The Magic Portfolio - Round 4

Adding 3 new stocks to the Magic Portfolio

Welcome back!

Time for Round 4 of building my Magic Formula Portfolio.

As a reminder, while studying investing masters, I am creating two separate portfolios to put my learnings into practice:

1 - Guru Gems Portfolio - Can I build a portfolio that outperforms over the long term by cloning the best long-term investing masters?

This portfolio consists of ‘Gems’ I uncover in Guru portfolios. Read more here.

2 - Magic Formula Portfolio - Does Joel Greenblatt’s Magic Formula of buying good companies at bargain prices still work?

This portfolio will have 20-25 stocks that rank highest on a combination of ‘good’ (high Return on Capital) and ‘cheap’ (high Earnings Yield).

Joel Greenblatt called this his ‘Magic Formula’ - read more on Greenblatt and his Magic Formula here.

Current performance

It was a rough month for my Magic Portfolio, with some significant declines for a few stocks.

SIGA Technologies (SIGA), which was by far my best performer until now, fell nearly 20%(!) on Friday after reporting Q3 financial results

Molina Healthcare (MOH), a stock also owned by Guru Bill Nygren, significantly missed analyst expectations for their Q3 results and fell over 20% a few weeks ago

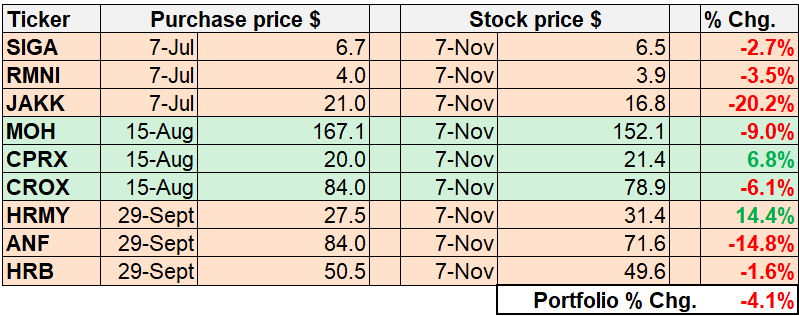

Here is how the portfolio has performed to date:

The overall performance is currently -4.1%, compared to +8% for the S&P500 over the same time period.

12% underperformance doesn’t exactly feel good, but as Joel Greenblatt wrote in his book, the magic formula is supposed to work over longer periods. So let’s not give up yet ;)

Over one-year periods, the magic formula stock portfolios underperformed the market averages in one out of every four years tested.

If you enjoy this newsletter, please help others discover it by clicking 🤍

New Magic Stocks

Here are the companies I will be adding to the Portfolio on Monday (read my first Magic Portfolio post for my step-by-step approach of selecting the companies):

Consensus Cloud Solutions (CCSI) - A company that delivers cloud-based, healthcare data interoperability platforms.

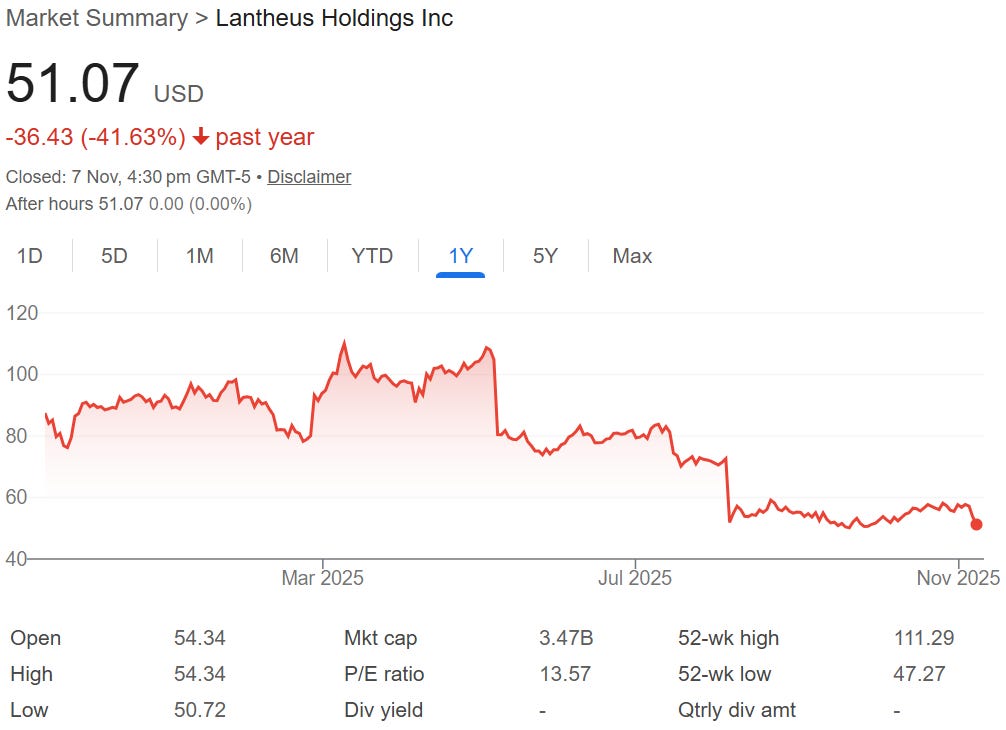

Lantheus Holdings (LNTH) - A company that develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases.

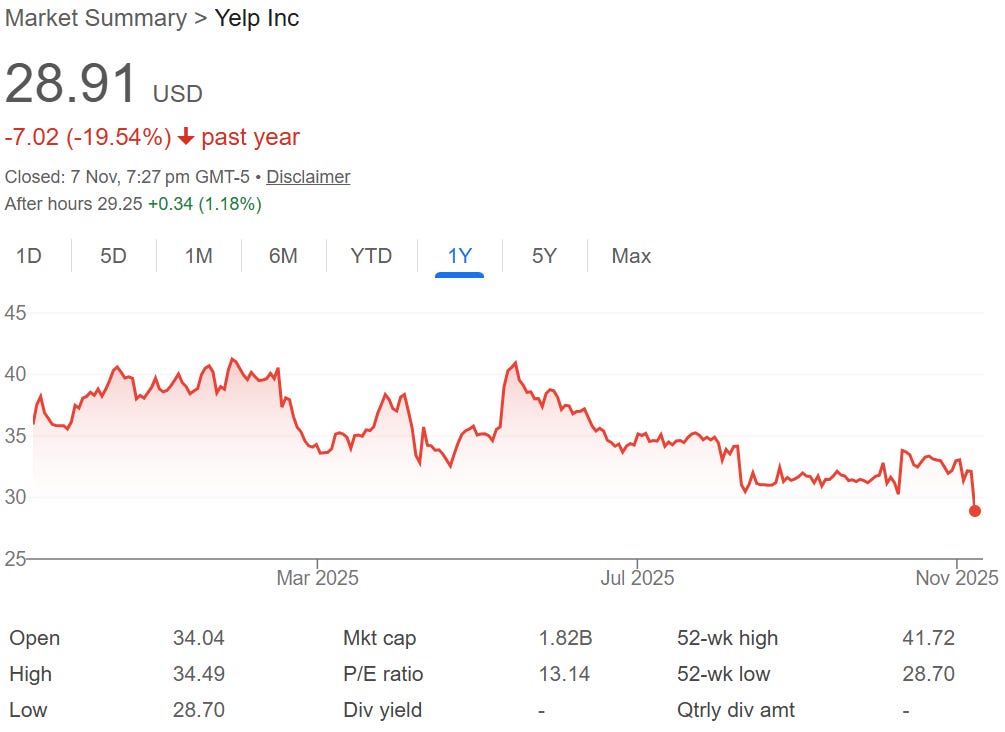

Yelp (YELP) - A company that develops the Yelp.com website and the Yelp mobile app, which publishes crowd-sourced reviews about businesses. It also operates Yelp Guest Manager, a table reservation service.

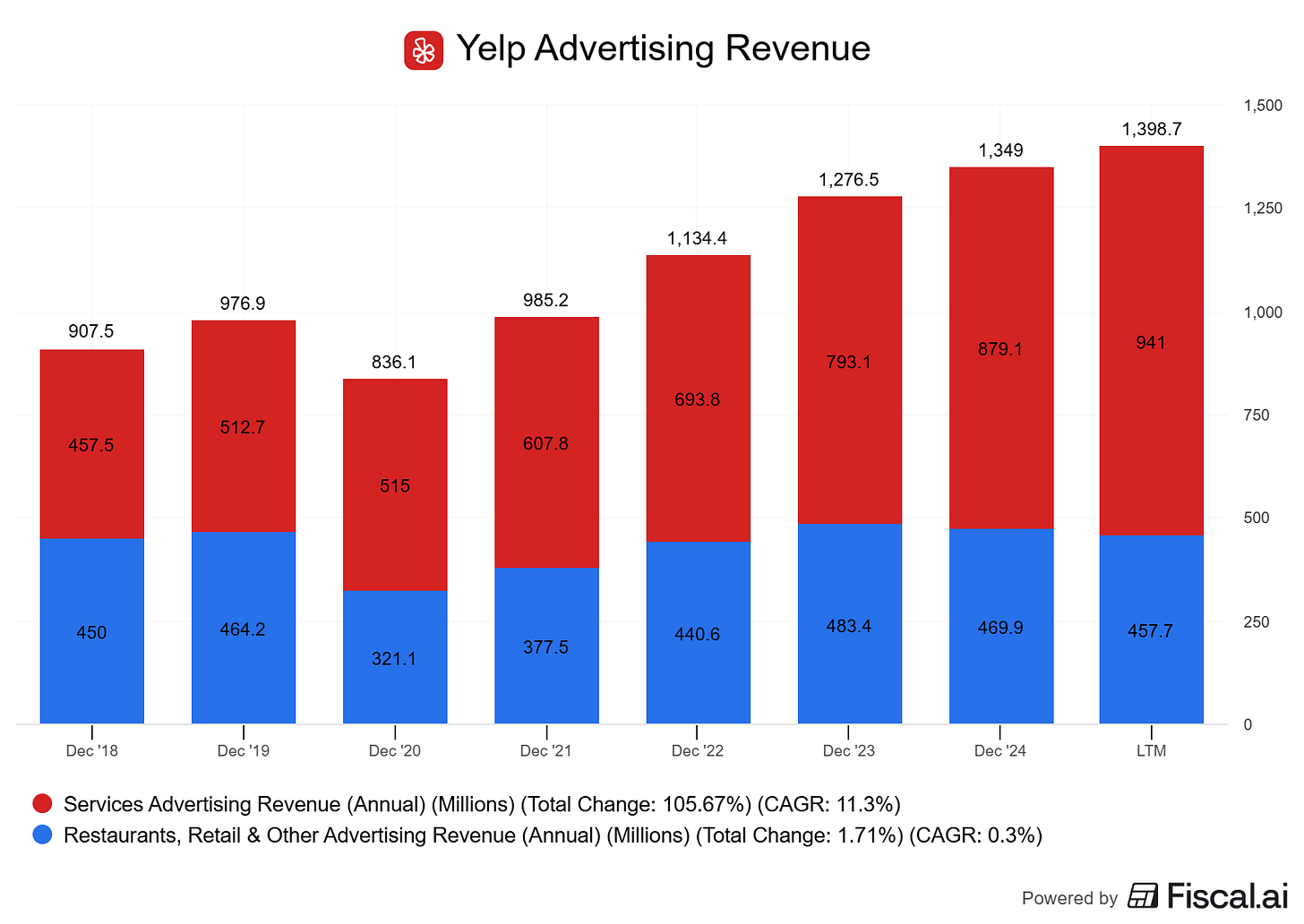

Yelp may have been very popular 10-15 years ago, but is it still relevant today and haven’t Google and others killed Yelp’s business? Not yet, it turns out…

Its revenue (mostly advertising revenue) is still increasing and is increasingly coming from services advertising:

I recently saw a good deep-dive on Yelp on the Chit Chat Stocks Podcast for those interested:

CCSI and YELP are small caps, and as I wrote last week, small caps now trade near record-low valuations relative to large caps. So if a turn in this cycle comes, it may hopefully be an extra boost for the small caps in my portfolio.

On Monday, I’ll be adding these 3 names to the Magic Formula Portfolio and hold them for one year, as Greenblatt prescribes.

That brings me to 12 holdings, and the goal is to get to a full 20-25 stock portfolio.

And once built, I’ll let the magic unfold…

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

Until next week!

Buy the dip? ;-)