The Magic Portfolio

Putting Joel Greenblatt's formula to practice

Welcome back!

In one of my first Guru Gems editions, I wrote about legendary investor Joel Greenblatt and his Magic Formula:

Today I will put the Magic Formula to practice.

Here is Joel Greenblatt himself explaining how he came up with the Magic Formula:

The central idea is to rank stocks based on two key metrics:

Return on Capital (a measure of quality) and;

Earnings Yield (a measure of value).

I’m certainly not the first to test or implement the Magic Formula. You can find a lot online from people who tested or back-tested the formula for different time periods, like this one for example.

The conclusion is mostly that it still beats the market over a long enough period, but not by the same margin as Greenblatt described in his book.

In the spirit of adding another datapoint to the research and also to implement what I am learning on my journey, I will start a Magic Portfolio!

It will also be interesting to see which of my 2 portfolios will perform better over time: the Guru Gems portfolio or the Magic Formula portfolio.

Before I continue…

If you enjoy reading this, please help others discover Guru Gems by liking this post (🤍 at the bottom) and subscribe for weekly deep-dives

Last week I covered legendary value investor Bill Nygren and one of his newer positions Airbnb

You can also follow me on X @guru_gems for interesting Guru insights.

And now back to our Magic Formula portfolio

Getting started

In his book ‘The Little Book that (Still) beats the Market’, Joel Greenblatt added a chapter at the end titled ‘Step-by-Step Instructions’.

The steps can be summarized as following:

Obtain a list of top-ranked magic formula companies

Buy 5 to 7 top-ranked companies

Repeat every 2-3 months until you have a portfolio of 20-30 stocks

Sell each stock after holding it for one year

Repeat for many years

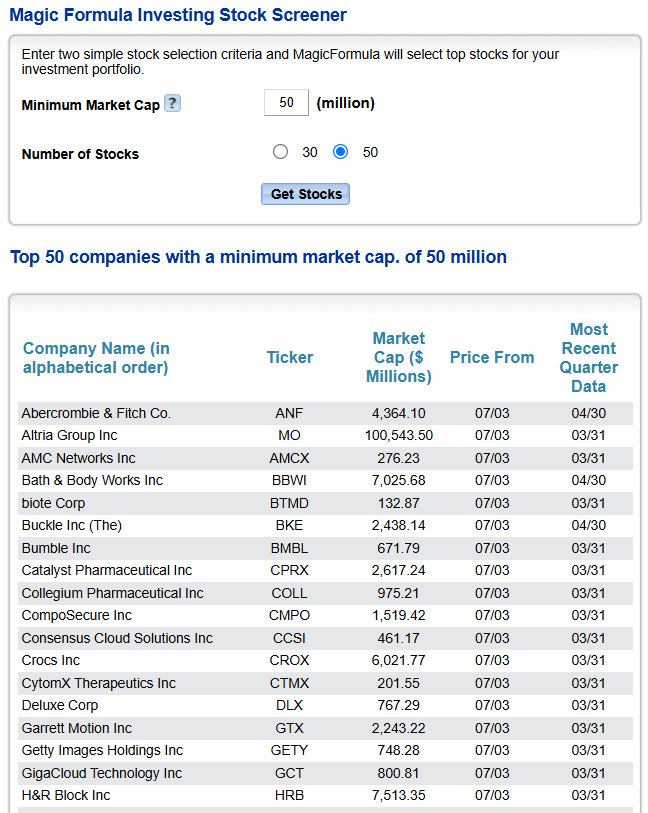

For Step #1 I will leverage Joel Greenblatt’s own screener which can be found at MagicFormulaInvesting.com .

Greenblatt’s screener gives you a list of 30 or 50 companies to choose from but it doesn’t rank them yet.

To buy the top ranked stocks from this list as described in Step #2, I will have to do a bit of work myself ;-)

Selecting the first companies to buy

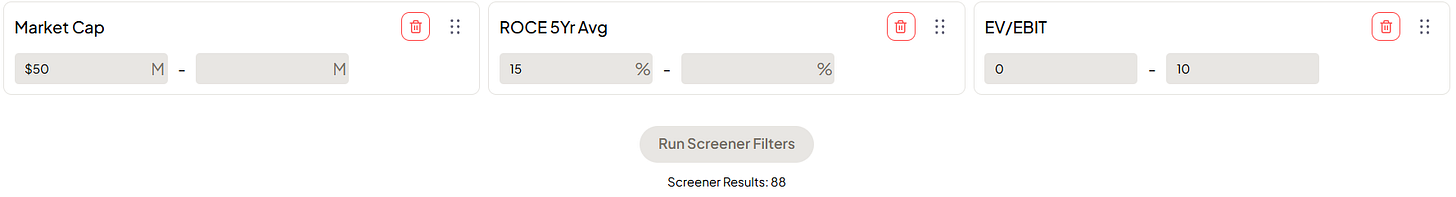

I used Fiscal.ai (formerly FinChat) to create my own screener. To filter the companies, I will try to stay as close as possible to what Greenblatt suggests in the book.

For Return on capital, he defines it as:

EBIT / (Net Working Capital + Net Fixed Assets)And for Earnings yield he used:

EBIT / Enterprise Value (EV)Using EBIT (Earnings Before Interest and Tax) and EV instead of E/P allows to compare companies with different levels of debt and different tax rates.

There are quite a few Capital Efficiency ratios in Fiscal.ai:

I tested a few to see which one gets me closest to Greenblatt’s screener list and I ended up using Return on Capital Employed (ROCE) 5yr Avg.

After filtering out all utilities and financial stocks as Greenblatt suggests, the best overlap of companies from the MagicFormulaInvesting website I get, is when I apply the following criteria:

Out of this list of 88 companies, 30 of them also appear in the MagicFormulaInvesting website list.

Ranking these according to the criteria gets me my top 3:

On Monday I will purchase the first 3 companies and hold them for exactly 1 year as Greenblatt suggests:

SIGA Technologies (SIGA) - A pharmaceutical company developing medicines to prevent and treat emerging infectious diseases

Rimini Street (RMNI) - A global provider of end-to-end enterprise software products, services, and support for various industries

JAKKS Pacific (JAKK) - A toy manufacturer best known for producing licensed action figures, playsets, dolls, plush toys and dress-up sets.

In the next few months, I will repeat this process until I have ~25 companies in my Magic Portfolio

That’s it… and now we wait for those 30% returns :-)

“If you are able to stick with the magic formula strategy through good periods and bad, you will handily beat the market averages over time”

— Joel Greenblatt

I will be back next week with a new Guru and a potential new Gem to look into!