What Gurus are buying and selling - Q4 2025 13F updates

Are software stocks a buy?

Earlier this week was the deadline for Superinvestors ($100M+) to report their US positions held on 31st December 2025 (13F filings).

Today I’ll share my key takeaways from the latest changes in the portfolios of some of my favorite Gurus.

Here is a 2-minute AI summary:

1️⃣ Alphabet remains the ultimate Guru Gem…

… but Gurus are trimming after the stock increased +38% in Q3 and another 28% in Q4.

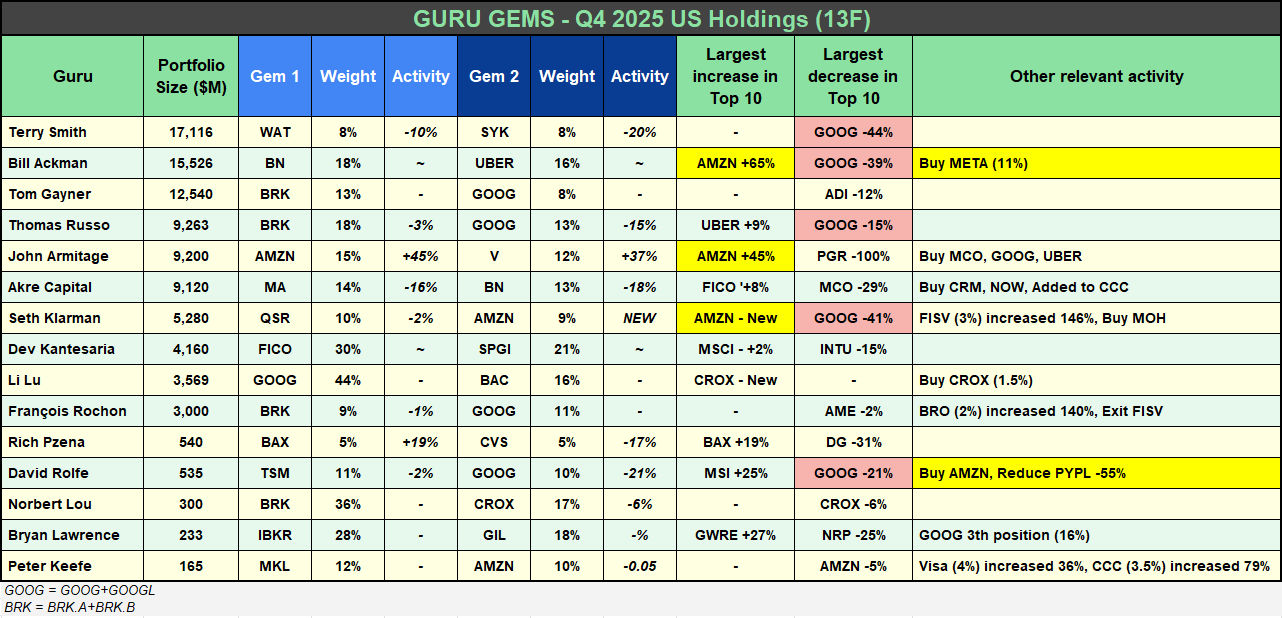

Below is a table I put together listing most of the Gurus covered so far in the Guru Gems series as well as some Gurus I plan to cover in the future.

→ For the full table with more names, access the Guru Master Google Doc, which also contains my full portfolio and latest activities

Out of the 15 Gurus listed below, 10 of them hold Alphabet in their portfolio. For 5 of them it is even the #1 or #2 position (‘Gem 1’ or ‘Gem 2’ in the table).

At the same time, Alphabet is also the stock that appears most in the column ‘Largest decrease in Top 10’, meaning that this position is being trimmed significantly, and the Gurus are taking profits after the massive gains this stock had over the past 6-9 months.

Amazon (and Meta) have been added most

If we look at where the Gurus are shifting their attention and investments to, Amazon (and to some extent Meta) is a clear favorite.

Amazon was a laggard in the ‘Magnificent 7’ group in 2025 with just a ~1% stock price increase over full 2025.

Gurus clearly believed that Amazon was undervalued during Q4 and started loading up.

Here are some extracts of what Gurus are saying about Amazon.

“Amazon operates two of the world’s great, category-defining franchises [AWS, Amazon.com]

Both businesses supported by decades-long secular growth trends, occupy dominant market positions, and leverage scale to continually improve their value proposition”

—Bill Ackman

Amazon continues to plow back all of its cash flows into its business, which seems rational given the attractive returns on investment the Company is generating. The Company's returns have regained all-time highs, over 20%, as margins have expanded thanks to advertising, AWS growth, and a sharper focus on retail productivity. Despite these record returns and excellent growth, Amazon's valuation multiples, particularly EV/EBITDA, are trading at historically depressed levels. We started initial positions during the fourth quarter as we expect Amazon's growth, profitability, and valuation present an attractive long-term investment opportunity.

— David Rolfe

This last extract comes from Wedgewood Partners’ Q4 Client Letter, which is well worth reading in full. I always look forward to reading David Rolfe’s letters and I listed it as one of my favorite in a recent post.

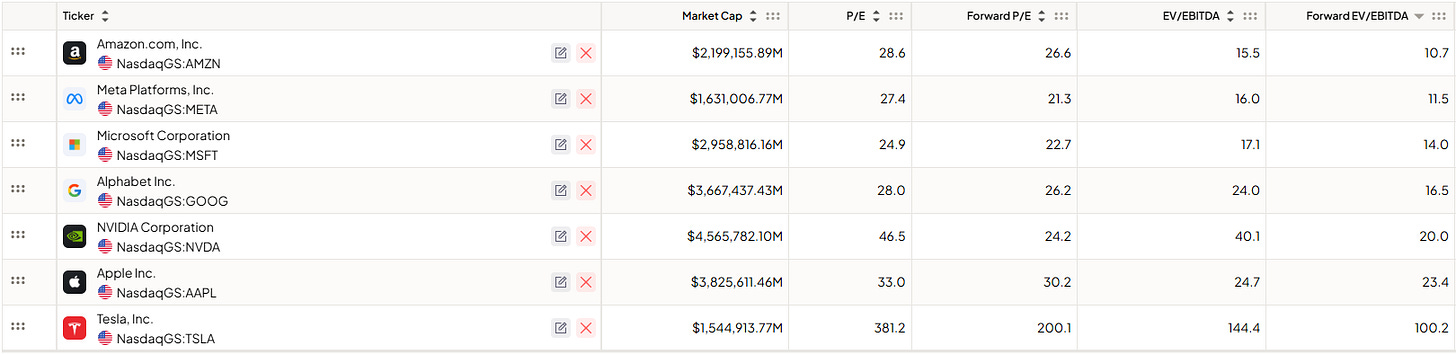

Amazon and Meta currently have some of the lowest valuations in the Mag7 group, primarily driven by the market’s fear of the huge Capital Expenditure spending that the hyperscalers are planning for this year.

A few other highlights

UBER, a core position in Bill Ackman’s portfolio, was also added by John Armitage (Egerton Capital). UBER is the latest stock in my portfolio - read last week’s edition on Bill Ackman if you want to learn more

Rich Pzena continued to add to Baxter (+19%), making it his largest position as he is convinced that the current pessimism around Baxter is temporary and that “investor confidence is likely to return to this high-quality medtech franchise.”

David Rolfe significantly reduced his PayPal position (-55%) during Q4

We trimmed our PayPal positions during the quarter as we believe the combined slowing of transaction volumes and heightened expenses will result in slower profit growth than we previously expected.

This turned out to be a good call as PayPal is down nearly 30% this year, with the largest part of that decline coming after the poor earnings report and the exit of the CEO.

Norbert Lou, who stayed true to his Punch Card Capital mindset in Q4, had a significant position in PayPal at the end of Q4. It will be interesting to see if he will give up on the stock or maybe further add to it.

Another significant position is Crocs which seems to be a better ‘Punch’, especially after the stock jumped 20% after a good earnings report.

If you enjoy this newsletter, please help others discover it by clicking 🤍

And if you learned something useful, consider buying me a virtual coffee ☕

2️⃣ Are software stocks a buy?

An update on super investors’ Q4 portfolios wouldn’t be complete without talking about the SaaS massacre (‘SaaSpocalypse’).

While many software stocks had already been bleeding throughout 2025 (Salesforce, Adobe, ServiceNow …), the real blood bath came earlier this year, when the emergence of AI agentic tools (like Anthropic’s Claude Cowork) caused investors to panic sell anything related to software and data.

It feels like we are now reaching ‘peak fear’ with this software sell-off, and this is usually a time of great buying opportunities if you know where to look. This thinking seems to be confirmed by some of the Gurus:

On February 6, Akre Capital Management put out a letter to shareholders to address the extreme selloff in many of Akre’s portfolio companies (Constellation, Topicus, CCC, Roper)

We have spent our time as a research team actively trying to shake our conviction, to understand the vulnerabilities to AI that the market is ascribing. So far, we have failed to do so. Our frustration is high, but dwarfed by our conviction, which we continue to test. Given our conviction, we are doing the only thing that makes sense to us in the face of this fear-driven AI stampede over the dominant businesses we own: leaning in and buying more of these great businesses.

In addition to increasing their CCC position, they also added Salesforce (CRM) and ServiceNow (NOW) to the portfolio.

A similar sound came from Bill Nygren’s Harris Oakmark. They put out an article titled ‘Why we’re buying software today’

In our view, the current fear that AI will displace software incumbents fails to appreciate how large enterprises actually operate.

They don’t mention specific names yet (their latest 13F is also not yet released), but they were already adding significantly to their Salesforce position in Q3.

Bryan Lawrence (Oakcliff Capital), who manages a concentrated portfolio of exceptional businesses, usually has very little activity in his portfolio. In Q4, he increased his position of Guidewire Software (Property & Casualty insurance software company), which also got caught in the ‘SaaSpocalypse’. Surely this must reflect his belief that GWRE is an ‘AI-Resilient’ software company.

Finally, JP Morgan also released an article titled ‘Software Shock: AI’s Broken Logic’ and shared with investors a list of 19 names which they believe are ‘AI resistant’. The list includes Microsoft, CrowdStrike, ServiceNow, … and also Guidewire Software which is the one stock Bryan Lawrence added to.

“It’s our job as contrarians to catch falling knives, hopefully with care and skill. That’s why the concept of intrinsic value is so important. If we hold a view of value that enables us to buy when everyone is selling - and if our view turns out to be right - that’s the route to the greatest rewards earned with the least risk.”

— Howard Marks in The Most Important Thing

💎 What this means for the Guru Gems portfolio

There are some clear ‘clusters’ emerging in my portfolio, and this could be a good way to analyze what actions I might consider based on the latest Gurus’ moves.

Cluster 1 — Clear Guru signals, strong business fundamentals

Alphabet, Uber (+ Amazon as a potential add to the portfolio)

Alphabet has doubled in size in my portfolio, and following the Gurus, I may consider trimming it a bit

Uber is still a small position but I intend to keep adding until it reaches 8-10% of the portfolio

I am strongly considering adding Amazon to the portfolio. As discussed in the first section, this is the most bought stock by super investors in Q4. The lowest price during Q4 was around $213, so with the stock currently trading ~$210, I could buy it cheaper than what the Gurus have paid for it.

Cluster 2 — Guru conviction, business has ‘temporary headwinds’

LVMH, Airbnb, Baxter, Copart

These are companies backed by Gurus, but where the thesis hasn’t fully played out yet

I’m watching these closely, and may add a bit to Baxter and Copart as these are still small positions in the portfolio.

Cluster 3 — Guru conviction, market believes these companies are cooked

Constellation Software (CSU), CCC Intelligent Solution, PayPal

CSU and CCC are down 35%(!), not exactly a great feeling. I may add to CCC, following similar moves by Akre Capital and Triple Frond Partners

PayPal is another one that got crushed. Fortunately, the position was still relatively small. I will keep it for now, but as I get more fully invested, I may consider selling it if I see better opportunities to deploy the funds.

That’s it for this week’s edition!

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!