The Gayner Guidance: How Markel became a 250-bagger

On Patience & the Power of Playing the Long Game

Welcome to a new edition of Guru Gems, where I study the world’s long‑term investing masters and build a portfolio of ‘Gems’ based on the Gurus’ wisdom.

Today’s Guru is one of the most respected long-term capital allocators. Tom Gayner transformed Markel from a small insurance company into a global conglomerate, turning the stock into a 250-bagger along the way.

In today’s edition:

🕴️ The Guru: Tom Gayner

💎 The Gem: Markel Group (MKL), a 250-bagger(!) since IPO

🏛️ The Philosophy: The 4 Pillars behind 35 years of outperformance

If you are new to Guru Gems, start here.

Guru in the spotlight: Tom Gayner

Tom Gayner is the CEO of Markel Group, a Fortune 500 financial holding company.

He started at Markel in 1990 to build their equity portfolio and gradually moved up to lead the entire company.

In a recent interview on the Behind the Balance Sheet podcast, Gayner calls himself a “Plodder”: a slow steady guy.

A recurring theme in all of Gayner’s interviews and Shareholder Letters, is the idea of steady, incremental progress sustained over a long period of time.

When asked to describe the essence of Markel, he replied ‘endurance’, which reflects Markel’s relentless journey to compound capital over the past 4 decades as a public company.

In his 2024 Shareholder Letter, he compares Markel Group to a Redwood Tree to illustrate this long-term focus:

“Redwood trees symbolize enduring growth. […] If you ever cut down a redwood tree, you will see a ring marking each year […] Some rings would be thin and some would be thick. They demonstrate resilience and survival.

[…] Similarly, the 94 rings of Markel Group tell the story of enduring growth.”

If you enjoy this newsletter, please help others discover it by clicking 🤍

The Gem: Markel Group (MKL)

Usually, in this newsletter, I look for a stock that a Guru owns. Today, I look at the company the Guru runs.

“We follow a simple mission at Markel Group.

We aspire to build one of the world’s great companies.”

Markel is often compared to Berkshire Hathaway: they use the “float” from their insurance operations to invest in public stocks and to buy private businesses.

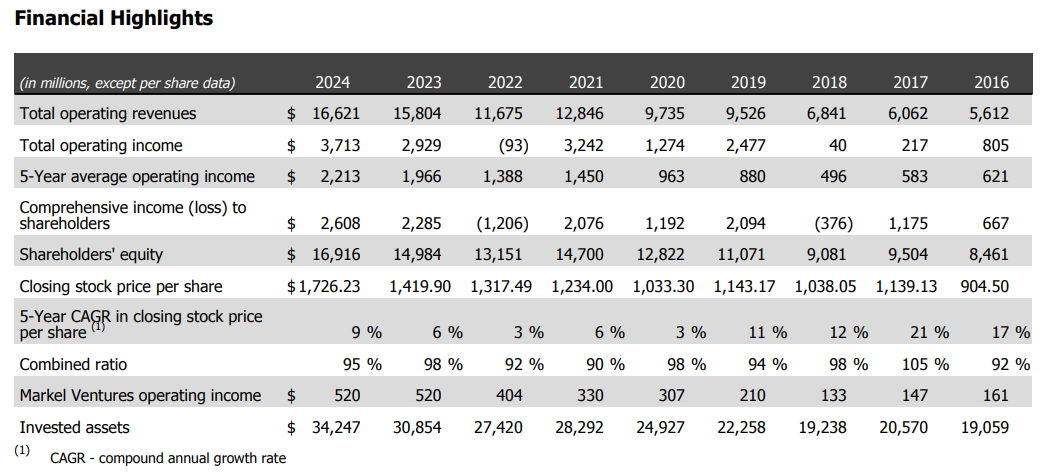

Markel’s Three Engines

Insurance Operations: Writing specialty insurance policies (and generating “float” which can be invested).

Investment Portfolio: These have been managed for decades by Gayner himself, and has compounded at 12.8% over the last five years, with very low turnover (see Q3 screenshot below)

Markel Ventures: A collection of private businesses that Markel fully owns (from bakery equipment to houseplants), providing stability and cash generation.

Tom Gayner’s Investment Philosophy

Whether he is buying a stock for the investment portfolio or acquiring a whole company for Markel Ventures, Gayner says he looks for four things:

He calls these his “Four Pillars”:

🏛️ 1. Profitable business with good returns on capital and low debt

Gayner wants companies that are already winning and generating high returns on the money invested.

🏛️ 2. Talented management with integrity

This is non-negotiable. Because Markel operates with a decentralized structure (hands-off), Gayner needs to trust the people running the businesses. He looks for leaders who treat the company’s money as their own.

🏛️ 3. Reinvestment opportunities

Similar to Chuck Akre’s ‘Reinvestment Runway’, Gayner loves businesses that can take their profits and reinvest them at high rates of return to grow the compounding engine.

🏛️ 4. A reasonable price

Unlike deep value investors (like Rich Pzena), Gayner does not need a bargain-basement price. He is willing to pay a “fair” price for a great business.

Here is a snapshot of Markel’s stock portfolio (top 10 positions, end of Q3):

Two things stand out from this $12 billion portfolio:

Largest position (13%) is Berkshire, the very first stock Gayner bought when he joined Markel in 1990

No changes in the top 10 positions (~40% of the portfolio) during Q3 highlighting the very low turnover

To Buy or Not to Buy

Now let’s evaluate MKL through our Terry Smith inspired checklist to decide if I should add Markel to the Guru Gems portfolio:

1/ Buy good companies

Markel certainly has a lot of strengths making it a very high quality company:

Compounding engine: The three engines work together to generate consistent growth and diversified earnings which also reduces volatility

Strong, low-debt balance sheet: “We see our strong capital position and low-debt philosophy as necessary preconditions for long-term thinking.”

Culture: Gayner often talks about his win-win-win philosophy of service to others (customers, associates, shareholders)

“The Markel Style, our company’s creed, grounds and guides us.”

Alignment: Gayner and the management team own a significant amount of stock.

“We believe that you, as shareholders, are our partners and not distant unnamed institutional entities.”

2/ Don’t overpay

As I discussed in my review of Berkshire Hathaway, valuing an insurance conglomerate can be tricky.

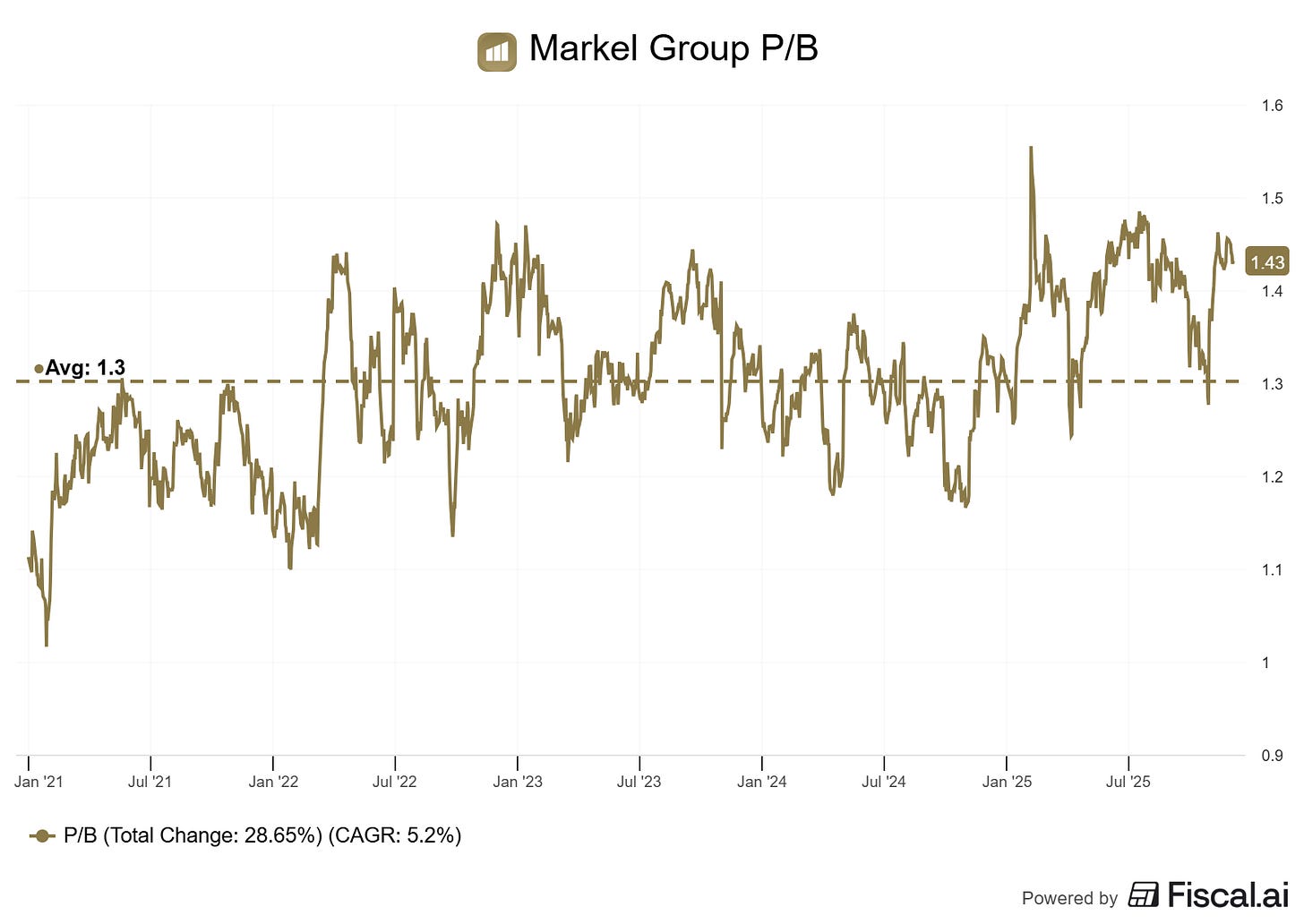

‘Price to Book Value’ (P/B) is a common metric, and currently Markel trades at a P/B ratio of 1.43x, which is 10% above its 5-year average:

However, Gayner himself highlights in his Shareholder Letter that “book value per share no longer works as the best metric to evaluate our performance”.

Gayner provides a guidance on what he believes is the intrinsic value of the company and he estimated that on 31st Dec 2024 it was $2,610 compared to a stock price of $1,726.

The stock price has gone up nearly 20% this year and is currently at $2,048. It will be interesting to see in the upcoming 2025 Shareholder Letter what Gayner’s latest estimate of intrinsic value is.

3/ Final decision

Markel is probably not a stock that will deliver excitement or quarterly drama, but the way it has steadily compounded until now, makes it almost a no-brainer to at least consider for a long-term focused portfolio.

“We run marathons, not sprints. Our name is on some marathon trophies, and we try not to lose the focus that got us there or let others’ sprint times distract us.”

📌 Decision: Adding Markel Group (MKL) to the Watchlist

I’m a bit hesitant to actually buy it given the run it had this year, but I am strongly considering to add a 4-5% position on any pullback or period of pessimism.

“As a public company, we always keep the welcome mat out for new investors. We also hope that once you arrive, you stay indefinitely.” — Tom Gayner

That’s it for this week’s edition!

If you want to learn more about Tom Gayner, I highly recommend the Richer Wiser Happier podcast (my favorite as you know by now!) episode with Tom Gayner.

As always, thank you for reading and following along. You can find me on X @guru_gems for more Guru Gems insights.

Until next week!