Dev Kantesaria & The Valley Forge Way

FICO - Kantesaria's ultimate intersection of growth and predictability

Welcome back for your weekly dose of timeless investment wisdom from the world’s investing masters. Start here if you are new to Guru Gems.

As suggested by a Guru Gems reader, I’m trying something new this week. I included a short AI-generated podcast of today’s newsletter. Let me know what you think and what other suggestions you may have to improve the Guru Gems experience :)

(Note that in Substack you can also listen to the full post by clicking on the audio button in the top right corner.)

In today’s edition:

🕴️ The Guru: Dev Kantesaria

📈 Valley Forge's concentrated conviction playbook

💎 The Gem: Fair Isaac Corporation (FICO) — Kantesaria's largest position

🧧 Quick reminder that you can win a one-month subscription to Michael Burry’s Substack or a copy of Richer, Wiser, Happier by referring new subscribers to Guru Gems!

Guru in the spotlight: Dev Kantesaria

Devang (‘Dev’) Kantesaria is the founder and portfolio manager of Valley Forge Capital Management, a Miami-based investment firm.

Trained as a medical doctor, Kantesaria spent nearly 20 years in venture capital before launching his own investment firm in 2007.

A big fan of Buffett and Munger, he is considered one of the great quality investors.

“There’s no playbook better than the Buffett & Munger playbook, and that playbook is quite simple to describe. You own very high quality businesses.”

Since inception, Valley Forge Capital has delivered very strong returns, outperforming the S&P 500 by a significant margin while managing over $4 billion in assets.

What makes Kantesaria unique is his extraordinary discipline, long-term thinking, and selectivity. He owns a small number of exceptional businesses and lets them compound for a very long time.

The level of concentration in his portfolio reminds me of what I saw in Bryan Lawrence’s Oakcliff portfolio. What’s even more impressive with Kantesaria, is that he brings this level of concentration to a portfolio ten times the size of Oakcliff’s.

There are more overlaps with investors I’ve covered before in Guru Gems (Terry Smith, Chuck Akre, and even Tom Gayner) but Kantesaria may be the purest expression of the “own the compounding machine and do nothing” philosophy.

If you enjoy this newsletter, please help others discover it by clicking 🤍

And if you learned something useful, consider buying me a virtual coffee ☕

Valley Forge’s concentrated conviction playbook

There are a few interviews and podcasts available with Kantesaria where he shares his approach to investing.

Here is one I really enjoyed:

Across interviews and letters, Kantesaria consistently mentions a few key criteria he looks for in a business:

1. 📈 Organic growth & Predictability

“Predictability” is probably the #1 criteria Kantesaria looks for in a business. He would rather sacrifice a few points of growth to ensure he owns a business that won’t blow up in ten years.

“We define quality as finding the perfect intersection between growth and predictability. […] We’re trying to build a portfolio that on a weighted average basis can grow in the high teens to low 20s over the next decade, but can do it in a very predictable way.”

This means he will exclude businesses with high growth but low predictability, which for Kantesaria includes most of the big tech for example.

Businesses with high predictability but low growth (the Nestlés and P&Gs of this world) are also excluded.

2. 💪 Dominant businesses with Pricing power

Kantesaria looks for very dominant businesses, preferably ‘toll booth’ type monopolies or duopolies in their respective industries.

“The businesses that we buy are so dominant, they are natural monopolies or oligopolies”

And when businesses are dominant, they can more easily raise prices above inflation every single year without losing a single customer.

“If you have control over your pricing, that is an amazing tool to have as a company”

For Kantesaria, “pricing power is the hallmark of a great business.”

3. 🪶 Capital light

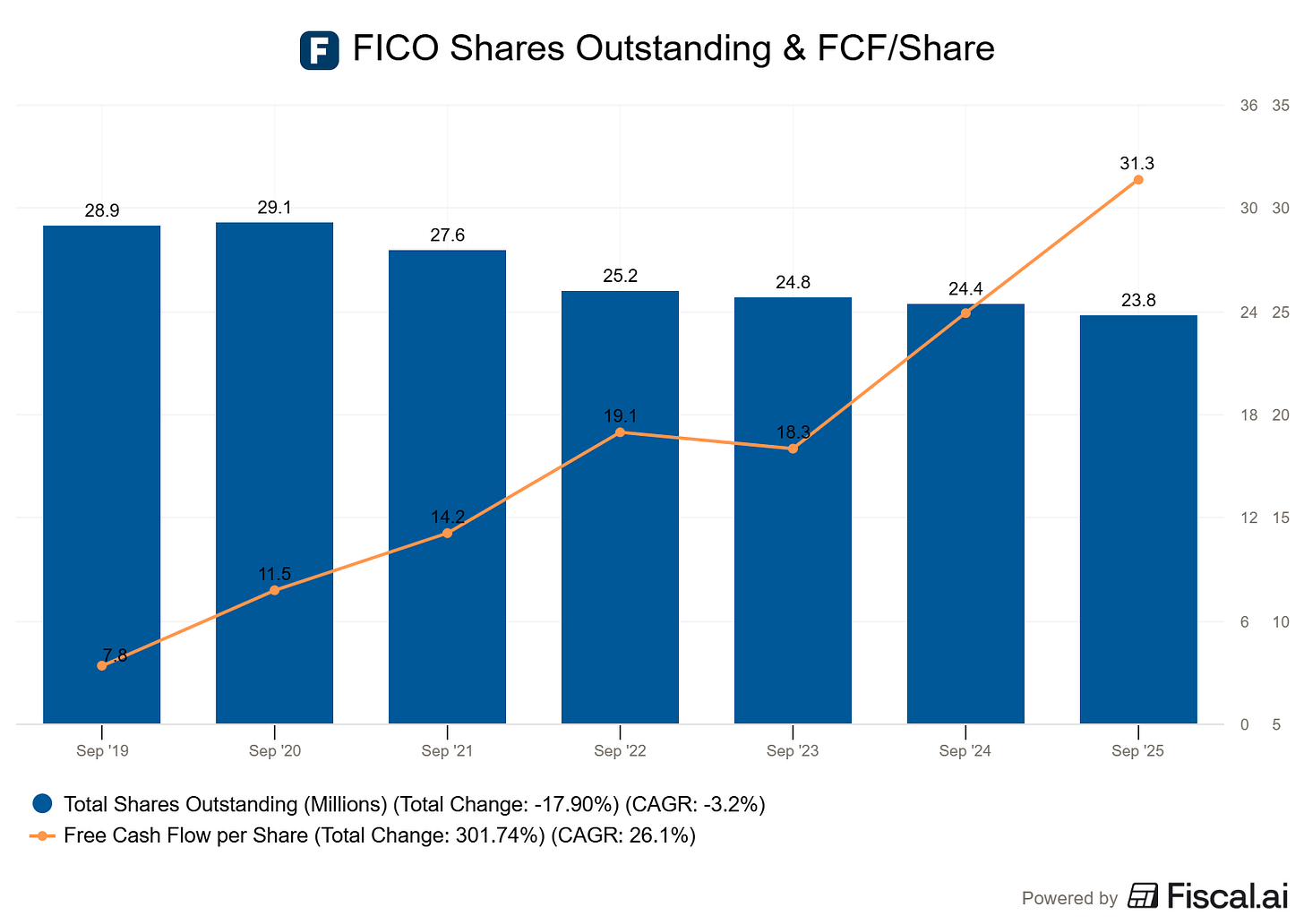

Finally, Kantesaria looks for companies that don’t require massive R&D or Capital Expenditures (‘Capex’). He wants businesses that "print cash" which can then be used preferably to cannibalize their own shares via buybacks.

“We love it when a great compounding machine buys back a lot of their stock. That is our preference. I think it also keeps these companies out of trouble.”

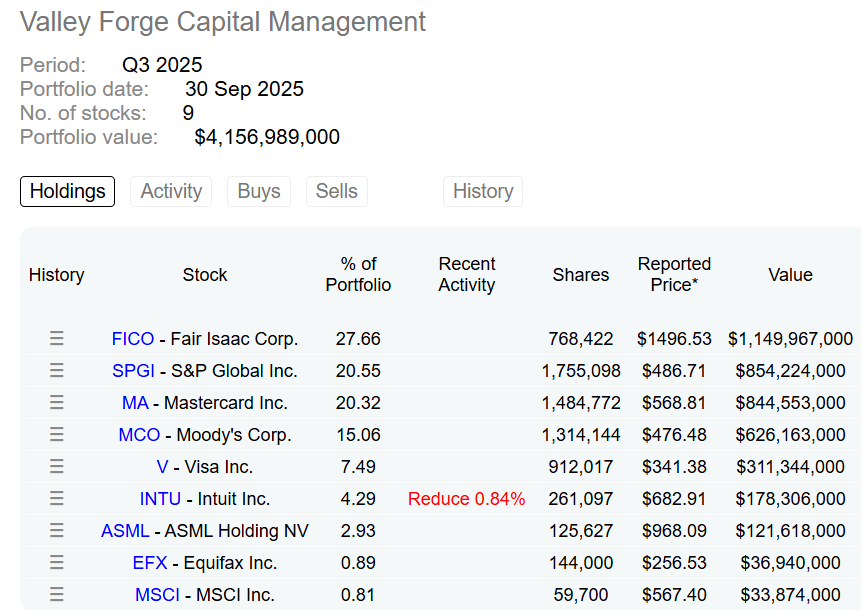

Valley Forge Capital Management portfolio

The fact that Kantesaria has such a concentrated portfolio is almost a consequence of the strict criteria described above.

“Our fishing pond for high quality businesses is about 50 companies in the world”

Here is Valley Forge’s stock portfolio at the end of Q3 2025:

A few highlights from this $4 billion portfolio:

Highly concentrated → the top 5 stocks represent more than 90% of the portfolio

Very few changes to the portfolio → the ‘art of doing nothing’

No Mag7 in the portfolio. He used to own Amazon but sold it in 2023.

Some stocks have been in portfolio for 10+ years (S&P Global for example, which he bought during the depths of the 2009 financial crisis)

The largest position is FICO, which he first purchased in 2018, after studying it for 7(!) years

“We’re very aggressive about the expectations we have for the companies that we own. So people should not interpret low activity with complacency.”

The Gem: Fair Isaac Corporation (FICO)

Fair Isaac Corporation (FICO) is the crown jewel of Kantesaria’s portfolio.

FICO is the company behind the FICO Score, the credit score used by approximately 90% of top U.S. lenders to evaluate consumer creditworthiness (mortgages, auto loans, credit cards). It is deeply embedded in the systems of US banks, insurers, and regulators.

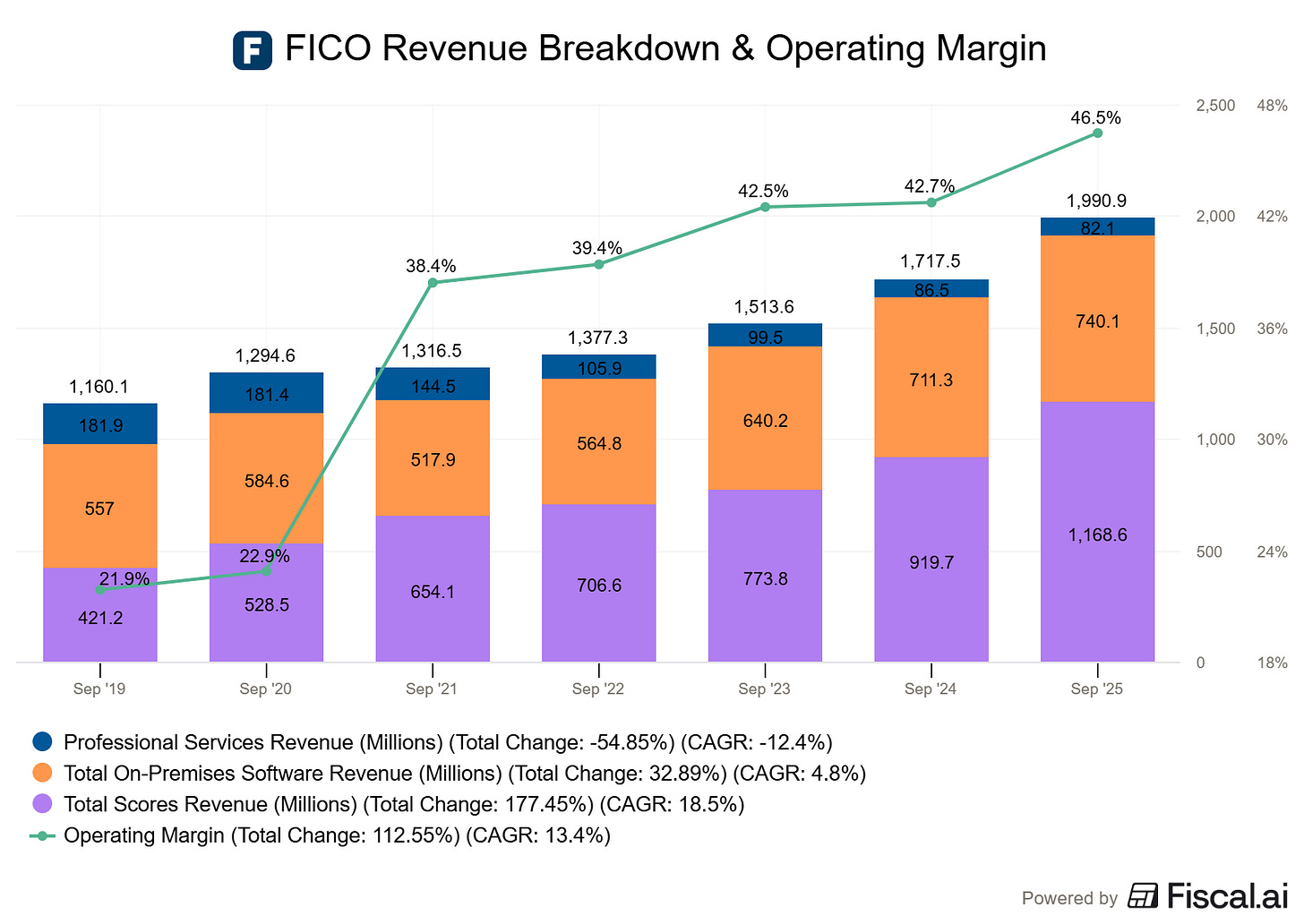

In addition to the credit scores business (which is a bit more than 55% of the revenue but 75% of the operating income), they also have a software business which provides customers with additional fraud detection and other customer management applications.

To Buy or Not to Buy

Let’s evaluate FICO through our Terry Smith inspired framework to decide if I should add it to the Guru Gems portfolio.

1/ Buy good companies

There is no doubt that FICO is a high quality company. Dev Kantesaria has spent more than 15 years studying this company, and it still meets his high expectations.

Why FICO fits the Valley Forge Playbook:

An exceptional moat: FICO operates as a wide-moat “toll booth” business, charging a small fee every time a credit rating is accessed.

FICO has established itself as the universal credit scoring, with nine out of ten lending decisions relying on its score

A powerful network effect further reinforces the moat: lenders, regulators, and investors all use FICO as a universal standard, making it extremely difficult for the market to move off this standard

Pricing power: FICO possesses significant pricing power because its fee is almost a ‘rounding error’ cost compared to the thousands of dollars involved in loan closing costs

After maintaining low prices for decades to ensure industry-wide adoption, FICO began raising prices in 2018, resulting in a 725% increase in its wholesale mortgage fee since then

FICO could probably keep raising its prices, as lenders are unwilling to risk their business for such a small cost saving

Capital-light: FICO is a highly efficient, capital-light business because its core product is a mathematical algorithm developed decades ago

FICO requires almost no capital to run (no factories, no significant R&D), resulting in incredible operating profit margins (nearly 90% for the Scores business!)

Management is using the free cash flow to buy back shares, which they keep doing consistently (see chart below)

For a more in-depth review of the company, I would highly recommend the below episode of The Intrinsic Value Podcast.

It goes into a lot of detail and also highlights the risks (yes, there are in fact risks) and competitive environment.

Finally, FICO isn’t just a Kantesaria holding, it’s also owned by Akre Capital Management, another signal that this is a business that checks a lot of ‘high-quality compounder’ boxes.

2/ Don’t overpay

High quality companies like FICO rarely come cheap.

FICO’s forward P/E is currently around 40 and the stock has historically traded at a premium multiple.

Kantesaria often mentions that getting worked up about whether a company has a P/E (Price to Earnings) of 28 or 32 is far less important than making the right decisions about what companies you buy.

“The idea of bringing great precision to valuation, I think is a silly exercise because at the end of the day, we’re trying to predict the future and that’s an inexact science.”

A few months ago, FICO share price faced some volatility due to regulatory scrutiny, competition from VantageScore, as well as some insider selling.

Akre Capital probably took advantage of this price fluctuation in August to significantly increase their position. The lowest price they could have paid is around $1,300, and this is probably a good indication of what Akre Capital considers to be a ‘fair price’ for this business.

3/ Final decision

I am very much convinced that FICO is a wonderful business and a high quality compounder. So I think it belongs in the Guru Gems portfolio. The question is at which price. For now, I’ll go with $1,300 and will be happy to buy it if it comes back down to this price.

As always, I’ll keep monitoring closely what Kantesaria and Akre Capital will be doing and if there is any selling or accumulation.

📌 Adding Fair Isaac Corporation (FICO) to the Guru Gems Watch list

That’s it for this week’s edition!

Thank you for reading and following along. You can find me on X @guru_gems for more Guru Gems insights.

Until next week!