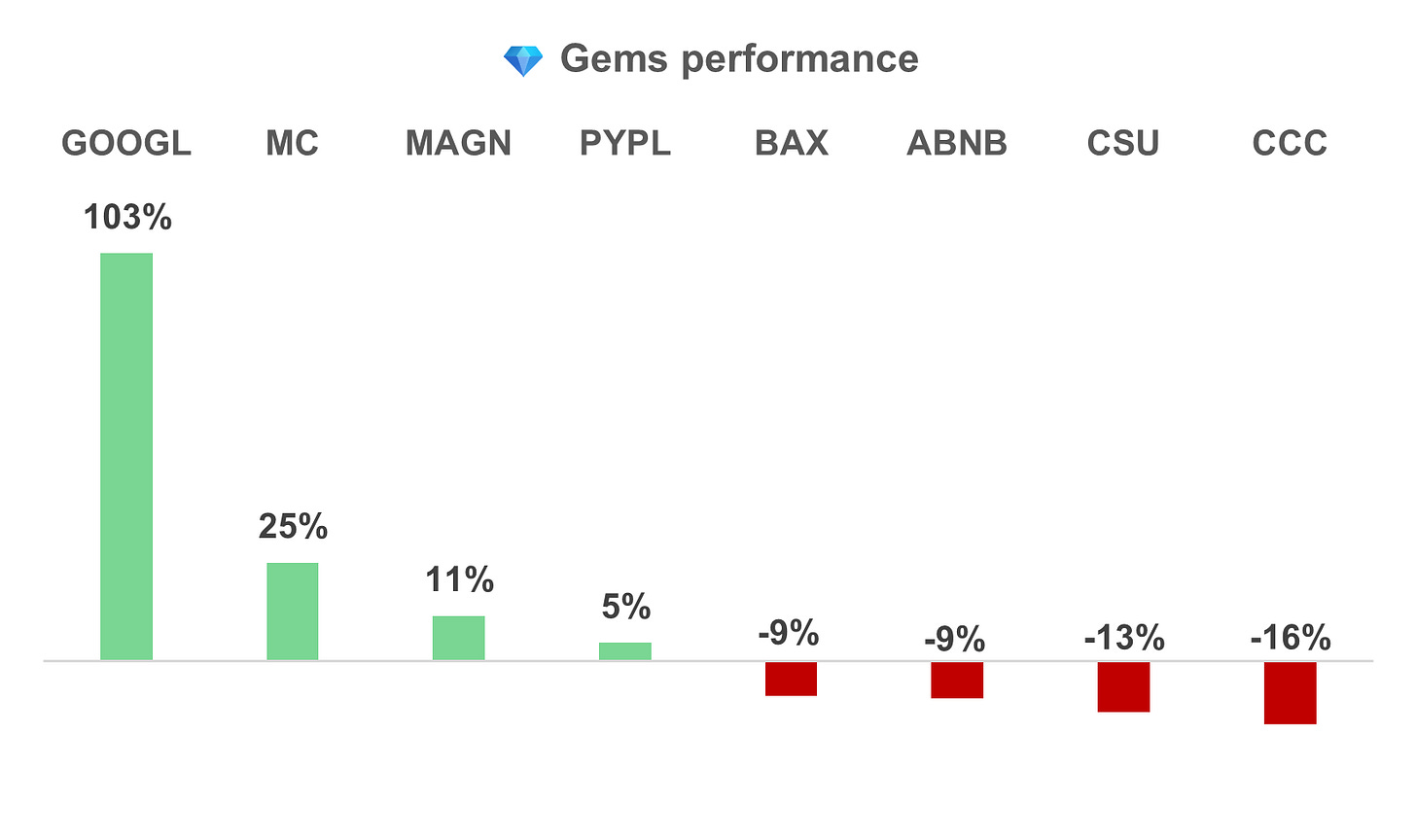

The return on the capital invested so far over the first 7 months is 14.4%, driven primarily by LVMH (+23%) and Alphabet’s phenomenal performance (+103% !!!).

Magnera, which was my main underperformer until a few weeks ago, is now up 11% after reporting strong Q4 results.

CCC Intelligent Solutions (CCC; -16%) and Constellation Software (CSU; -13%) are currently my main laggards.

That’s it for this week…thanks for reading and I’ll be back next week with a new edition!

Check out my portfolio, any thoughts?

https://open.substack.com/pub/buysidealpha/p/portfolio-update-november-2025?utm_source=share&utm_medium=android&r=69w6c1