Testing Joel Greenblatt's Magic Formula - Round 6

Adding a Small-Cap, a Mid-Cap, and a Large-Cap to my Magic Formula Portfolio

Welcome back!

Today is Round 6 of building my Magic Formula Portfolio.

Here is the 2-minute AI audio version of today’s post if you’re short on time

If you are new to Guru Gems, start here.

As a reminder, while studying investing masters, I am creating two real-money portfolios to put my learnings into practice.

In last week’s edition, I shared an update on the Guru Gems portfolio:

Quick refresh on the Magic Formula

In his book “The Little Book that Beats the Market”, Joel Greenblatt suggests that a regular investor can beat the market averages by buying a group of ‘good’ companies at ‘bargain’ prices.

‘Good’ → high return on capital

‘Bargain’ → high earnings yield

When Greenblatt wrote the first edition of his book, he had tested his formula over a 17-year period (until Dec 2004) by selecting 30 stocks from the 1000 largest companies.

While Greenblatt warned that the formula had underperformed the market averages for some one-year periods and two-year periods (which is why people will not stick with the formula according to Greenblatt), his tests showed that following the formula for any three-year period in a row, led to the magic formula beating the market averages 95 percent of the time (160 out of 169 three-year periods tested).

Of the 169 separate three-year periods tested, the worst return for the magic formula was a gain of 11 percent. The worst return over a three-year period for the market averages was a loss of 46 percent. That’s a pretty big difference!

But that’s not all. If one were to pick not just from the largest 1000 companies but instead from the largest 3500 stocks (market values over $50 million), the results were even better.

Every three-year period tested (169 of 169) was positive for the magic formula portfolios, and every three-year period beat the market averages (169 of 169). That’s right. The magic formula beat the market averages in every single period!

Of course, there is no guarantee that this would still be true today, but that’s exactly what I’m testing.

And if I’m serious about finding out whether the Magic Formula still works, I have to stick with it at least for a 3 year period!

You can read more on Joel Greenblatt and his Magic Formula here.

You can also download my Joel Greenblatt e-book for free:

Current Magic Portfolio performance

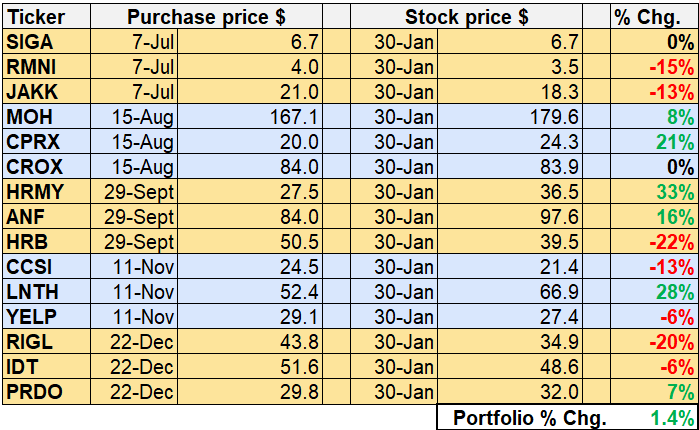

The overall performance of the Magic Portfolio is currently +1.4%, compared to +10.5% for the S&P500 over the same time period (7 months).

Not exactly a great performance…

A few names have taken a serious beating since my last update in December:

Abercrombie & Fitch (ANF) was up more than 50% at some point, but pulled back heavily after the company issued a business update that disappointed investors

Rimini Street (RMNI) and Yelp (YELP) both dropped ~10% since the last update

This shows how volatile some of these names can be and why it makes sense to hold a portfolio of ~25 names.

Many companies are reporting earnings over the next few weeks, so I definitely expect more volatility to come.

I need to stick to the formula and as described above, the real test will be a timeframe of 3 years as that is where Greenblatt observed outperformance 100% of the time.

If you enjoy this newsletter, please help others discover it by clicking 🤍

New Magic Formula Stocks

Here are the 3 companies I will be adding to the Magic Portfolio on Monday:

(Read my first Magic Portfolio post for my step-by-step approach of how I select the companies)

OneSpan Inc. (OSPN) - OneSpan provides software and services that secure and facilitate digital transactions and agreements, with a portfolio spanning authentication (including multi-factor authentication and transaction signing), fraud/risk capabilities, identity verification, and e-signature/digital agreement workflows.

Market Cap: $448M (Small-Cap)

A few insiders have bought shares in August and November last year

AI Deep Research report:

Halozyme Therapeutics (HALO) - Halozyme is a biopharmaceutical platform company best known for ENHANZE, a proprietary drug-delivery technology that enables subcutaneous administration of large-volume biologics that historically required intravenous infusion.

Market Cap: $8.4B (Mid-Cap)

AI Deep Research report:

The Cigna Group (CI) - The Cigna Group is a large U.S.-centric managed healthcare and insurance company

Market Cap: $73B (Large-Cap)

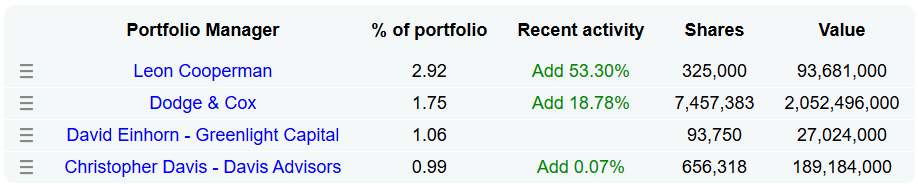

Some superinvestors have been adding the stock to their portfolio recently

AI Deep Research report:

On Monday, I’m adding these 3 names to the Magic Formula Portfolio and I will hold them for one year, as Greenblatt prescribes.

That brings me to 18 stocks in the portfolio. The goal is to get to a full portfolio of ~25 names, so I’m getting closer to being fully invested.

And once built, I’ll let the magic unfold…

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

That’s it for this week! Please like or share if you enjoy reading Guru Gems.

You can follow me on X @guru_gems and Substack @gurugems for more insights.

Until next week!

Really appreciate the transparancy here. That ANF pullback stings but shows why 25+ names matter. Quick question - are you tracking sector concentration with HALO and CI both being healthcare, or just letting the formula run? Also, sticking throuhg 7 months of underperformance takes real discipline. How are you mentally preparing for potentially longer stretches of lagging if it continues into year 2?