Portfolio update #2

Monthly update on the Guru Gems portfolio

Welcome back and welcome to the new subscribers!

Today I’m sharing my second monthly update on the Guru Gems portfolio. Next week, I’ll be back with the usual Guru deep-dive and a potential Gem to add to the portfolio.

In case you missed previous editions:

#1 Cloning the world’s best investors (start here if you are a new subscriber)

#5 The Davis Discipline (latest deep-dive - Chris Davis)

Follow me on X @guru_gems for more investing insights

Guru Gems portfolio overview

Current holdings:

Current watchlist:

Berkshire Hathaway

Restaurant Brands International (QSR)

👜 LVMH

LVMH continued to face headwinds over the past month, closing this week at €471. LVMH is now down 25% since the start of the year and nearly 40% (!) over the past year.

LVMH’s deputy chief executive officer said earlier this week that Chinese customers have been pulling back on travel and consumer spending, adding to the recent uncertainty on Chinese luxury spending.

On 23 May, I added to the LVMH position (+1%), taking advantage of this further weakness in the share price, which brings my average purchase price to €509.

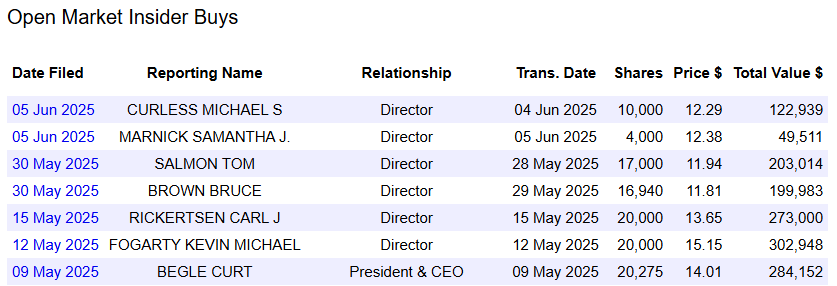

This move aligns with continued insider buying by CEO and founder Bernard Arnault (see table below), whose stake in LVMH is now approaching 50%, which could indicate a move to further consolidate control.

Finally, while doing research on the next Guru to cover, I found that Chuck Akre, a legendary investor and founder of Akre Capital Management, also initiated a position in 2024 and recently increased his position to 1.3% of his portfolio.

🔎 Alphabet

No changes to my Alphabet position.

The stock is up 10% versus our average purchase price, though still 8% below its price from early January.

Alphabet is still caught between competing narratives - an undervalued AI leader and digital advertising giant versus a threatened search business and regulatory worries.

With a forward P/E of 18.3 and a three-year revenue CAGR of 10%, Alphabet is still very attractive and should continue to be a long-term compounder.

🏗️ Magnera Corp

On May 19, I initiated a position in Magnera Corp, allocating 1.3% of the portfolio. (See newsletter from 18 May)

Magnera saw additional insider purchases by 4 Directors over the past two weeks. (See table below)

The share price increased 10% over the past week, despite any noteworthy news.

Maybe it was in anticipation of the 2025 Wells Fargo Industrials & Materials Conference, where Magnera will present on June 11 to institutional investors.

Slow but steady

“The big money is not in the buying or selling, but in the waiting”

— Charlie Munger

My goal is to build a portfolio of 8-12 stocks that will hopefully beat the index in the long run. It will be key to be very selective and especially to be mindful of the price to pay.

I’ll have to wait for the right opportunities and it may take time to build out the full portfolio.

In the meantime I keep learning as much as possible about the long-term Gurus and their portfolios, and I will keep sharing my learnings through my updates.

I’ll be back next week with a new Guru and a potential new Gem to look into!